As global markets react positively to the Trump administration's initial policy moves, with U.S. stocks reaching record highs and AI-related investments gaining traction, investors are keeping a keen eye on opportunities that align with these economic shifts. In this environment, dividend stocks can offer a compelling option for those seeking steady income and potential growth, as they often provide a buffer against market volatility while benefiting from favorable economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.63% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

AP (Thailand) (SET:AP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AP (Thailand) Public Company Limited, along with its subsidiaries, is involved in real estate development in Thailand and has a market capitalization of THB24.54 billion.

Operations: AP (Thailand) Public Company Limited generates revenue primarily from its Low-Rise Segment, which accounts for THB32.09 billion, and its High-Rise Segment, contributing THB3.46 billion.

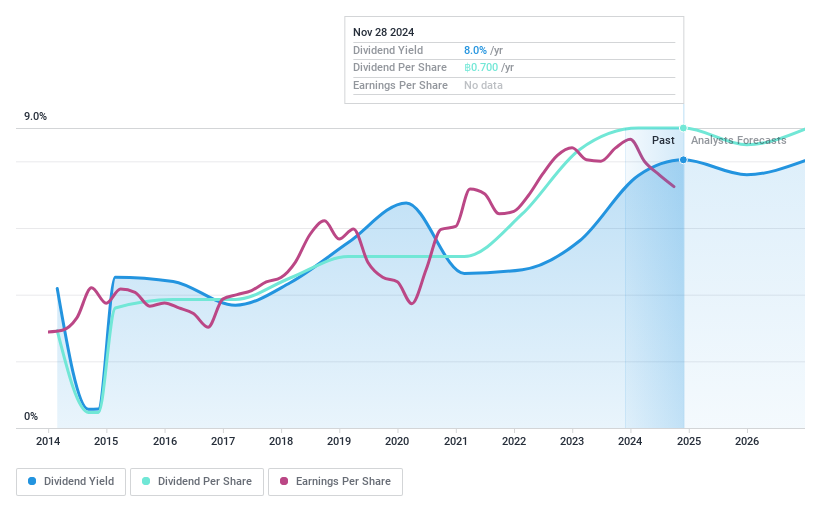

Dividend Yield: 8.8%

AP (Thailand) offers a high dividend yield of 8.81%, placing it in the top 25% of dividend payers in Thailand. However, its dividends have been volatile and not well covered by free cash flows, with a high cash payout ratio of 234.4%. Despite this, the payout ratio is reasonably low at 43.5%, indicating coverage by earnings. Recent earnings showed a decline in net income compared to last year, potentially impacting future dividends.

- Take a closer look at AP (Thailand)'s potential here in our dividend report.

- The analysis detailed in our AP (Thailand) valuation report hints at an deflated share price compared to its estimated value.

Mitsui DM Sugar Holdings (TSE:2109)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsui DM Sugar Holdings Co., Ltd. operates in Japan, focusing on the manufacturing and sale of sugar and food materials, with a market cap of ¥108.14 billion.

Operations: Mitsui DM Sugar Holdings Co., Ltd. generates revenue through its primary segments, with the Sugar segment contributing ¥146.51 billion, the Life Energy Business adding ¥26.10 billion, and the Real Estate Business accounting for ¥3.24 billion.

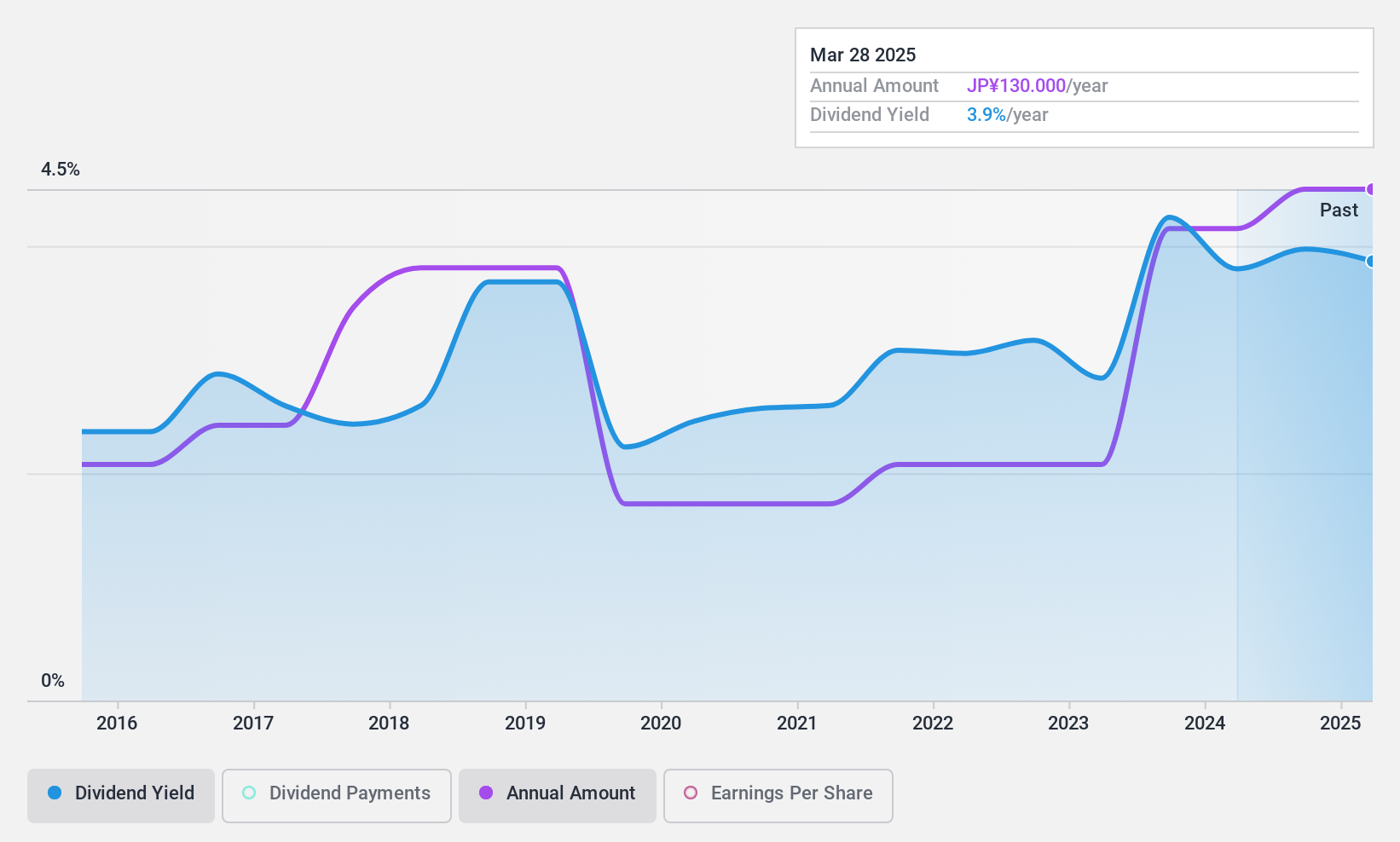

Dividend Yield: 3.9%

Mitsui DM Sugar Holdings' dividend yield of 3.88% ranks in the top 25% in Japan, with recent increases from ¥60.00 to ¥65.00 per share. Despite a volatile dividend history, payouts are well-covered by earnings and cash flows, with payout ratios of 55.5% and 29.7%, respectively. However, profit margins have decreased to 4.5%, which may affect future stability despite current positive guidance for net sales and operating income for the fiscal year ending March 2025 at ¥180 billion and ¥11 billion respectively.

- Click here and access our complete dividend analysis report to understand the dynamics of Mitsui DM Sugar Holdings.

- Our comprehensive valuation report raises the possibility that Mitsui DM Sugar Holdings is priced lower than what may be justified by its financials.

Kuriyama Holdings (TSE:3355)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kuriyama Holdings Corporation operates through its subsidiaries in industrial, construction, sports facility, and other materials businesses both in Japan and internationally, with a market cap of ¥25.03 billion.

Operations: Kuriyama Holdings Corporation generates revenue from various segments, including North America (¥43.01 billion), Asian Business - Industry Materials (¥17.74 billion), Asian Business - Sports and Construction Materials (¥9.46 billion), Europe, South America and Oceania Business (¥6.83 billion), and Asian Business - Others (¥0.95 billion).

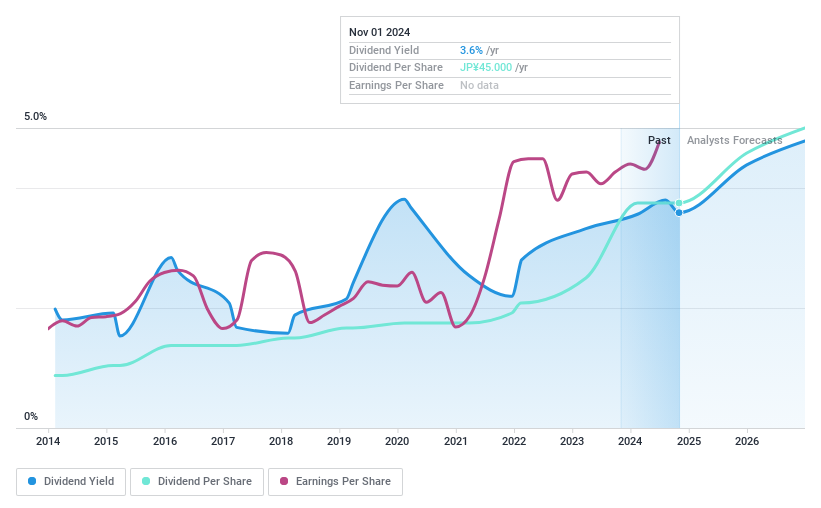

Dividend Yield: 3.5%

Kuriyama Holdings offers a stable dividend with a yield of 3.53%, though slightly below Japan's top quartile. Its dividends are well-covered by earnings and cash flows, with payout ratios of 31.9% and 17.8%, respectively, ensuring sustainability. Over the past decade, dividends have been reliable and steadily increasing without volatility. The stock trades at a favorable price-to-earnings ratio of 6.5x compared to the JP market average of 13.5x, indicating good relative value.

- Dive into the specifics of Kuriyama Holdings here with our thorough dividend report.

- According our valuation report, there's an indication that Kuriyama Holdings' share price might be on the cheaper side.

Seize The Opportunity

- Click through to start exploring the rest of the 1961 Top Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kuriyama Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kuriyama Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3355

Kuriyama Holdings

Manufactures and sells of various hoses, rubber, and plastics products in Japan, the United States, Canada, Europe, and internationally.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives