Is Dai-ichi Life Holdings (TSE:8750) Undervalued? Examining Its Current Valuation and Growth Strategy

Reviewed by Simply Wall St

Dai-ichi Life Holdings (TSE:8750) shares have attracted attention recently, as investors consider its recent stock performance and fundamentals. Year to date, the insurer has gained 10%, and over the past year, the stock shows an increase of 20%.

See our latest analysis for Dai-ichi Life Holdings.

Dai-ichi Life Holdings’ momentum is picking up, with a 6.31% share price return over the past week and nearly 10% year-to-date. Its impressive 19.73% total shareholder return for the last twelve months reflects ongoing optimism about growth and profitability.

If strong recent gains have you weighing other opportunities, now could be an ideal moment to discover fast growing stocks with high insider ownership.

With Dai-ichi Life Holdings’ shares climbing and optimism building, investors may wonder whether the market is offering a genuine bargain on future potential or if the company’s impressive growth is already priced in.

Most Popular Narrative: 14.6% Undervalued

Dai-ichi Life Holdings currently trades at a notable discount to the fair value outlined in the most widely followed narrative. This puts the spotlight on market mispricing and future catalysts.

Expansion in international business, particularly in Asia and Australia, is delivering strong profit growth and improving diversification. This reduces reliance on Japan's mature insurance market and supports higher consolidated revenue and earnings stability. The company's strategic shift toward asset management and alternative investments, along with improving fixed income yields from portfolio rebalancing, is expected to enhance investment spreads and recurring income. These developments could benefit net margins and long-term profitability.

What’s giving Dai-ichi Life’s fair value such an edge? It is all about bold bets on international expansion and reinvention in asset management. Curious whether these strategic moves really justify an aggressive future price target? The answer may surprise you. Click through to see the critical assumptions behind this valuation.

Result: Fair Value of ¥1,361 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low interest rates and rising operating costs remain potential hurdles that could pressure Dai-ichi Life Holdings’ profit margins and future growth prospects.

Find out about the key risks to this Dai-ichi Life Holdings narrative.

Another View: Looking Through a Different Lens

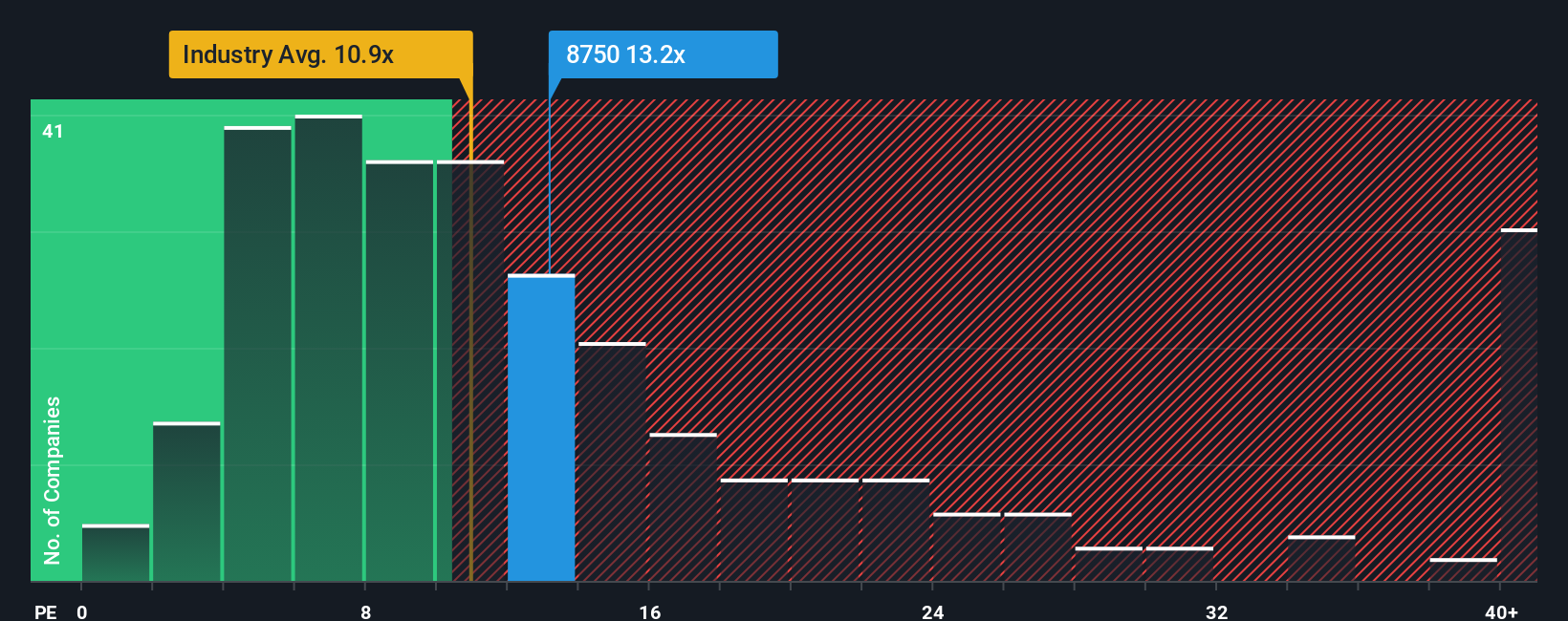

While the market sees Dai-ichi Life Holdings as undervalued based on discounted cash flow assumptions, a closer look at price-to-earnings tells a different story. The company trades at 12.5x earnings, which is higher than the industry’s average of 11x. This gap could point to valuation risk if growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dai-ichi Life Holdings Narrative

If you see things differently or want to dig deeper into the numbers, you can develop your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Dai-ichi Life Holdings.

Looking for more investment ideas?

Smart investors know opportunities rarely wait. Sharpen your strategy and seize the next big trend with powerful, data-driven screens made for real results.

- Tap into long-term income and stability when you browse these 14 dividend stocks with yields > 3% yielding over 3% for reliable cash flow potential.

- Capitalize on technology’s rapid evolution and spot tomorrow’s winners by checking out these 27 AI penny stocks at the forefront of artificial intelligence.

- Catch the market’s hidden gems trading below fair value by finding these 883 undervalued stocks based on cash flows before others do.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8750

Dai-ichi Life Holdings

Through its subsidiaries, provides insurance products in Japan, the United States, and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives