Asahi Kasei (TSE:3407) Valuation in Focus After Launch of New Pharma Excipient Grades

Reviewed by Kshitija Bhandaru

Asahi Kasei (TSE:3407) has revealed plans to add two new specialty grades to its Sonanos™ excipient lineup. This move is designed to tackle pharmaceutical formulation challenges for injectable drugs. The update comes as demand in biotech and pharma continues to climb.

See our latest analysis for Asahi Kasei.

Building on strong momentum from its core businesses and a string of forward-looking product launches, Asahi Kasei has seen its share price climb by 18.7% over the past three months. With a one-year total shareholder return close to 18% and five-year returns nearing 50%, the stock’s solid long-term performance suggests growing confidence from investors, especially as the company steps further into innovation-driven markets.

If Asahi Kasei’s pharma push has you thinking about future-focused companies, it might be time to see what’s happening in other healthcare leaders. See the full list for free.

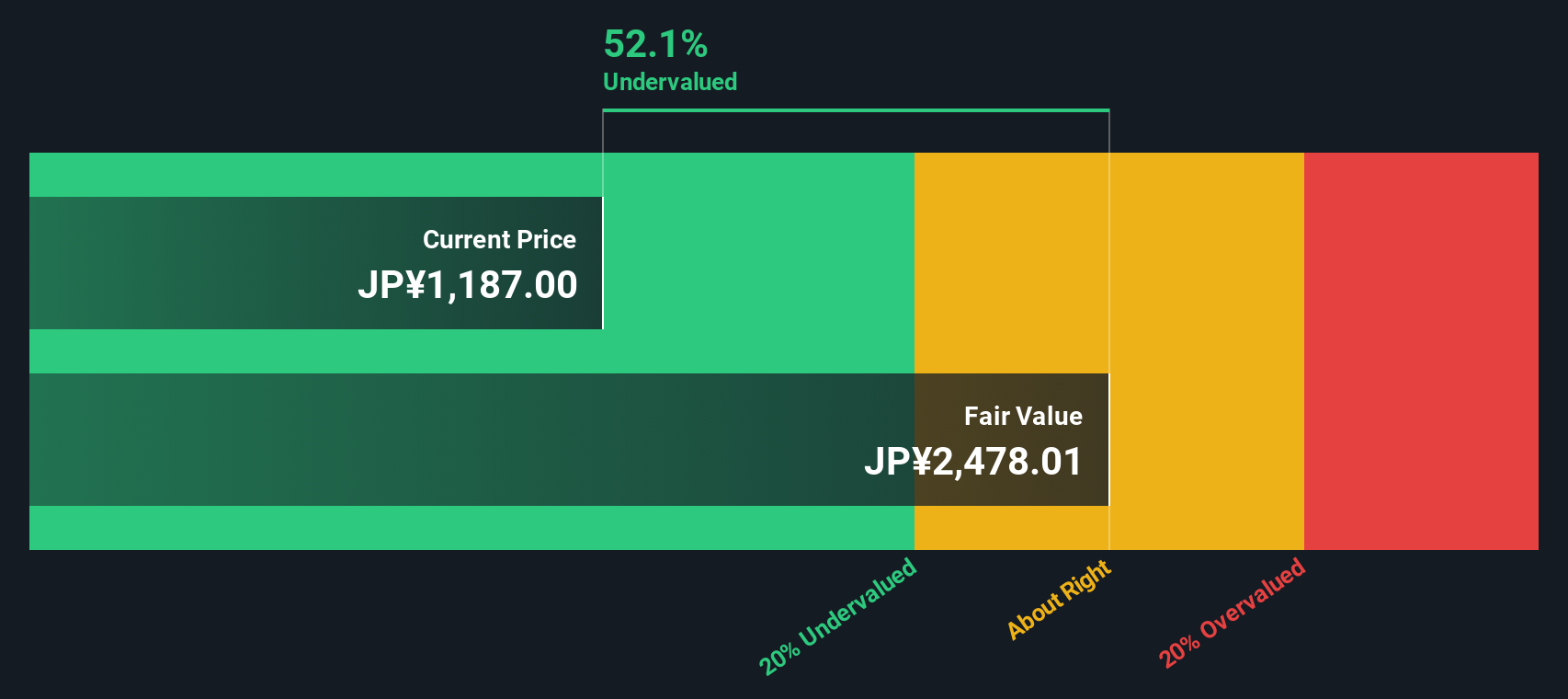

But with shares already up and the company’s momentum clear, the real question for investors is whether Asahi Kasei remains undervalued at current levels or if the market is already factoring in years of future growth.

Price-to-Earnings of 13.4x: Is it justified?

Asahi Kasei trades at a price-to-earnings (P/E) ratio of 13.4, placing it slightly above the Japanese Chemicals industry average but well below the average P/E of its direct peers. This creates a nuanced valuation debate as shares have rallied.

The P/E ratio measures the relationship between a company’s current share price and its earnings per share. It is a key indicator for investors who are gauging how the market values a company's profit potential relative to others in the sector. A relatively modest P/E like 13.4x, especially compared with much higher peer averages, could suggest that investors are either overlooking potential upside or are factoring in some caution around future growth.

Looking at industry comparisons, Asahi Kasei’s P/E is slightly higher than the broad Chemicals industry average of 13x but remains far below the average for its peer group at 28.7x. The company’s current P/E is also well below our estimate of its fair value P/E ratio of 19.9x, indicating potential room for share price expansion if market sentiment shifts.

Explore the SWS fair ratio for Asahi Kasei

Result: Price-to-Earnings of 13.4x (UNDERVALUED)

However, persistent global economic uncertainty and the potential for slower than expected revenue growth could quickly change the outlook for Asahi Kasei’s shares.

Find out about the key risks to this Asahi Kasei narrative.

Another View: What Does the SWS DCF Model Say?

While the P/E ratio paints a picture of potential value, our SWS DCF model offers a completely different perspective. According to this approach, Asahi Kasei is trading at roughly half its estimated fair value. This suggests the market may be seriously underestimating future cash flows and long-term earnings power. Is this a mispricing waiting to close, or are there risks investors are overlooking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Asahi Kasei for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Asahi Kasei Narrative

If you think there’s more to the story or prefer to dive into the data yourself, you can build your own perspective in just minutes. Do it your way

A great starting point for your Asahi Kasei research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you're intent on making your next move count, don't let today's opportunity turn into tomorrow's regret. Step up your research and uncover fresh possibilities now.

- Capture growth by following these 24 AI penny stocks, which are transforming industries with breakthroughs in artificial intelligence.

- Tap into steady income with these 18 dividend stocks with yields > 3%, offering attractive yields and consistent payouts for long-term investors.

- Stay at the forefront of innovation by reviewing these 26 quantum computing stocks, pioneering advances in computing technology and shaping the future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3407

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives