If You Had Bought Sk KakenLtd's (TYO:4628) Shares Three Years Ago You Would Be Down 36%

As an investor its worth striving to ensure your overall portfolio beats the market average. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Sk Kaken Co.,Ltd. (TYO:4628) shareholders, since the share price is down 36% in the last three years, falling well short of the market decline of around 4.4%.

See our latest analysis for Sk KakenLtd

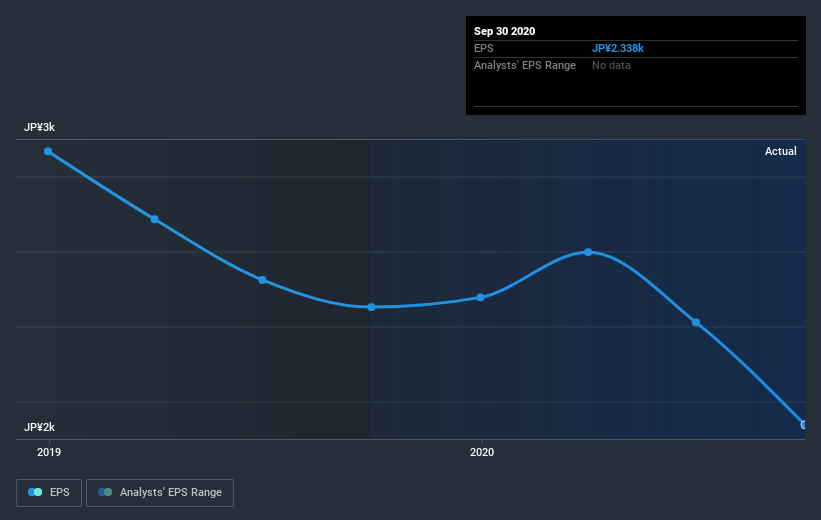

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Sk KakenLtd saw its EPS decline at a compound rate of 15% per year, over the last three years. This change in EPS is reasonably close to the 14% average annual decrease in the share price. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. It seems like the share price is reflecting the declining earnings per share.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Sk KakenLtd's key metrics by checking this interactive graph of Sk KakenLtd's earnings, revenue and cash flow.

A Different Perspective

Investors in Sk KakenLtd had a tough year, with a total loss of 18% (including dividends), against a market gain of about 10%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Sk KakenLtd has 1 warning sign we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

If you’re looking to trade Sk KakenLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:4628

Sk KakenLtd

Engages in the manufacture and sale of organic and inorganic water-based coating materials, synthetic resin paints, inorganic coating materials, and inorganic building materials in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives