- Japan

- /

- Personal Products

- /

- TSE:4920

The Market Doesn't Like What It Sees From Nippon Shikizai, Inc.'s (TSE:4920) Earnings Yet As Shares Tumble 26%

Nippon Shikizai, Inc. (TSE:4920) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 27% share price drop.

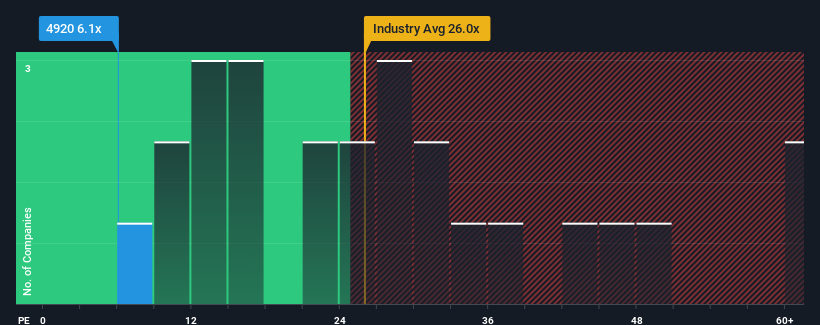

Following the heavy fall in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may consider Nippon Shikizai as a highly attractive investment with its 6.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Nippon Shikizai has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Nippon Shikizai

How Is Nippon Shikizai's Growth Trending?

In order to justify its P/E ratio, Nippon Shikizai would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 12% last year. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 11% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Nippon Shikizai's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Nippon Shikizai's P/E

Nippon Shikizai's P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Nippon Shikizai maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Nippon Shikizai (of which 2 can't be ignored!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Shikizai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4920

Nippon Shikizai

Researches and develops, manufactures, and sells cosmetics in Japan and internationally.

Slight and slightly overvalued.

Market Insights

Community Narratives