Teijin (TSE:3401): Examining Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Teijin (TSE:3401) has kept investors interested with its recent stock performance, especially over the past month. Shares have climbed nearly 5% during this period, even in spite of slight dips seen over the past week.

See our latest analysis for Teijin.

Teijin’s 1-month share price return of nearly 5% stands out against a more modest year-to-date climb and recent weekly softness. This suggests fresh momentum may be building. Looking at the bigger picture, the 3-year total shareholder return of over 17% highlights longer-term resilience even as volatility persists.

If Teijin’s upward shift has you thinking bigger, now’s a good time to discover fast growing stocks with high insider ownership.

With shares rising even as the company faces both recent gains and longer-term mixed returns, the big question remains: is Teijin undervalued at current levels, or is the potential for future growth already reflected in the price?

Most Popular Narrative: 13.5% Overvalued

Teijin’s most-followed narrative puts fair value notably below the current share price, setting up a clash between recent market optimism and analysts’ measured view. Let’s look at what’s moving the needle in this story.

Innovation in sustainable materials and divestment of low-yield businesses position the company for new growth opportunities and improved earnings quality. Heavy reliance on cost-cutting amid weak demand, competition, and divestitures raises concerns about long-term growth, margin sustainability, and increasing structural risks at Teijin.

Want to know why analysts see a price drop ahead? The real intrigue lies in their bold assumptions, such as profit margin turnarounds and a sharp profit leap. Curiosity piqued? Dive in to uncover what dramatic changes they are betting on for Teijin’s future.

Result: Fair Value of ¥1,180 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure from overseas competitors and stagnant healthcare revenues could undermine the upbeat growth story that analysts envision for Teijin.

Find out about the key risks to this Teijin narrative.

Another View: How Our DCF Model Sizes Up Teijin

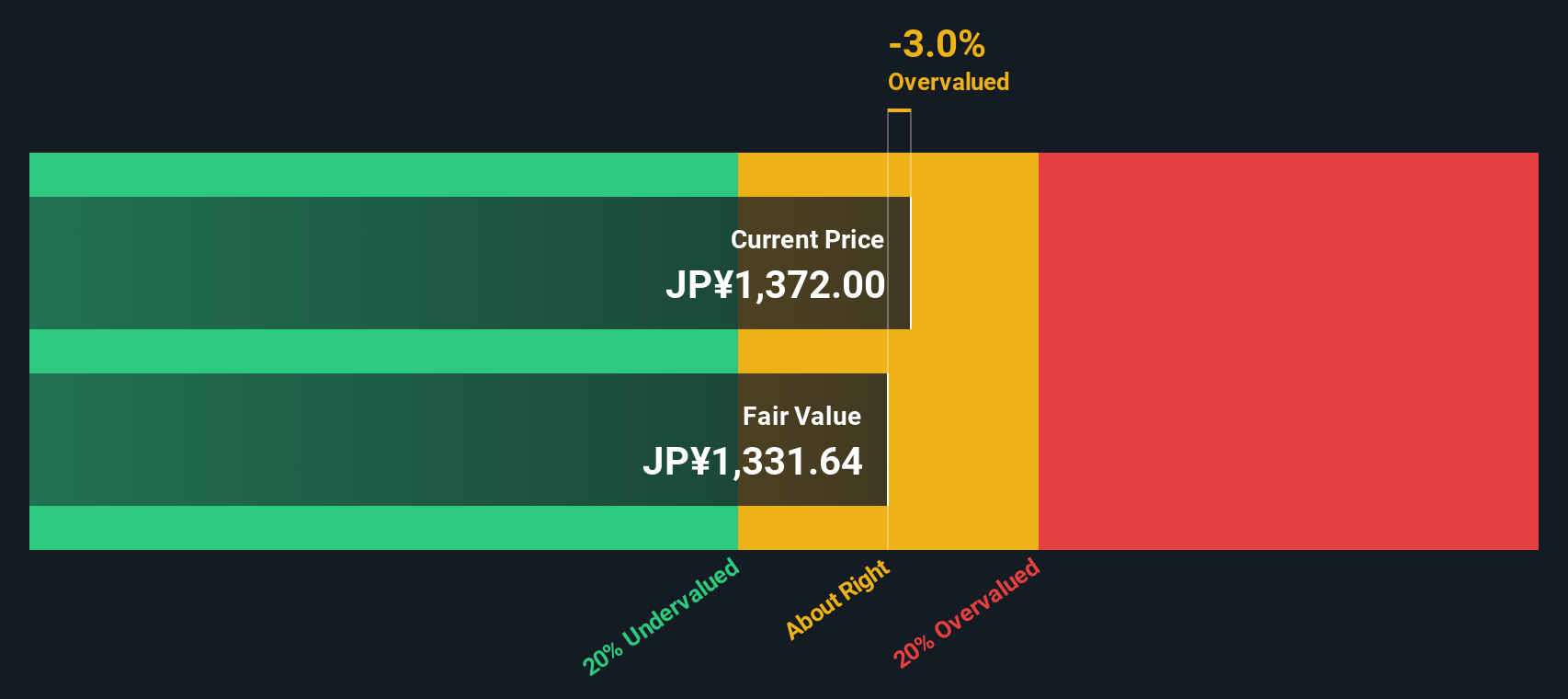

Looking beyond analyst forecasts and multiples, our SWS DCF model takes a closer look at Teijin's future cash flows. This approach values the company at ¥1,364 per share, just above the current trading price. This suggests a slight undervaluation. But which method tells the truer story for investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Teijin Narrative

If you see the story differently or want to dig deeper into the numbers yourself, it takes just a few minutes to shape your own viewpoint and analysis. Do it your way.

A great starting point for your Teijin research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let the best opportunities pass you by. Take the lead and use these powerful tools to spot high-potential stocks before the crowd catches on.

- Capitalize on market mispricing and get ahead of trends by starting with these 844 undervalued stocks based on cash flows.

- Secure reliable cash flow for your portfolio by digging into these 20 dividend stocks with yields > 3% with yields above 3%.

- Tap into breakthroughs in healthcare technology by checking out these 33 healthcare AI stocks, featuring innovators set to disrupt patient care and diagnostics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teijin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3401

Teijin

Engages in the fibers, films and sheets, composites, healthcare, and IT businesses in Japan and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives