- Japan

- /

- Personal Products

- /

- TSE:4967

Earnings Tell The Story For Kobayashi Pharmaceutical Co., Ltd. (TSE:4967)

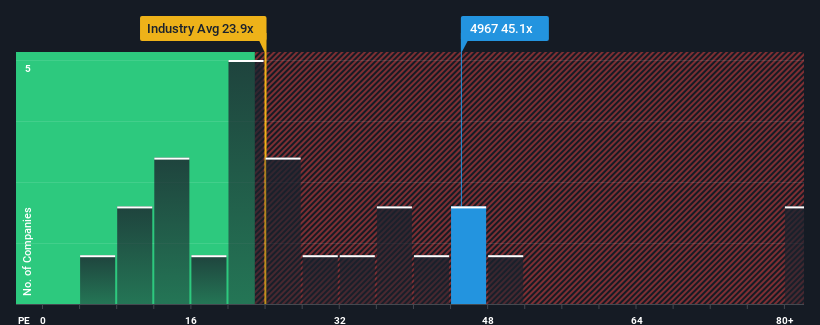

With a price-to-earnings (or "P/E") ratio of 45.1x Kobayashi Pharmaceutical Co., Ltd. (TSE:4967) may be sending very bearish signals at the moment, given that almost half of all companies in Japan have P/E ratios under 13x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Kobayashi Pharmaceutical hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Kobayashi Pharmaceutical

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Kobayashi Pharmaceutical's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 50% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 43% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 22% each year over the next three years. With the market only predicted to deliver 11% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Kobayashi Pharmaceutical's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Kobayashi Pharmaceutical's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Kobayashi Pharmaceutical, and understanding these should be part of your investment process.

If you're unsure about the strength of Kobayashi Pharmaceutical's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kobayashi Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4967

Kobayashi Pharmaceutical

Engages in the manufacture and sale of OTC pharmaceuticals, guasi-drugs, deodorizing air fresheners, and sanitary products in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives