Does Government-Backed Hydrogen Expansion Shift the Bull Case for Asahi Kasei (TSE:3407)?

Reviewed by Sasha Jovanovic

- Asahi Kasei recently received official approval and government financial support to expand its Kawasaki Works with new facilities producing electrolysis system components for both alkaline water and chlor-alkali electrolysis, supporting clean hydrogen and industrial chemical markets.

- This move underscores the company's shift toward materials vital to the energy transition, with a particular focus on the growing hydrogen economy.

- We'll explore how advancing vertical integration in hydrogen-related materials could influence Asahi Kasei's broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Asahi Kasei's Investment Narrative?

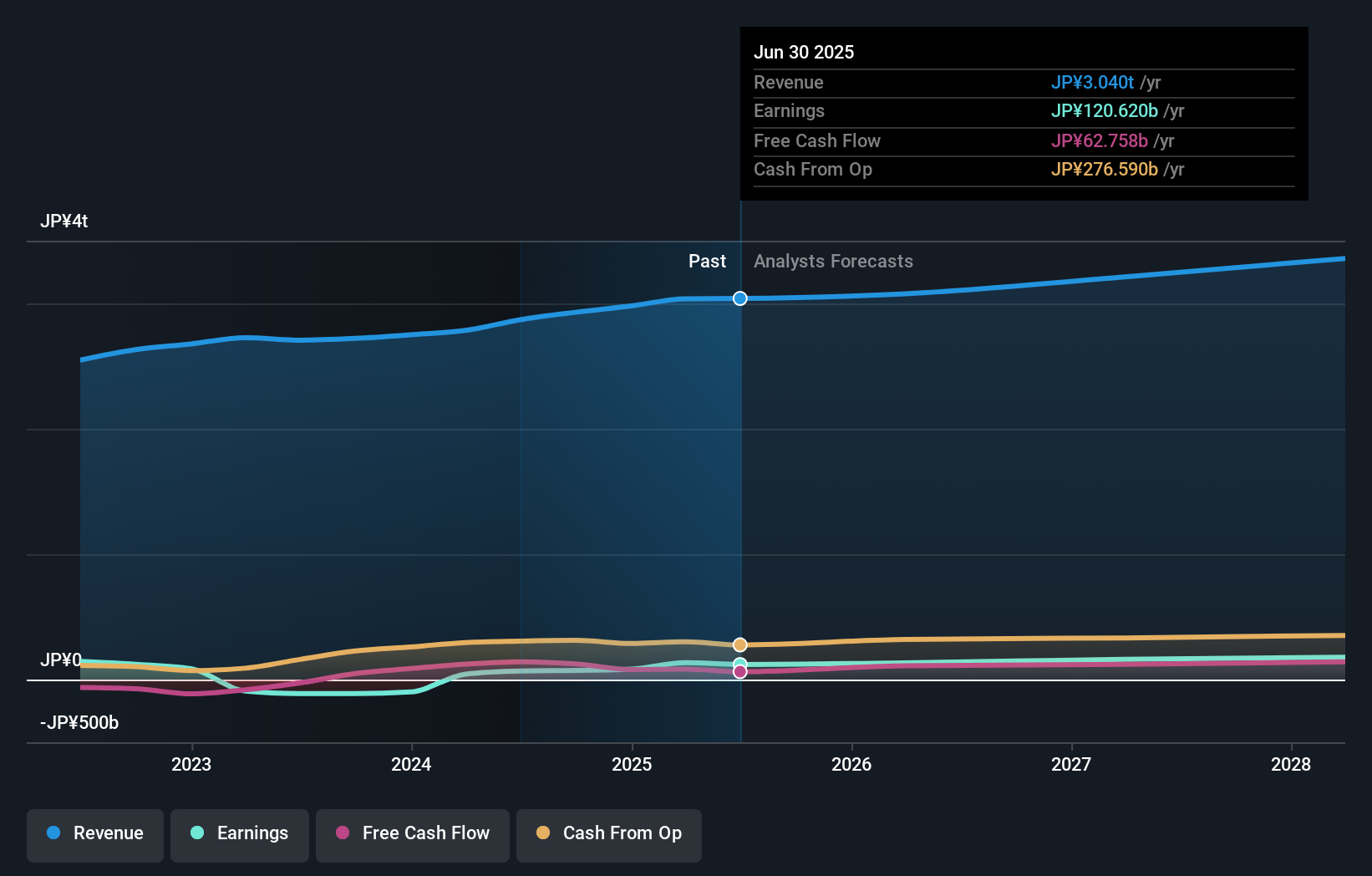

If you're considering Asahi Kasei, the conviction really rests on whether the company’s bold investments in hydrogen and clean technology can become meaningful growth engines in the years ahead. The recent news about expanding electrolysis component production, with government backing and integration into Japan's energy transition strategy, could shift near-term sentiment and strengthen one of the most important catalysts: confidence in the hydrogen story. Previously, slow revenue growth and relatively low returns on equity were seen as risks, alongside above-average debt, but this expansion signals management’s intent to stay ahead in sectors with long-term relevance. Still, any gains from hydrogen and related materials may not move the needle immediately for such a diversified business, the real payoff could take time, and execution risk remains, especially as attention shifts to upcoming earnings and the scale-up timeline.

But, with all this excitement, high debt levels remain an important risk investors should watch closely. Asahi Kasei's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Asahi Kasei - why the stock might be worth over 2x more than the current price!

Build Your Own Asahi Kasei Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asahi Kasei research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Asahi Kasei research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asahi Kasei's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3407

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives