Why Dai-ichi Life Holdings (TSE:8750) Is Up 11.8% After Upward Earnings and Dividend Revisions

Reviewed by Sasha Jovanovic

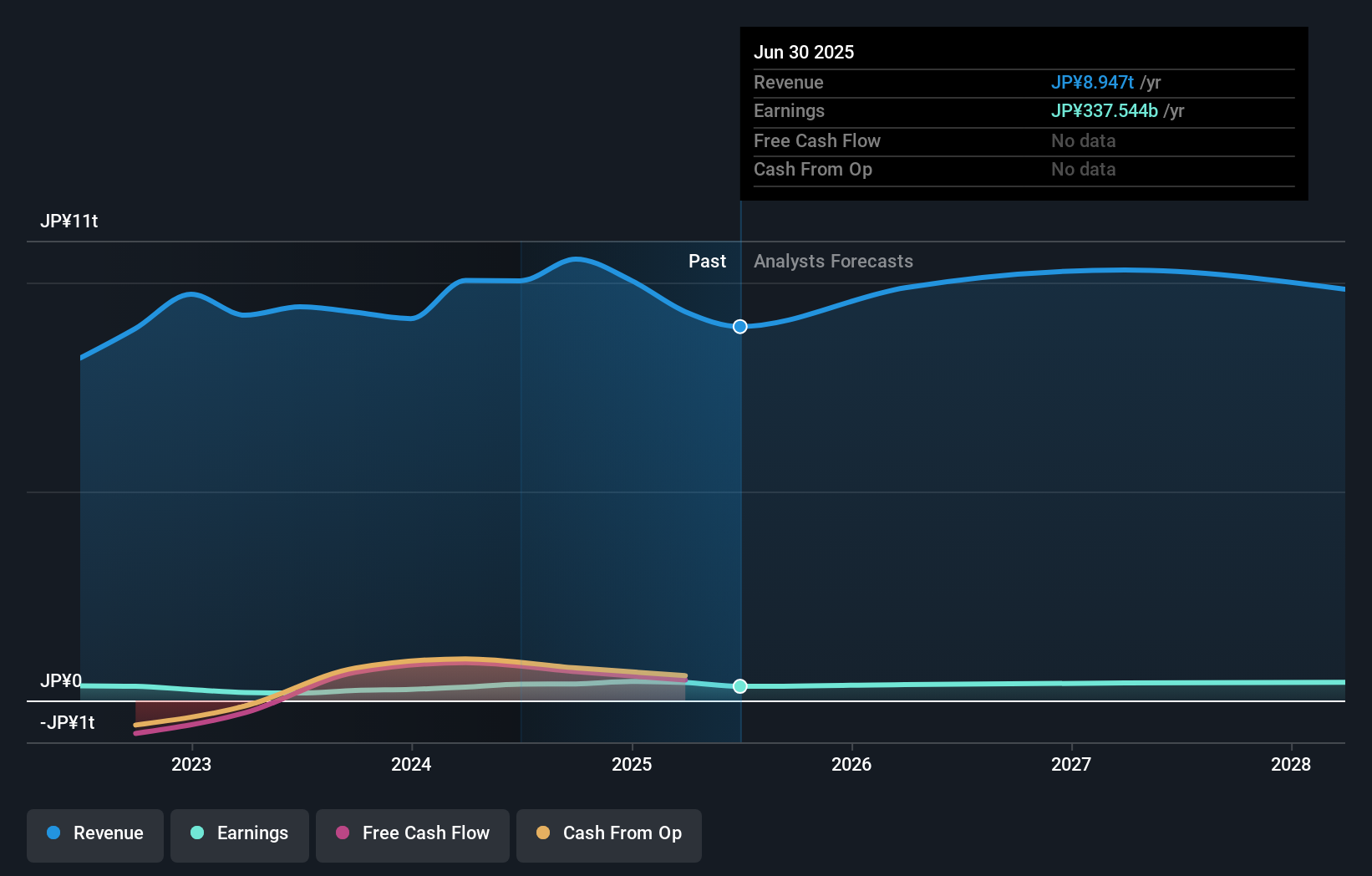

- Dai-ichi Life Holdings recently revised its consolidated earnings and dividend forecasts for the fiscal year ending March 31, 2026, now expecting ordinary revenues of ¥10.32 trillion and net income of ¥400 billion.

- A meaningful increase in consolidated total assets following a completed reinsurance transaction, coupled with higher gains on security sales, has strengthened the company’s financial position and prompted upward revisions in profit and dividend outlooks.

- We’ll explore how Dai-ichi Life Holdings’ improved asset base and higher profit guidance may influence its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Dai-ichi Life Holdings Investment Narrative Recap

To be a shareholder in Dai-ichi Life Holdings, you need to believe in the company’s ability to grow internationally and increase recurring earnings despite challenging conditions in Japan, such as demographic headwinds and pressured investment yields. The recent upward revision in revenue and net income forecasts for 2026 is a constructive sign for near-term profitability, though it does not materially reduce the most significant risk, which remains persistently low investment yields from the domestic portfolio. Short-term catalysts still hinge on international business expansion and improvements in asset management returns.

Among recent developments, the completed reinsurance transaction that added US$6.7 billion to total assets directly supports Dai-ichi Life’s financial strength and underpins the improved earnings outlook for 2026. This asset boost is relevant as it bolsters the company’s resilience, partly addressing concerns over capital adequacy and creating some buffer against the risk of weak domestic investment returns. Contrast this with the underlying risk investors should be aware of: despite stronger asset levels and profit forecasts, Dai-ichi Life remains exposed to ...

Read the full narrative on Dai-ichi Life Holdings (it's free!)

Dai-ichi Life Holdings' outlook anticipates ¥10,954.9 billion in revenue and ¥447.5 billion in earnings by 2028. This scenario is based on 7.0% annual revenue growth and a ¥110.0 billion increase in earnings from the current ¥337.5 billion level.

Uncover how Dai-ichi Life Holdings' forecasts yield a ¥1361 fair value, a 12% upside to its current price.

Exploring Other Perspectives

All one of the Simply Wall St Community’s fair value estimates sits at ¥2,483.52, above current levels. However, many participants remain wary about the ongoing pressure of low or negative interest rates on profits, inviting you to compare a range of investor views before considering your next move.

Explore another fair value estimate on Dai-ichi Life Holdings - why the stock might be worth just ¥2484!

Build Your Own Dai-ichi Life Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dai-ichi Life Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Dai-ichi Life Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dai-ichi Life Holdings' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8750

Dai-ichi Life Holdings

Through its subsidiaries, provides insurance products in Japan, the United States, and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives