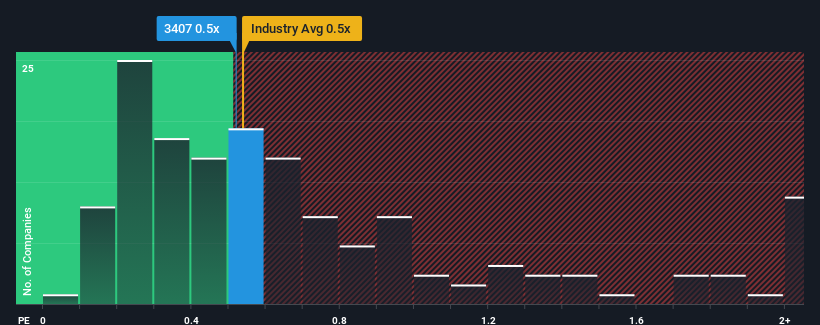

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Chemicals industry in Japan, you could be forgiven for feeling indifferent about Asahi Kasei Corporation's (TSE:3407) P/S ratio, which comes in at about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Asahi Kasei

How Asahi Kasei Has Been Performing

With revenue growth that's superior to most other companies of late, Asahi Kasei has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Asahi Kasei will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Asahi Kasei would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.6% last year. The solid recent performance means it was also able to grow revenue by 27% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 4.5% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 5.5% per annum, which is not materially different.

With this in mind, it makes sense that Asahi Kasei's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Asahi Kasei's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Asahi Kasei's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Chemicals industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

It is also worth noting that we have found 2 warning signs for Asahi Kasei that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3407

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives