- Norway

- /

- Oil and Gas

- /

- OB:BWLPG

Uncovering Undiscovered Gems With Potential In November 2024

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and smaller-cap stocks outperforming their larger counterparts, investors are keenly observing economic indicators such as the drop in jobless claims and improved home sales, which bolster positive sentiment. In this environment of broad-based gains and cautious optimism around potential interest rate cuts, identifying undiscovered gems requires a focus on companies that demonstrate strong fundamentals and adaptability to shifting market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

BWG (OB:BWLPG)

Simply Wall St Value Rating: ★★★★★★

Overview: BW LPG Limited is an investment holding company involved in ship owning and chartering activities globally, with a market capitalization of NOK19.94 billion.

Operations: BW LPG Limited generates revenue primarily from its Shipping and Product Services segments, with Shipping contributing $1.40 billion and Product Services adding $2.42 billion. The company's financials reflect a segment adjustment of -$287.74 million impacting overall revenue figures.

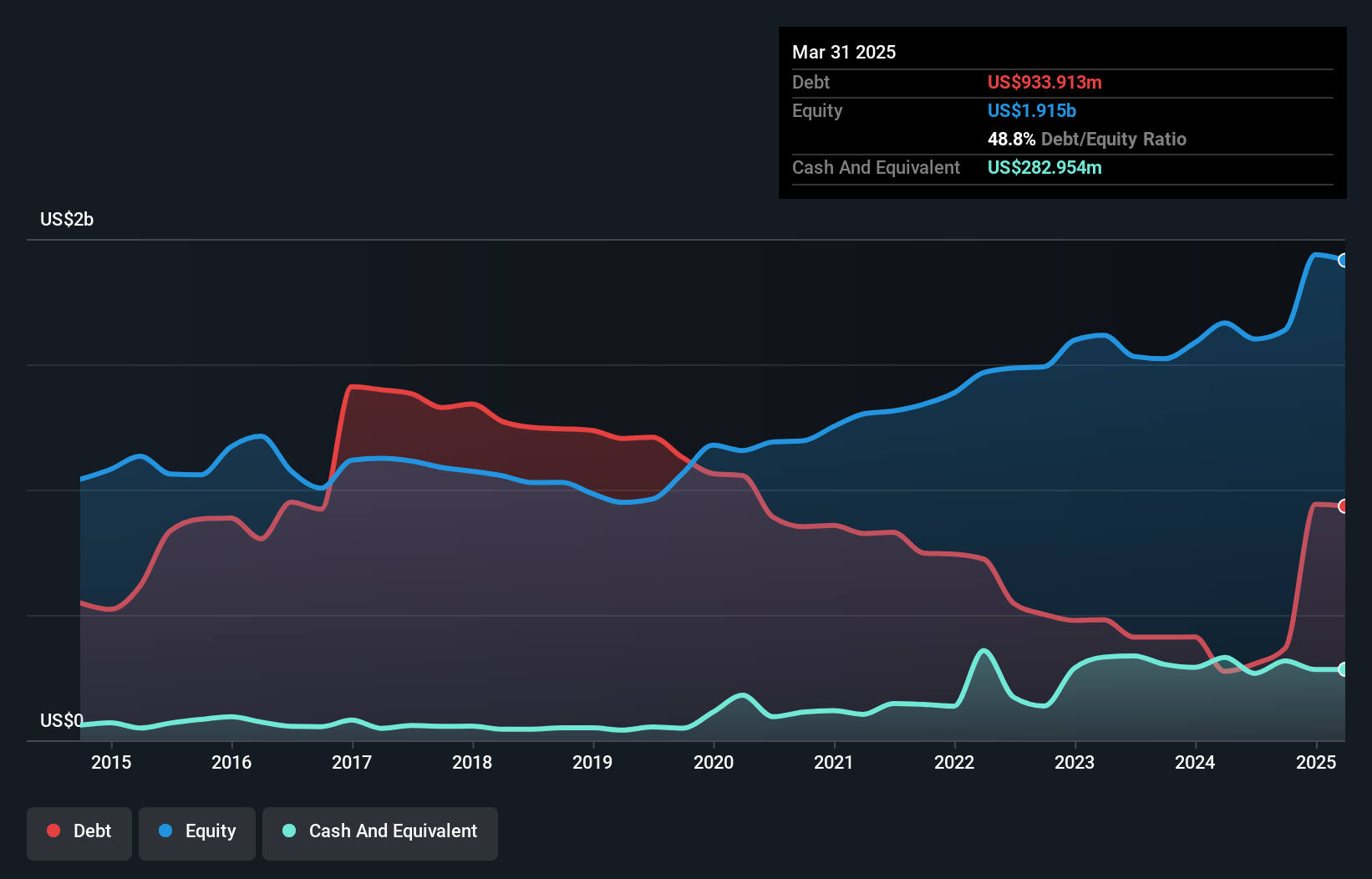

BW LPG, a notable player in the oil and gas industry, has shown robust financial health with its interest payments well covered by EBIT at 66.6 times. The company's net debt to equity ratio stands at a satisfactory 2.4%, reflecting prudent financial management as it reduced from 125.7% over five years. Despite significant insider selling recently, BW LPG's earnings surged by 41.8% last year, outpacing the industry's -16.9%. Trading at an attractive valuation—77.7% below fair value—it offers potential despite forecasts of a yearly earnings drop of 21.4% over the next three years.

- Unlock comprehensive insights into our analysis of BWG stock in this health report.

Examine BWG's past performance report to understand how it has performed in the past.

Mayinglong Pharmaceutical Group (SHSE:600993)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mayinglong Pharmaceutical Group Co., Ltd. is a company engaged in the production and sale of pharmaceuticals, with a market cap of approximately CN¥10.99 billion.

Operations: The company generates revenue primarily through the sale of pharmaceuticals.

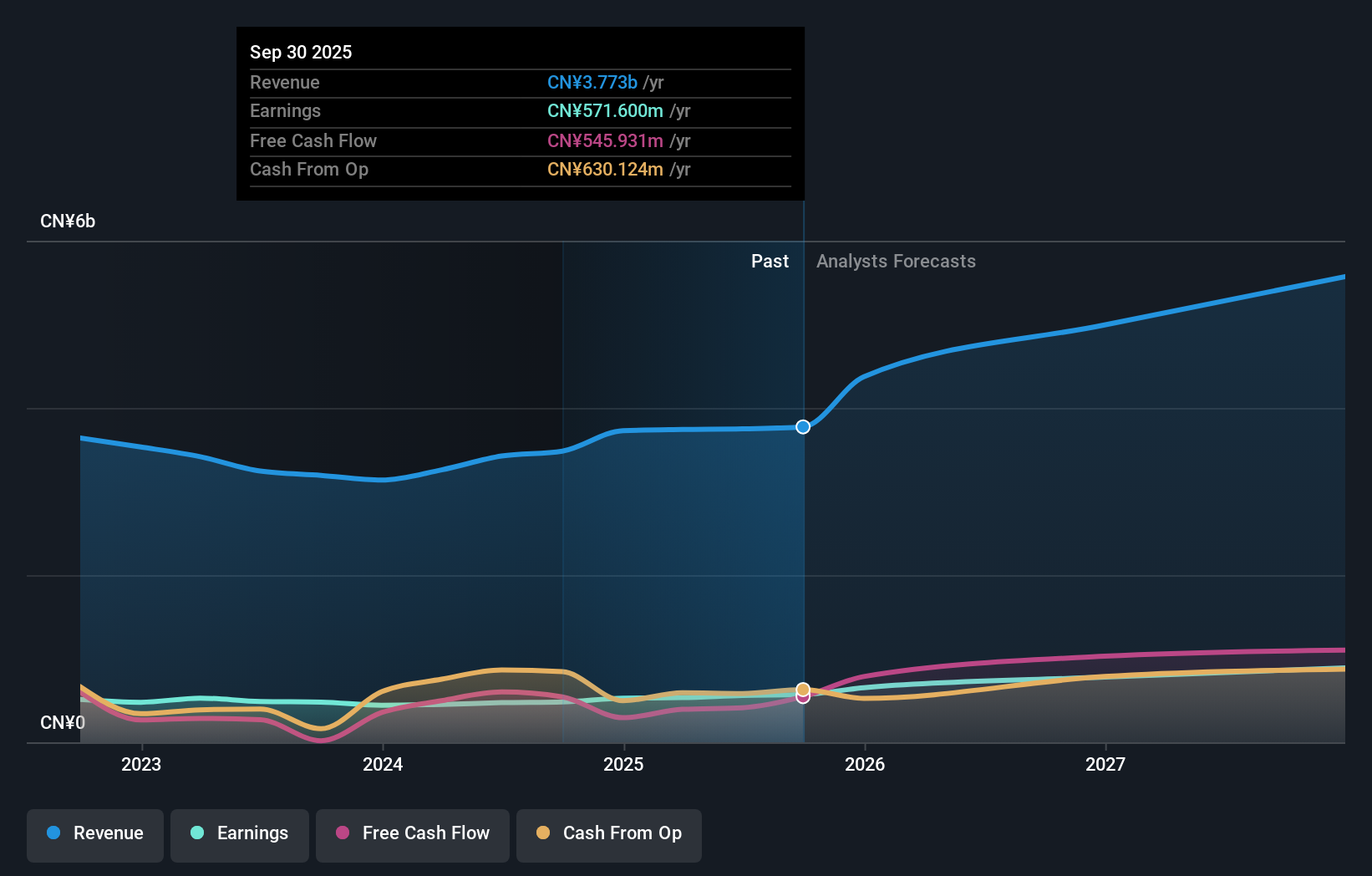

Mayinglong Pharmaceutical Group, a nimble player in the pharmaceutical sector, is showcasing notable financial resilience. Its earnings growth of 0.3% outpaced the industry's -2.5%, highlighting its competitive edge. Trading at 31% below estimated fair value suggests potential undervaluation compared to peers. The company reported CNY 2,791.82 million in sales for the first nine months of 2024, up from CNY 2,446.24 million last year, with net income rising to CNY 457.5 million from CNY 418.38 million previously. Despite an increased debt-to-equity ratio from 1.5% to 4% over five years, it remains profitable with positive free cash flow and high-quality earnings.

- Navigate through the intricacies of Mayinglong Pharmaceutical Group with our comprehensive health report here.

Learn about Mayinglong Pharmaceutical Group's historical performance.

FP Partner (TSE:7388)

Simply Wall St Value Rating: ★★★★★☆

Overview: FP Partner Inc. offers insurance services to individuals and corporations in Japan, with a market capitalization of approximately ¥69.84 billion.

Operations: FP Partner generates revenue primarily from its insurance agency business, which reported ¥34.63 billion. The company has a market capitalization of approximately ¥69.84 billion.

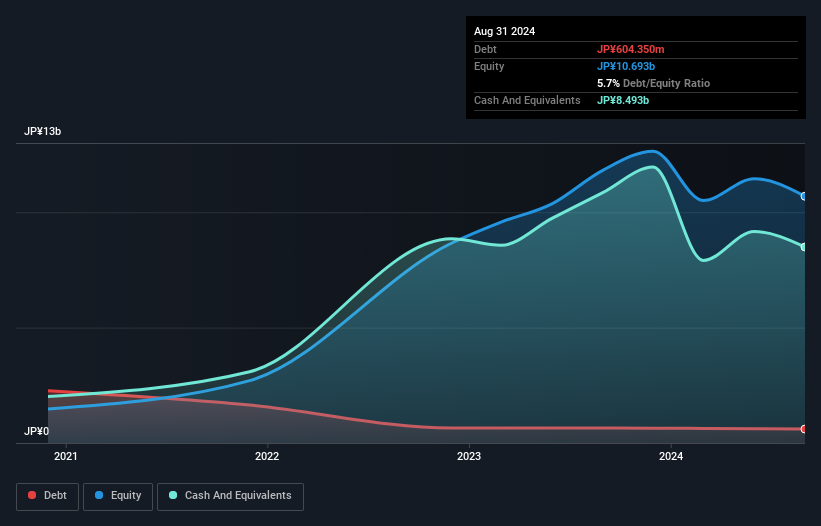

FP Partner, a small yet promising player in the insurance sector, has shown robust earnings growth of 36.8% annually over the past five years. Despite this, its recent performance didn't outpace the broader industry growth of 45.2%. The company is trading at an attractive 54.4% below its estimated fair value, hinting at potential undervaluation. While it enjoys high-quality earnings and more cash than debt, recent guidance revisions reflect challenges due to shifting product demand and external economic factors like high U.S. interest rates affecting sales composition and profit margins for the fiscal year ending November 2024.

- Dive into the specifics of FP Partner here with our thorough health report.

Understand FP Partner's track record by examining our Past report.

Key Takeaways

- Get an in-depth perspective on all 4640 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BWLPG

BWG

An investment holding company, engages in ship owning and chartering activities worldwide.

Very undervalued with flawless balance sheet and pays a dividend.