- Japan

- /

- Personal Products

- /

- TSE:4452

Kao (TSE:4452): Is There Still Upside After Recent Share Price Momentum?

Reviewed by Simply Wall St

Kao (TSE:4452) has recently caught investor interest, showing a modest share price increase over the past week and month. This movement prompts a closer look at its financial trends and where the valuation stands today.

See our latest analysis for Kao.

Momentum for Kao's share price has gradually built up, with a 7.3% gain over the past month capping off what has been a decent stretch for long-term holders. The one-year total shareholder return stands at 8.6%. The strong 3-year total return of 31% signals compounding rewards for patient investors, even after accounting for bumps along the way.

If you are interested in seeing what else might catch the market’s eye, broaden your search and check out fast growing stocks with high insider ownership

The question now is whether Kao’s recent gains reflect an undervalued opportunity, or if the market has already factored in all expected growth. Could there still be upside left for patient investors?

Most Popular Narrative: 12.7% Undervalued

Kao’s most widely followed narrative sees a notable gap between the latest share price and its fair value, hinting at upside potential if analyst projections hold true. The story hinges on robust product innovation and strategic moves in emerging markets.

Kao's consistent investment in developing high value-added and premium products, particularly in fabric care and hair care, responds to increasing consumer demand in Asia's growing urban middle class, supporting sustained revenue growth and improved net margin through pricing power. The company's accelerated expansion into emerging markets, including strong rollouts of core brands in ASEAN and China, as well as continued growth in Thailand, leverages demographic tailwinds and urbanization, which will expand Kao's addressable market and drive topline revenue.

Want to see what assumptions drive this ambitious fair value? The linchpin of the narrative is a multi-year earnings surge, premium margins, and a bold call on future valuation multiples. Find out which financial expectations make the difference and uncover the story behind this upside.

Result: Fair Value of ¥7,630 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on Japan and increased overseas competition could limit Kao's growth. This could put pressure on margins and test the long-term expansion narrative.

Find out about the key risks to this Kao narrative.

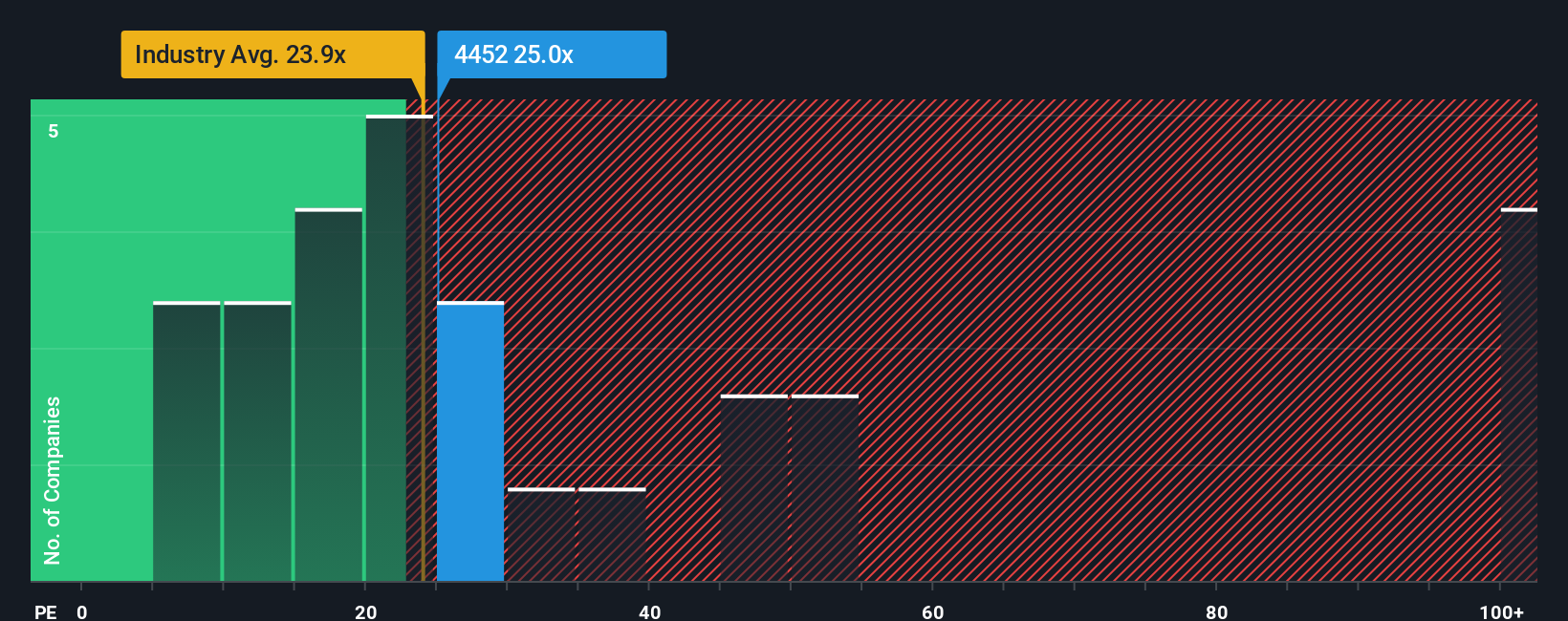

Another View: Looking at Price Ratios

While the fair value estimate suggests Kao is trading at a discount, a closer look at price-to-earnings tells a different story. Kao’s P/E ratio of 24.9 times is higher than its industry’s 24.3 and peers’ average of 29.8, but lags behind its fair ratio of 28. For investors, this gap signals potential for the market to adjust in either direction. Does it mean opportunity, or are expectations already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kao Narrative

Prefer to dig deeper or reach your own conclusions? You can craft a personalized Kao narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Kao.

Looking for Even More Investment Ideas?

Don't let new opportunities slip away. Power up your portfolio and get ahead of the crowd with handpicked stock ideas from the Simply Wall Street Screener.

- Uncover strong passive income prospects by checking out these 16 dividend stocks with yields > 3%, offering reliable yields above 3% for income-focused investors.

- Catch the momentum in artificial intelligence by seeking out market leaders among these 25 AI penny stocks, transforming everything from healthcare to autonomous vehicles.

- Get a head start on future champions by viewing these 3588 penny stocks with strong financials, which combine financial strengths with breakthrough growth credentials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kao might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4452

Kao

Develops and sells hygiene living care, health beauty care, life care, cosmetics, and chemical products.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives