- South Korea

- /

- Metals and Mining

- /

- KOSE:A001430

KBC Group And 2 Other Reliable Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and fluctuating interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming value shares. In this dynamic environment, dividend stocks like KBC Group offer a compelling opportunity to enhance your portfolio by providing potential income stability amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.05% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

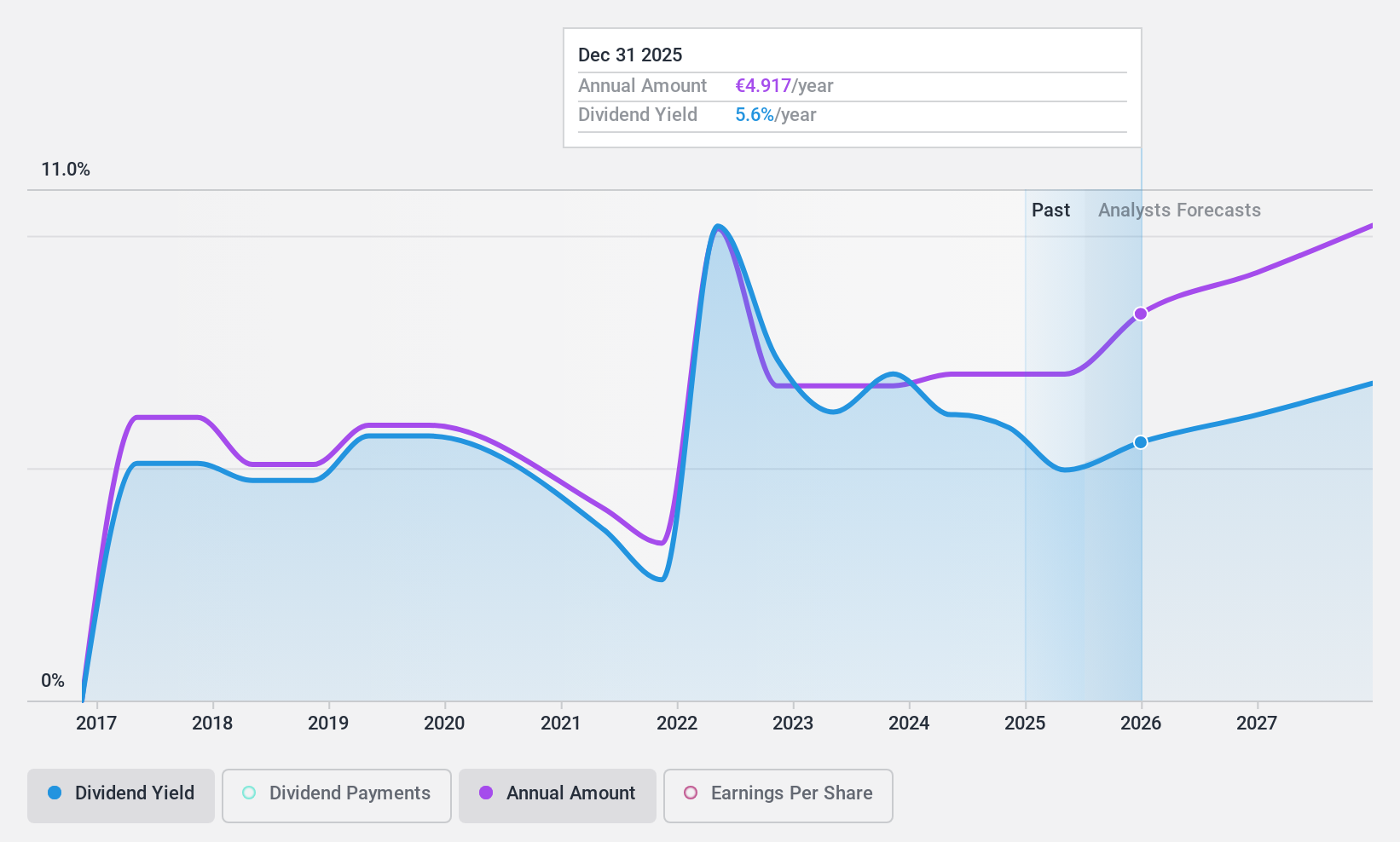

KBC Group (ENXTBR:KBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KBC Group NV is a financial institution offering integrated bank-insurance services to retail, private banking, SMEs, and mid-cap clients, with a market cap of €32.81 billion.

Operations: KBC Group's revenue is primarily derived from its Belgium Business segment at €6.46 billion, followed by the Czech Republic Business at €2.35 billion, and International Markets including Hungary (€1.13 billion), Bulgaria (€821 million), and Slovakia (€503 million).

Dividend Yield: 5%

KBC Group's dividend yield of 5.02% is below the top 25% of Belgian dividend payers, yet its payouts are well covered by earnings with a payout ratio of 49.8%. Despite a history of volatility and unreliability in dividends over the past decade, recent earnings growth—net income rising to €1.12 billion for Q4 2024—may provide stability. However, caution is advised due to high levels of bad loans at 2.1%.

- Get an in-depth perspective on KBC Group's performance by reading our dividend report here.

- The analysis detailed in our KBC Group valuation report hints at an deflated share price compared to its estimated value.

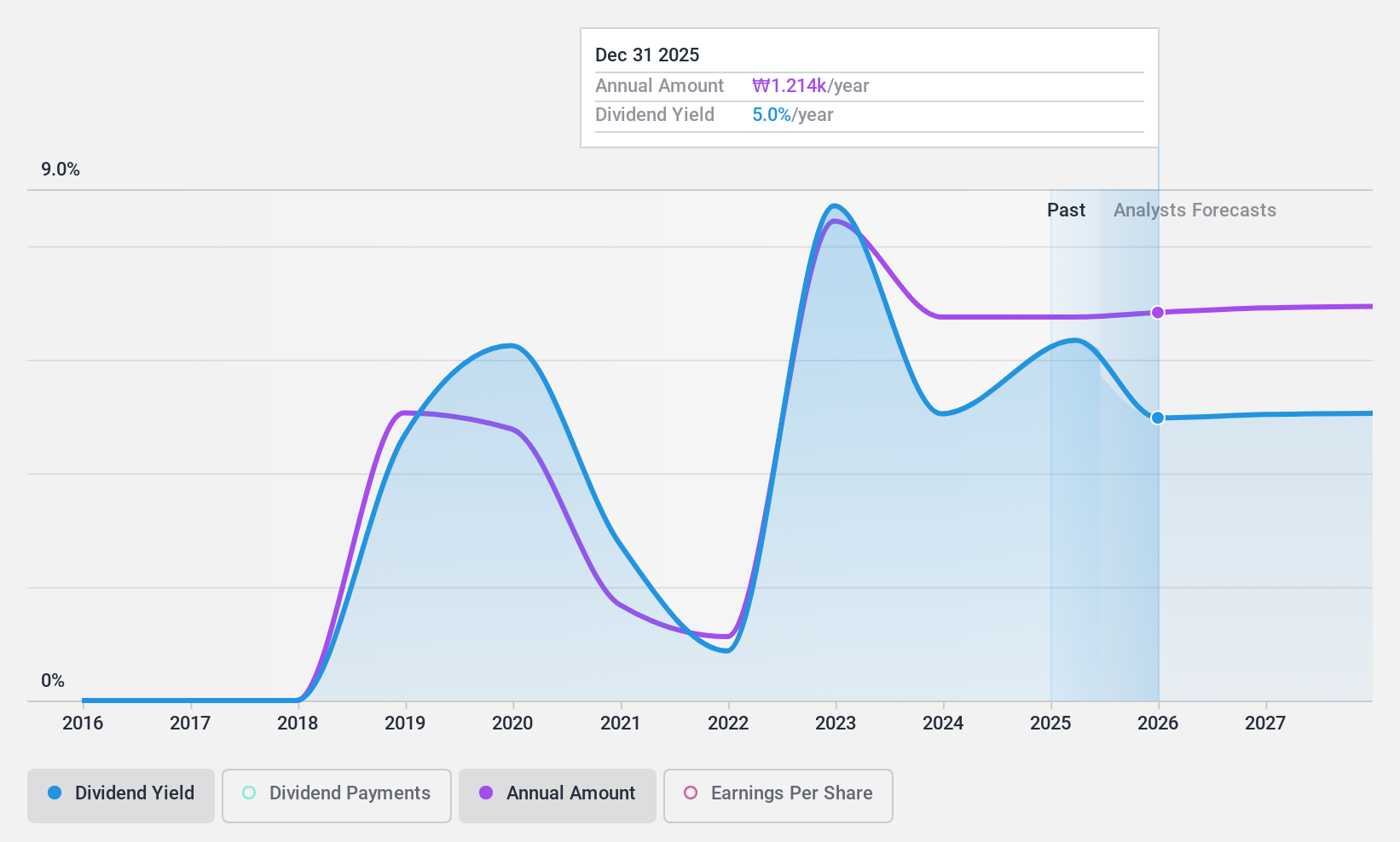

SeAH Besteel Holdings (KOSE:A001430)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SeAH Besteel Holdings Corporation operates in South Korea, focusing on the manufacture and sale of special steel, heavy forgings, auto parts, and axles with a market capitalization of approximately ₩690.70 billion.

Operations: SeAH Besteel Holdings generates revenue primarily from its Special Steel segment, amounting to ₩3.91 trillion, and its Aluminum Extrusion Division, contributing ₩98.66 billion.

Dividend Yield: 6.2%

SeAH Besteel Holdings offers a compelling dividend yield of 6.23%, placing it in the top 25% of Korean dividend payers. Its dividends are well-supported by earnings and cash flows, with payout ratios of 66.9% and 24.5%, respectively. However, the company's dividend history is marked by volatility over its seven-year track record, and profit margins have declined to 1.7%. The stock trades at a favorable price-to-earnings ratio of 10.7x compared to the market average of 12.1x.

- Click here and access our complete dividend analysis report to understand the dynamics of SeAH Besteel Holdings.

- Our valuation report unveils the possibility SeAH Besteel Holdings' shares may be trading at a premium.

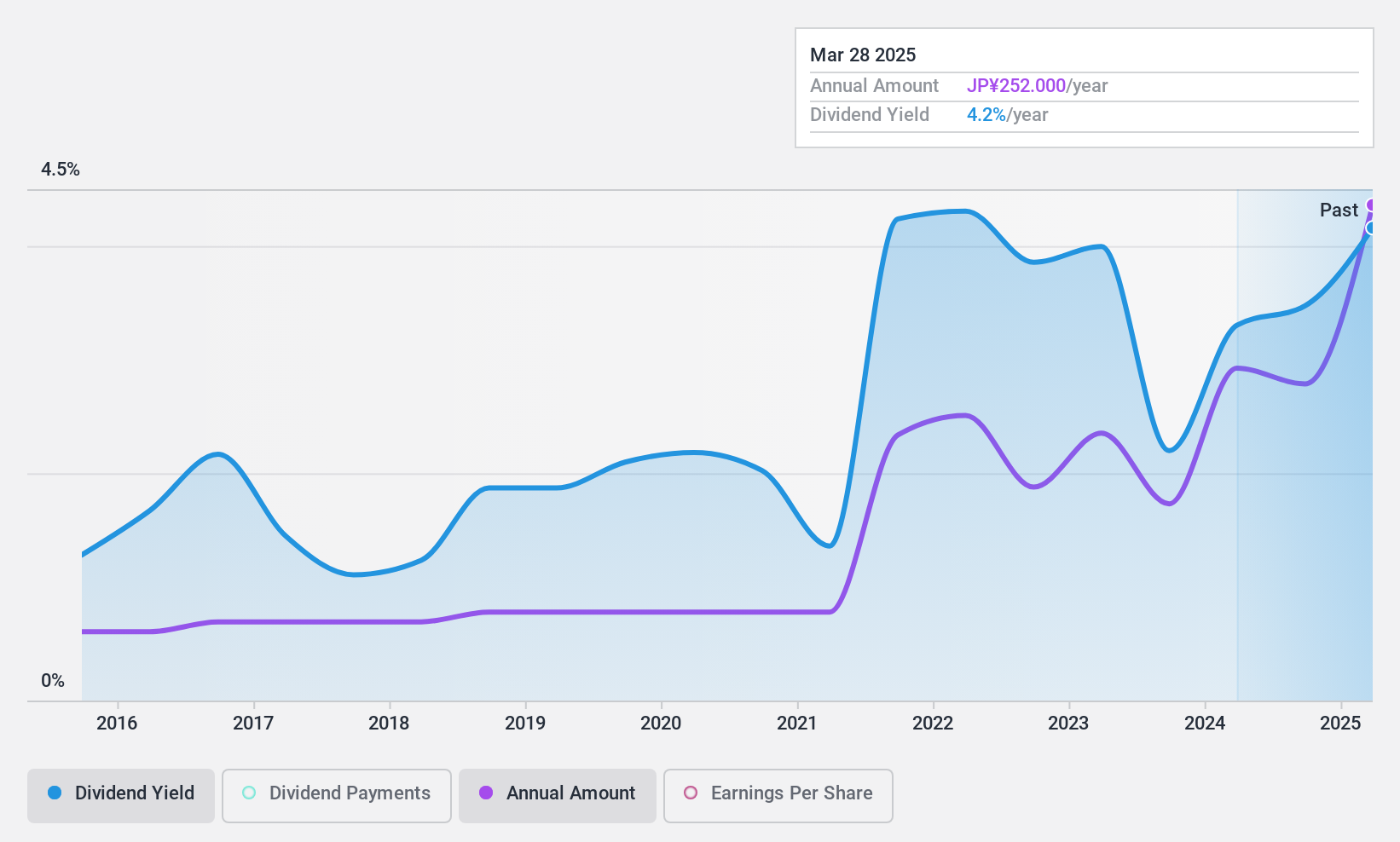

Nittetsu Mining (TSE:1515)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nittetsu Mining Co., Ltd. is involved in mining operations both within Japan and globally, with a market cap of ¥98.15 billion.

Operations: Nittetsu Mining Co., Ltd. generates revenue through its mining activities conducted both domestically in Japan and on an international scale.

Dividend Yield: 4.3%

Nittetsu Mining's recent dividend increase to ¥126 per share reflects its commitment to shareholder returns, despite a history of volatility and dividends not being covered by free cash flows. The company's payout ratio is low at 34.4%, suggesting dividends are well-supported by earnings. A recent buyback program worth ¥4.73 billion indicates strategic capital management. With a price-to-earnings ratio of 11.6x, the stock offers value compared to the Japanese market average of 13.2x.

- Delve into the full analysis dividend report here for a deeper understanding of Nittetsu Mining.

- In light of our recent valuation report, it seems possible that Nittetsu Mining is trading beyond its estimated value.

Next Steps

- Explore the 1983 names from our Top Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A001430

SeAH Besteel Holdings

Engages in the manufacture and sale of special steel, heavy forgings, auto parts, and axles in South Korea.

Moderate risk with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)