- Japan

- /

- Personal Products

- /

- TSE:4922

Does KOSÉ’s Share Slide Signal a Turnaround Opportunity in 2025?

Reviewed by Bailey Pemberton

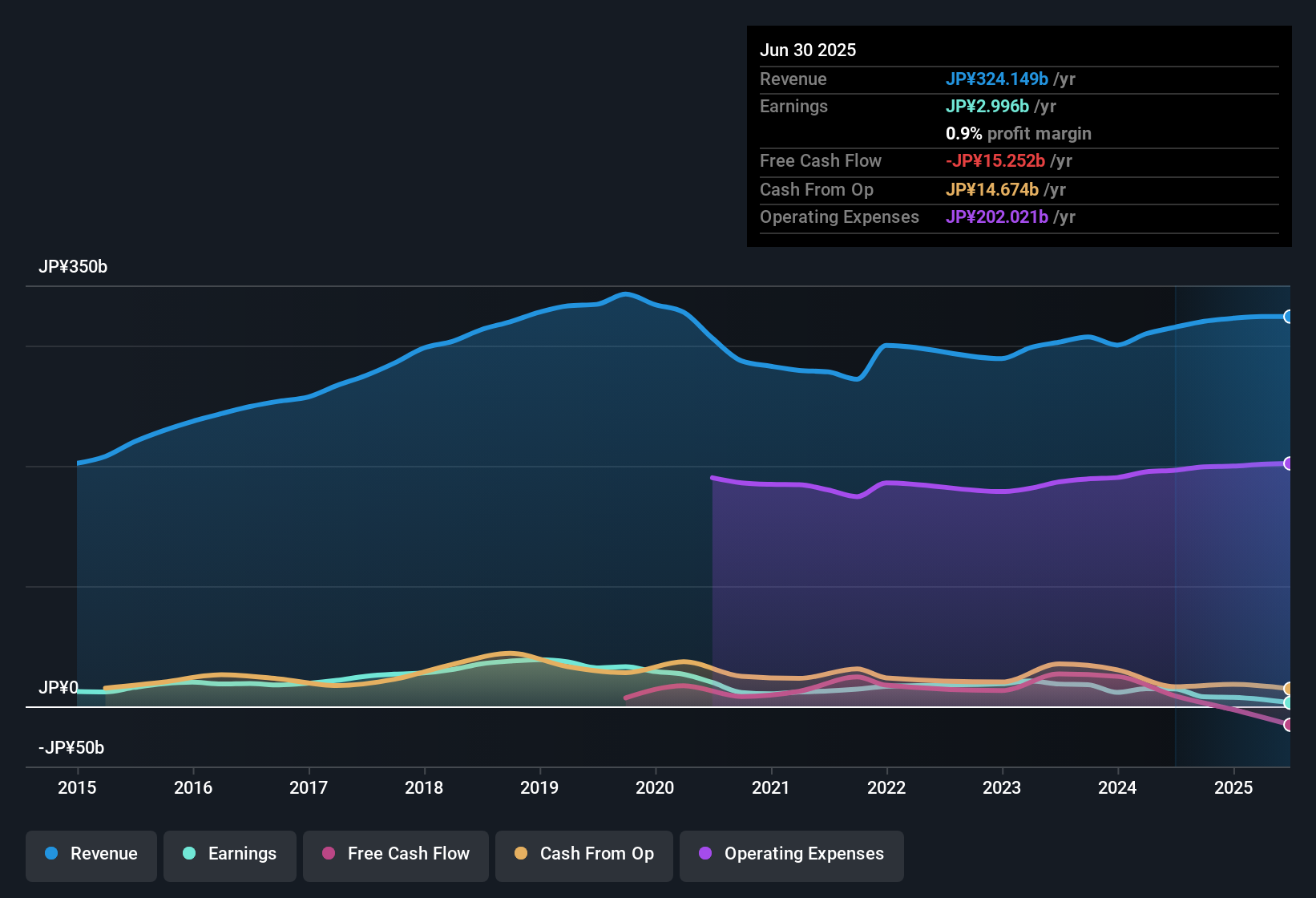

If you are wondering what to do with KOSÉ stock right now, you are not alone. After all, it is tough to ignore a company that has seen its share price fall by more than 35.6% in the past year and a staggering 61.4% over the last three years. Even so, stocks that have been beaten down this far sometimes emerge as diamonds in the rough, reviving interest among value-seekers who believe the declines have outpaced fundamentals.

Looking at shorter-term moves, KOSÉ's stock has shown only a modest rebound with a 0.1% gain in the last week and a 2.0% return in the past month. Despite these small upticks, the year-to-date performance remains negative at -14.7%, reflecting continued skepticism among investors. Some of these recent movements might be related to broader market trends or shifts in the cosmetics industry, but there has not been a specific surge in sentiment or major market change driving a new upward trend, at least not yet.

This brings us to the big question: is KOSÉ undervalued after all these declines? On a standard valuation scorecard using six different methods, KOSÉ scores a 2, meaning the company appears undervalued in two out of six key checks. That is a hint, but not the whole story. In the next section, we will break down how valuation is measured and what each indicator says about KOSÉ right now, and we will also explore a fresh perspective on value you may not have considered before.

KOSÉ scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: KOSÉ Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used method that estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to the present day. This process aims to identify how much those future yen are worth in today's terms, giving potential investors a clearer sense of the stock's long-term value.

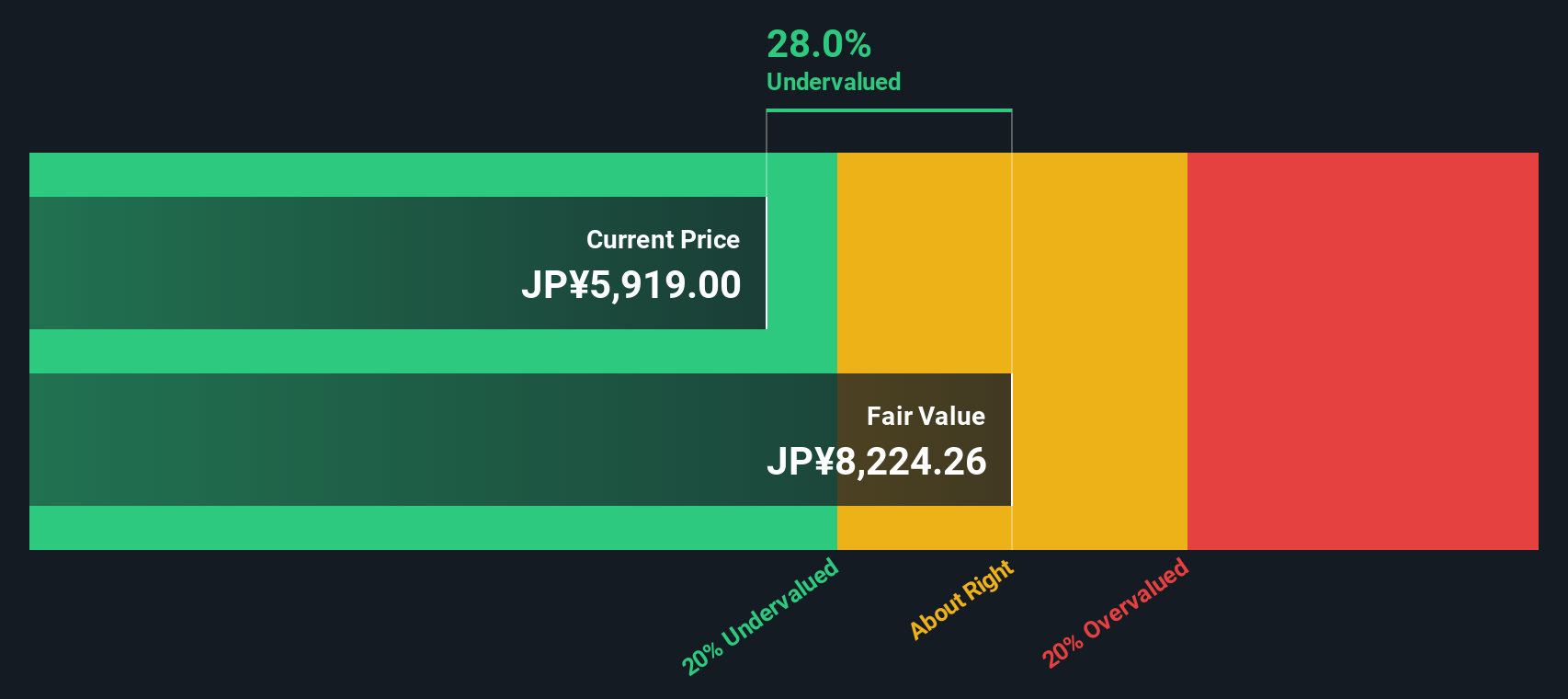

According to the DCF analysis for KOSÉ, the company’s most recent reported Free Cash Flow (FCF) is negative, at approximately -¥1.1 billion. However, analyst forecasts anticipate a turnaround in the coming years, projecting Free Cash Flow to climb steadily, with estimates reaching over ¥21.7 billion by 2029. Over the next ten years, projections, initially sourced from multiple analysts and then extrapolated further, suggest consistent growth in annual Free Cash Flow, targeting just under ¥27.0 billion in 2035.

Based on these calculated and forecasted cash flows, the estimated intrinsic (fair) value for KOSÉ stock is ¥8,180 per share. This represents a 28.1% discount to its current market price, signaling that the shares are potentially trading below what they are fundamentally worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests KOSÉ is undervalued by 28.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: KOSÉ Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies because it links the company’s market value directly to its earnings power. This makes it a straightforward way for investors to judge what they are paying for each yen of profit.

Generally, a "normal" or "fair" PE ratio is higher for companies expected to grow faster or with less risk. In contrast, slower-growing or higher-risk firms tend to trade at lower PE multiples. Growth potential, industry stability, and risk all influence what is considered reasonable for any one stock.

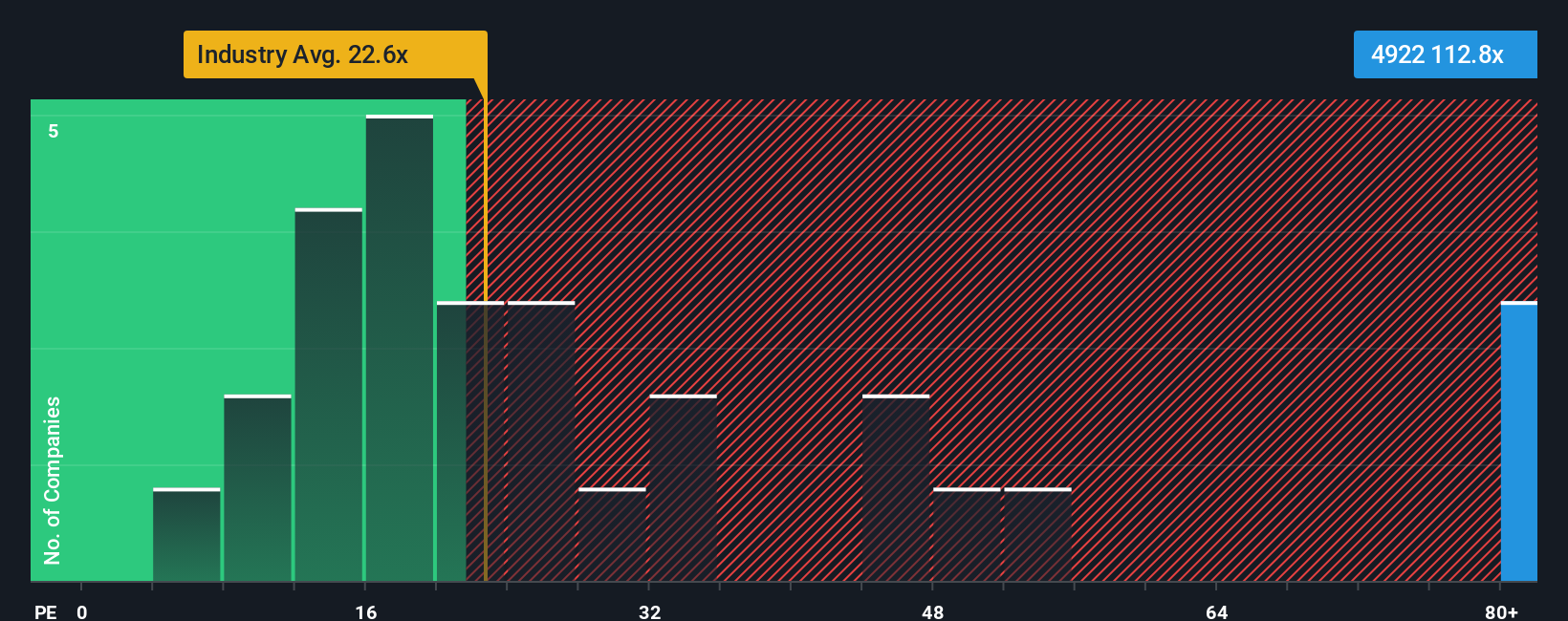

KOSÉ is currently trading at a PE ratio of 112x, which is significantly above the Personal Products industry average of 23.36x and the average for its listed peers at 30.27x. At first glance, this premium might suggest overvaluation, but the surface figures often miss important company-specific dynamics.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio (29.03x) estimates the PE multiple KOSÉ would deserve considering not just its industry but also its unique growth prospects, profit margins, market cap, and risk profile. This tailored approach goes beyond a simple comparison with peer or industry averages and offers a more nuanced insight into the stock’s fair value.

Comparing the Fair Ratio of 29.03x to the actual PE of 112x, KOSÉ’s shares appear significantly overvalued using this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your KOSÉ Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple, powerful tool that allows you to create your own story for a company like KOSÉ by combining your views on its future revenue, earnings, and profit margins into a single financial forecast and fair value estimate.

Instead of relying solely on standard ratios, a Narrative links what you believe about a company’s future to real financial outcomes. This approach makes your investment thesis more personal and actionable. On Simply Wall St’s platform, Narratives are easily accessible within the Community page and are already used by millions of investors to share their perspectives.

Narratives help you decide when to buy or sell by allowing you to clearly compare your calculated Fair Value to the current share price. In addition, Narratives update automatically as new earnings reports or breaking news emerges, ensuring your view is always current.

For example, while one KOSÉ Narrative might predict a Fair Value well below today’s price based on cautious growth assumptions, another may forecast a much higher value, reflecting optimism about a strong turnaround. This makes Narratives a dynamic way to invest that adapts as the real story unfolds.

Do you think there's more to the story for KOSÉ? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KOSÉ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4922

KOSÉ

Manufactures and sells cosmetics and cosmetology products primarily in Japan and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives