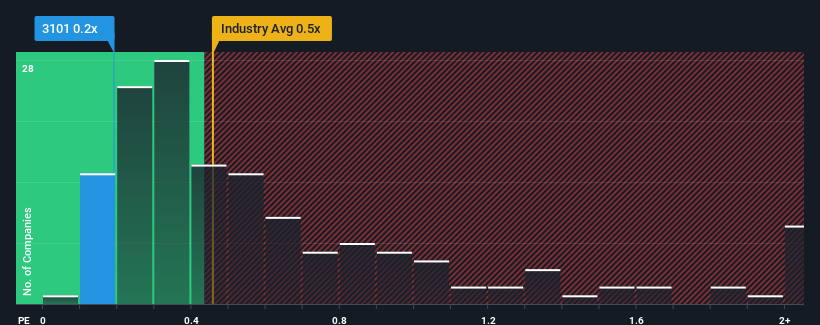

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Chemicals industry in Japan, you could be forgiven for feeling indifferent about Toyobo Co., Ltd.'s (TSE:3101) P/S ratio of 0.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Toyobo

How Has Toyobo Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Toyobo has been doing quite well of late. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Toyobo will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Toyobo?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Toyobo's to be considered reasonable.

Retrospectively, the last year delivered a decent 3.6% gain to the company's revenues. The latest three year period has also seen a 23% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 4.2% per year over the next three years. With the industry predicted to deliver 6.1% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Toyobo's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Toyobo's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Toyobo, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Toyobo, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Toyobo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3101

Toyobo

Provides films and functional polymers, industrial materials, and healthcare and textile products worldwide.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026