Teijin (TSE:3401) Valuation in Focus as Recent Gains Spark Investor Reassessment

Reviewed by Simply Wall St

Teijin (TSE:3401) shares have shown steady movement recently, leaving some investors weighing the company’s long-term potential. With monthly returns in positive territory, a closer look at the numbers can shed light on what is powering sentiment.

See our latest analysis for Teijin.

Teijin’s 1-month share price return of 6.7% signals momentum may be building again after a period of modest gains, with the 1-year total shareholder return reaching 3.9%. Compared to its muted five-year track record, this recent uptick suggests shifting sentiment as investors reassess the outlook.

If you’re in the mood to uncover more market movers, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

Amid recent gains and uneven longer-term returns, the big question is whether Teijin is offering compelling value at current levels or if the market has already priced in any future turnaround. Could this be a buy, or is caution warranted?

Most Popular Narrative: 16% Overvalued

Teijin’s current share price sits above what the consensus narrative sees as fair value, challenging the notion that recent gains signal a turnaround. The key assumptions behind the narrative’s valuation are more optimistic than what the market has delivered so far, setting up a critical fork in the story.

Innovation in sustainable materials and divestment of low-yield businesses position the company for new growth opportunities and improved earnings quality. However, heavy reliance on cost-cutting amid weak demand, competition, and divestitures raises concerns about long-term growth, margin sustainability, and increasing structural risks at Teijin.

What if the push into sustainability is only half the story? The narrative’s fair value hinges on rising margins, a major earnings jump, and a future market rating that beats the industry average. See the aggressive forecasts and what needs to go right for this optimistic scenario to play out.

Result: Fair Value of ¥1,180 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent price pressure in advanced materials and the risk of flat healthcare revenues could quickly undermine the case for a sustained turnaround.

Find out about the key risks to this Teijin narrative.

Another View: SWS DCF Model Offers a Different Angle

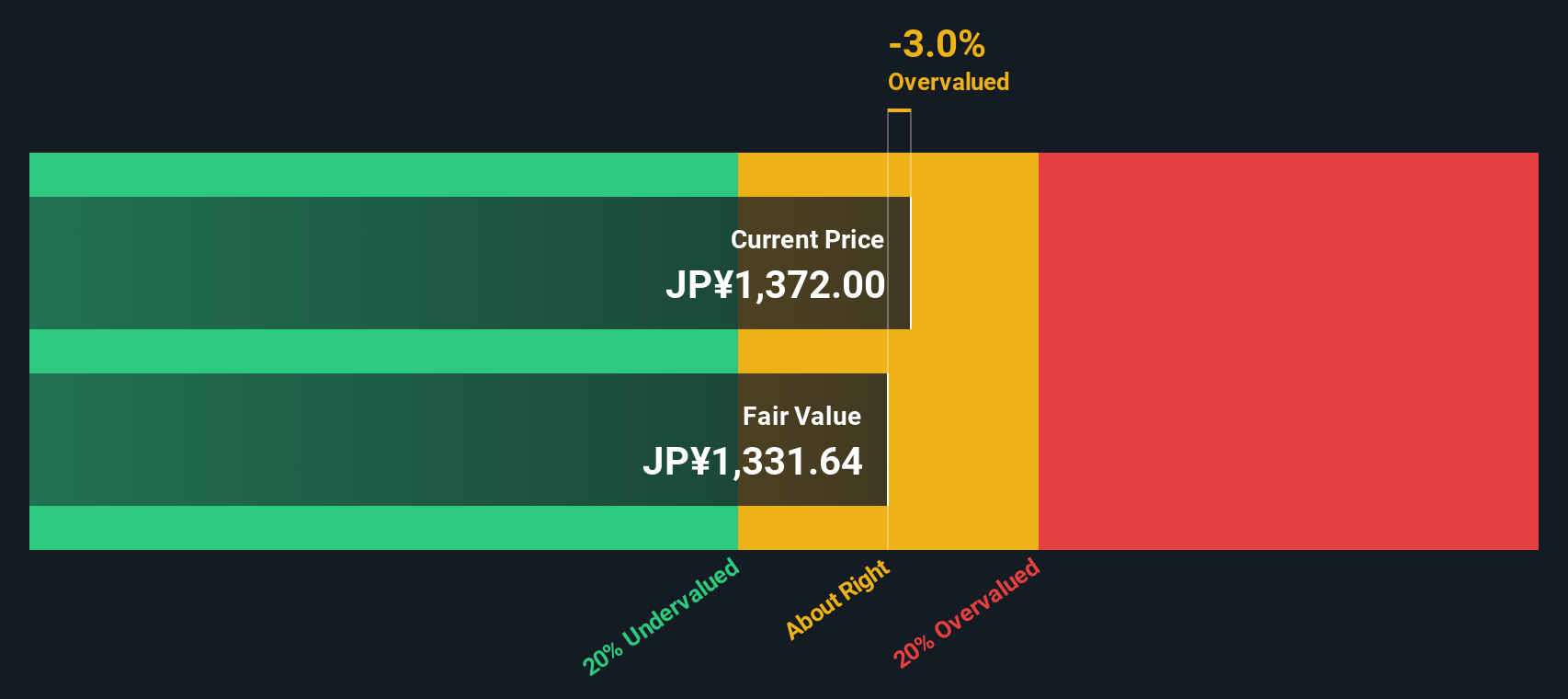

Looking at Teijin through the SWS DCF model, we find that the current share price of ¥1,372.5 sits moderately above our fair value estimate of ¥1,333.82. This suggests the stock could be slightly overvalued on a discounted cash flow basis, challenging the previous narrative's view. Will the market price eventually come back in line with fundamental cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Teijin Narrative

If you see the picture differently, or would rather dig into the numbers yourself, you can shape your own story in just a few minutes, then Do it your way.

A great starting point for your Teijin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready to Find Your Next Investment Edge?

Markets move fast. Smart investors keep their options open by staying ahead of new opportunities. Don’t let a great idea pass you by; tap into powerful investment themes now and give your portfolio an edge.

- Capitalize on untapped high-yield opportunities with these 17 dividend stocks with yields > 3% that could boost your income stream beyond typical benchmarks.

- Unlock strong growth prospects by evaluating these 27 AI penny stocks that are shaping tomorrow’s technology landscape and leading rapid sector change.

- Take advantage of hidden market value and spot potential bargains among these 876 undervalued stocks based on cash flows poised for future momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teijin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3401

Teijin

Engages in the fibers, films and sheets, composites, healthcare, and IT businesses worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives