Assessing Asahi Kasei (TSE:3407) Valuation After New Sustainable Textiles Collaboration

Reviewed by Simply Wall St

Asahi Kasei (TSE:3407) just expanded its sustainability credentials by teaming up its ROICA stretch fiber with NILIT’s SENSIL ByNature to create biomass balanced, lower impact fabrics for high performance apparel.

See our latest analysis for Asahi Kasei.

Investors seem to be warming to this sustainability push, with a 9.7 percent 1 month share price return supporting an already solid 22.4 percent year to date share price gain and a 25.5 percent 1 year total shareholder return. This suggests that momentum is steadily building.

If this kind of green innovation is on your radar, it may be worth seeing which other healthcare names are evolving too by exploring healthcare stocks.

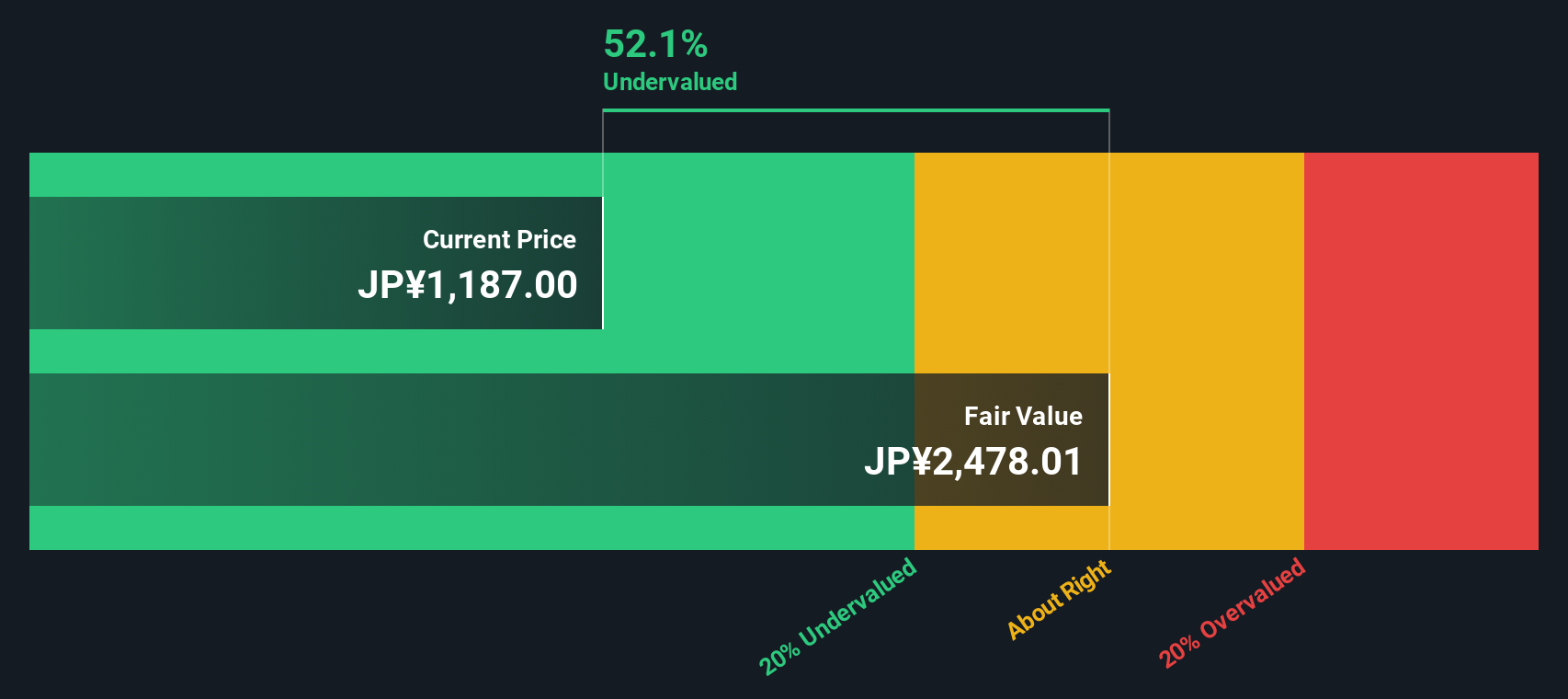

With earnings growing, a sizeable intrinsic value discount and shares still trading below analyst targets, the set up looks interesting. However, is this sustainability driven rally a genuine buying opportunity, or is future growth already priced in?

Price to earnings of 12.8x: Is it justified?

Asahi Kasei trades on a price to earnings ratio of 12.8 times, which helps frame whether the recent share price strength still leaves value on the table.

The price to earnings multiple compares the current share price to the company’s earnings per share, effectively showing how many yen investors are willing to pay for each yen of profit. For a diversified materials and healthcare group like Asahi Kasei, this is a useful lens because earnings quality, growth and cyclicality are all key to how the market values cash flows.

On one hand, the stock appears to offer value relative to an estimated fair price to earnings ratio of 18.7 times. This suggests the market is not fully pricing in earnings strength and the forecast profit growth ahead. On the other hand, the current 12.8 times multiple is slightly higher than the wider Japanese chemicals industry average of 12.2 times. This indicates investors are already paying a modest premium versus sector peers for that growth and quality profile.

Explore the SWS fair ratio for Asahi Kasei

Result: Price-to-earnings of 12.8x (UNDERVALUED)

However, risks remain, including potential setbacks in green technology adoption and slower-than-expected earnings growth that could dampen enthusiasm for the stock.

Find out about the key risks to this Asahi Kasei narrative.

Another View, What Does DCF Say?

Our DCF model presents a much stronger value case, placing fair value for Asahi Kasei at around ¥2681 compared with the current ¥1325 share price. This difference suggests the stock may be significantly undervalued if cash flow assumptions hold, but it also raises the question of whether those forecasts are too optimistic.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Asahi Kasei for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Asahi Kasei Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a personalized view in minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Asahi Kasei.

Ready for your next investing move?

Do not stop with one opportunity; use the Simply Wall Street Screener to uncover fresh, data driven ideas that other investors may be overlooking right now.

- Capture early stage potential by scanning through these 3571 penny stocks with strong financials that combine market mispricing with improving fundamentals and room for sentiment to re rate.

- Position yourself at the forefront of automation and data intelligence by targeting these 26 AI penny stocks shaping how businesses operate and scale in the new digital economy.

- Explore income focused opportunities by filtering for these 15 dividend stocks with yields > 3% that aim to deliver cash returns while still leaving scope for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3407

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026