- Japan

- /

- Personal Products

- /

- TSE:4934

Little Excitement Around Premier Anti-Aging Co., Ltd.'s (TSE:4934) Revenues As Shares Take 30% Pounding

Premier Anti-Aging Co., Ltd. (TSE:4934) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

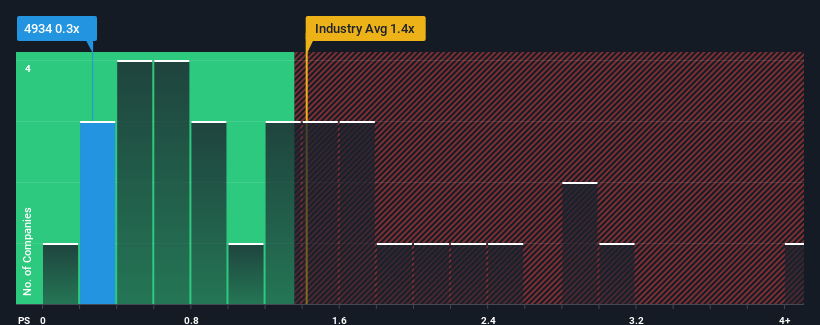

After such a large drop in price, it would be understandable if you think Premier Anti-Aging is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in Japan's Personal Products industry have P/S ratios above 1.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Premier Anti-Aging

How Premier Anti-Aging Has Been Performing

While the industry has experienced revenue growth lately, Premier Anti-Aging's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Premier Anti-Aging.Is There Any Revenue Growth Forecasted For Premier Anti-Aging?

In order to justify its P/S ratio, Premier Anti-Aging would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 26%. This means it has also seen a slide in revenue over the longer-term as revenue is down 35% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 8.3% over the next year. With the industry predicted to deliver 6.0% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that Premier Anti-Aging's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Premier Anti-Aging's P/S Mean For Investors?

Premier Anti-Aging's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Premier Anti-Aging's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You always need to take note of risks, for example - Premier Anti-Aging has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Premier Anti-Aging, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4934

Premier Anti-Aging

Engages in the planning, development, import, export, mail order, wholesale, and retail of cosmetics and health foods in Japan.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives