Should Investors Reassess Tokio Marine After Five Years of Triple Digit Share Price Growth?

Reviewed by Simply Wall St

If you have been eyeing Tokio Marine Holdings, you are far from alone. Investors everywhere are asking themselves whether now is the perfect moment to jump in or simply let it ride. Over the last five years, the company’s stock price has surged by an astonishing 372.7%, and its three-year return stands at a noteworthy 172.6%. Even just in the past year, shares have gained 31.2%. While the pace has cooled more recently, with the stock essentially flat over the last seven and 30 days, and up 13.7% year-to-date, this long-term growth story is hard to ignore.

Driving some of this momentum are shifts in how the market is viewing risk across global insurance players, along with Tokio Marine’s steady expansion efforts. The company has navigated changing economic landscapes, signaling both discipline and growth potential. But with so much progress already reflected in the price, it is natural to wonder about the current valuation. Investors may be questioning whether those buying now are getting a bargain or overpaying.

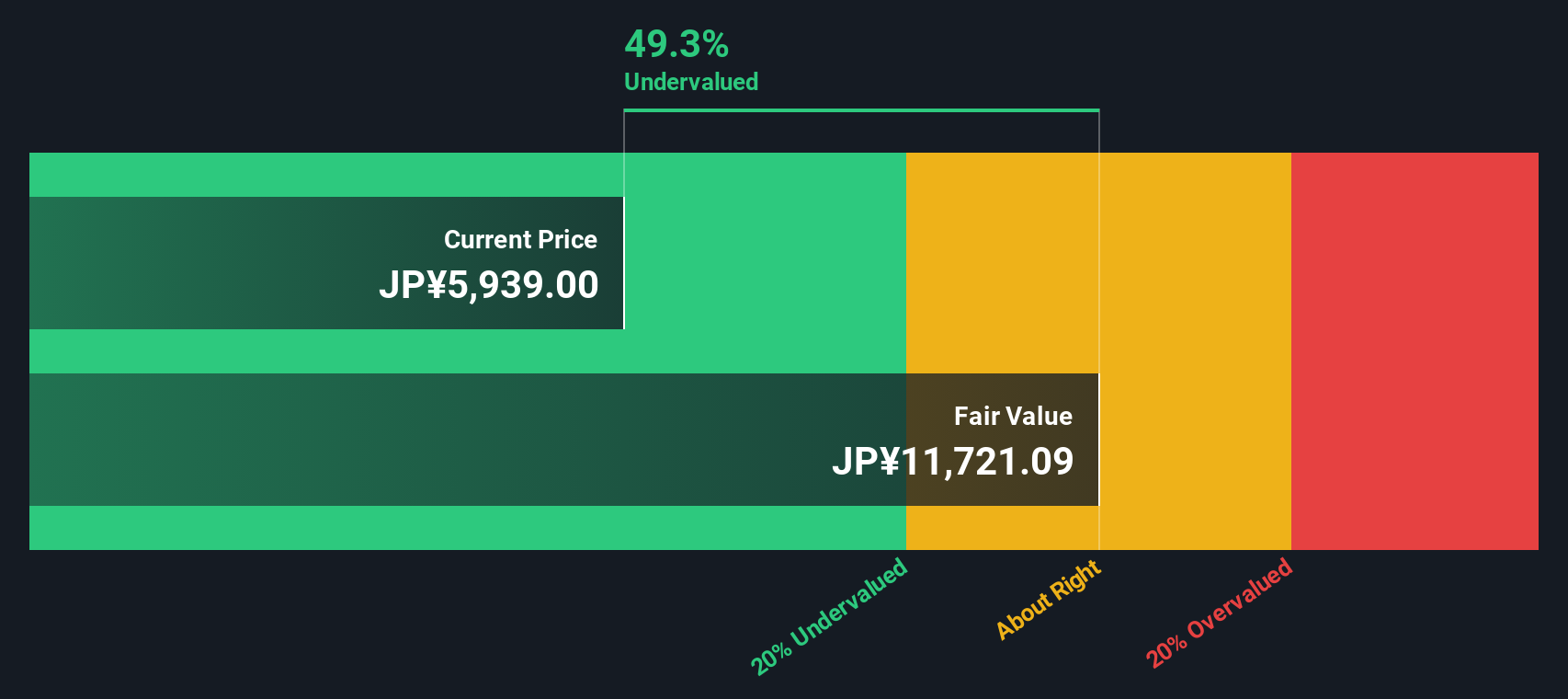

That is where the valuation metrics come in. We put Tokio Marine Holdings through six different valuation checks, and it passed five out of six. The company earned a value score of 5. This suggests it looks undervalued by most measures, but there are important nuances to consider.

Next, we will break down each of these valuation approaches to reveal how they paint a picture of the company’s true worth. At the end, we will also explore a smarter, more holistic way of thinking about valuation that goes beyond the numbers alone.

Why Tokio Marine Holdings is lagging behind its peersApproach 1: Tokio Marine Holdings Excess Returns Analysis

The Excess Returns model focuses on a company’s ability to generate returns on invested capital above the cost of equity. In this case, Tokio Marine Holdings stands out with an average Return on Equity (ROE) of 18.71%, indicating strong profitability relative to its net assets.

Here is how the model’s major figures break down:

- Book Value: ¥2,580.36 per share

- Stable EPS: ¥522.26 per share (based on weighted future ROE estimates from 9 analysts)

- Cost of Equity: ¥131.77 per share

- Excess Return: ¥390.49 per share

- Stable Book Value: ¥2,791.77 per share (from 7 analysts’ weighted book value projections)

By forecasting these excess returns over time, the model derives an intrinsic value that is 46.6% above the current share price. According to the model, the stock appears significantly undervalued based on its robust profitability and strong capital efficiency.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Tokio Marine Holdings.

Approach 2: Tokio Marine Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies like Tokio Marine Holdings. It gives investors a quick snapshot of what the market is willing to pay today for a company’s current earnings. A lower PE can point to a potential bargain, while a higher one may reflect optimism about future growth or simply a premium for quality and stability.

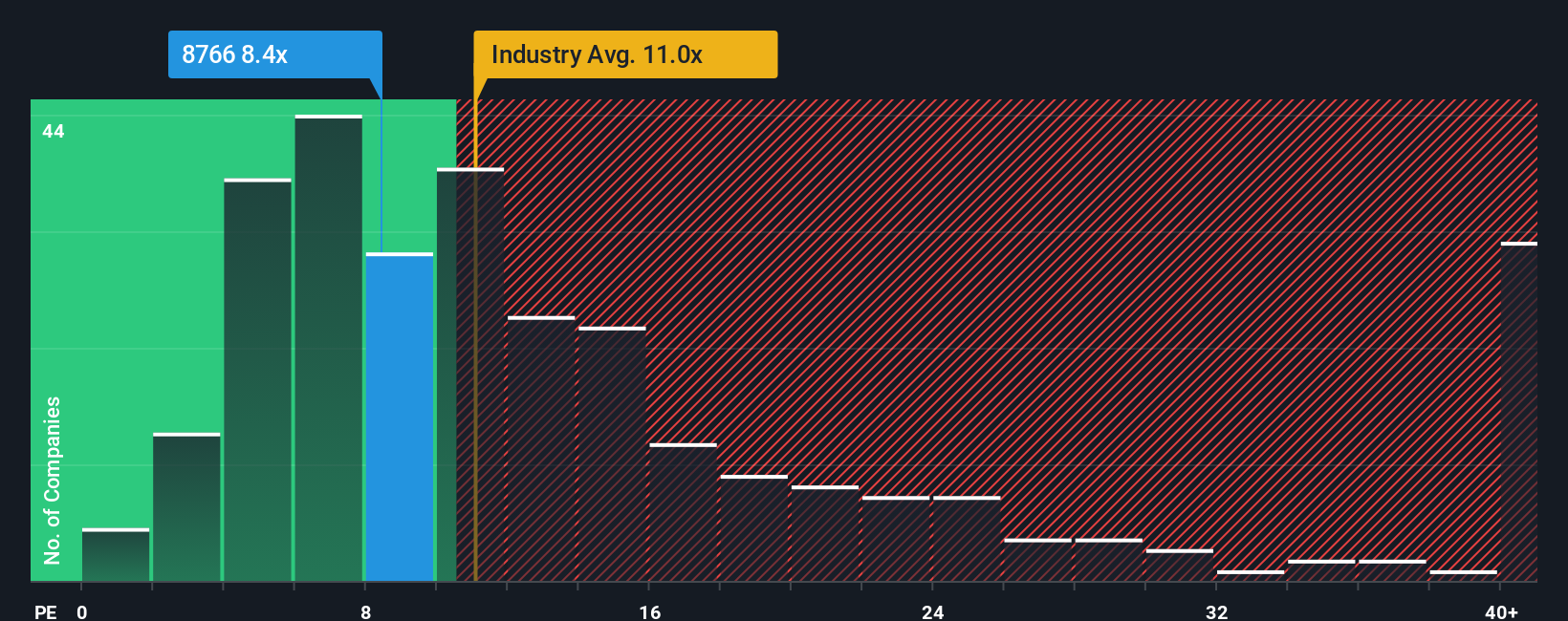

Determining what qualifies as a “fair” PE ratio involves balancing growth expectations and risk. Fast-growing, stable companies tend to command higher multiples. In contrast, slower growth or greater risk can keep valuations in check. For context, Tokio Marine Holdings currently trades at 9.3x earnings. This is lower than both the insurance industry average of 12.2x and the typical peer at 11.0x.

Simply Wall St’s “Fair Ratio” takes this analysis a step further by factoring in the nuances behind the numbers, such as the company’s forecasted earnings growth, profit margins, market capitalization and unique risks. Unlike a plain comparison to peers or industry averages, this tailored approach provides a more complete assessment of what multiple the business actually deserves. For Tokio Marine Holdings, the Fair Ratio is calculated to be 11.6x. Since this is meaningfully above the company's current PE, it suggests the market may be undervaluing the stock at today’s price.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Tokio Marine Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you tell about a company’s future, reflecting your perspective on where it is headed based on its underlying business, the broader environment, and your own assumptions about factors such as revenue growth, profit margins, and fair value. Narratives connect a company’s story to your financial forecasts and ultimately help you determine what you believe its shares are truly worth.

On Simply Wall St’s Community page, Narratives let you combine your thinking with dynamic, up-to-date data in a simple tool used by millions of investors. Instead of just looking at static numbers, you can create or explore Narratives, which are easy-to-digest scenarios showing how the business might perform, what fair value that suggests, and how it compares to the current share price. You can quickly see whether your Narrative points to buying, holding, or selling, with updates as new news or earnings come in, keeping your perspective relevant without any hassle.

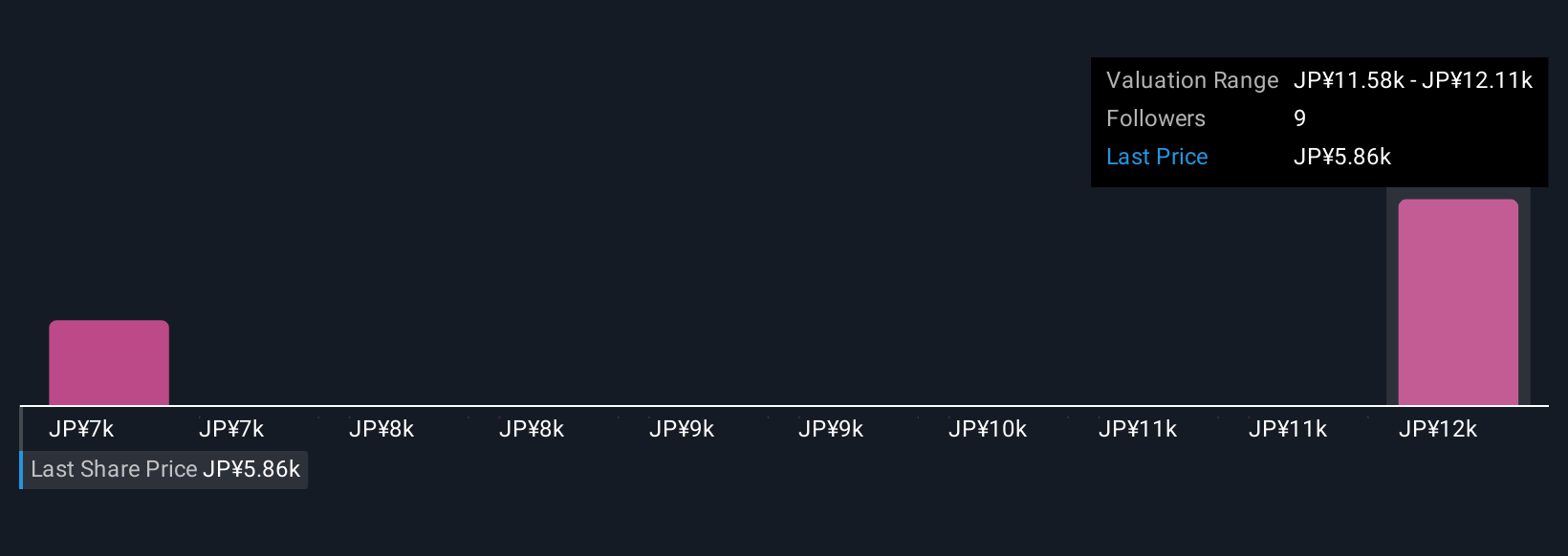

For example, some investors are optimistic and see a fair value as high as ¥7,900 for Tokio Marine Holdings, while others are more cautious, estimating it as low as ¥5,400. Both positions are driven by differing views of the company’s revenue, earnings power, and risks.

Do you think there's more to the story for Tokio Marine Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokio Marine Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8766

Tokio Marine Holdings

Engages in the non-life and life insurance, and financial and general businesses in Japan and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives