- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A079370

ZeusLtd And 2 More Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets grapple with tariff uncertainties and fluctuating economic indicators, investors are keenly observing how these factors influence stock performance. Amidst this backdrop, growth companies with strong insider ownership, like ZeusLtd and others, often attract attention for their potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Let's review some notable picks from our screened stocks.

ZeusLtd (KOSDAQ:A079370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zeus Co., Ltd. offers semiconductor, robot, and display total solutions both in South Korea and internationally, with a market cap of ₩469.64 billion.

Operations: The company's revenue is derived from its Valve segment, contributing ₩23.54 billion, and its Equipment Division, generating ₩477.92 billion.

Insider Ownership: 34%

Zeus Ltd. demonstrates strong growth potential with earnings expected to grow significantly at 39.4% annually, surpassing the Korean market average of 26%. Recent earnings show a substantial increase, with Q3 net income rising to KRW 11.48 billion from KRW 4.31 billion last year. Despite slower revenue growth forecasts at 15.4%, it remains above the market's rate of 8.8%. The company trades below fair value and shows no recent insider selling activity, supporting its growth narrative.

- Unlock comprehensive insights into our analysis of ZeusLtd stock in this growth report.

- The valuation report we've compiled suggests that ZeusLtd's current price could be quite moderate.

CYBERDYNE (TSE:7779)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CYBERDYNE Inc. engages in the research, development, production, sale, leasing, and maintenance of robotic equipment and systems for medical and welfare purposes across various regions including Japan, the United States, Europe, the Middle East, Africa, and Asia Pacific countries with a market cap of ¥38.21 billion.

Operations: CYBERDYNE Inc.'s revenue is generated through the research, development, production, sale, leasing, and maintenance of robotic equipment and systems designed for medical and welfare applications across several global regions.

Insider Ownership: 38.7%

CYBERDYNE's earnings are projected to grow at 70.04% annually, outpacing the Japanese market's revenue growth forecast of 4.3%. Despite a volatile share price and low future return on equity (1.5%), the company is advancing its Cybernics Medical Health Innovation with products like Cyvis M100, recently certified in Japan. Additionally, CYBERDYNE has secured significant contracts in Malaysia for its HAL series, contributing to long-term revenue prospects without recent insider trading activity reported.

- Click to explore a detailed breakdown of our findings in CYBERDYNE's earnings growth report.

- In light of our recent valuation report, it seems possible that CYBERDYNE is trading beyond its estimated value.

CHC Healthcare Group (TWSE:4164)

Simply Wall St Growth Rating: ★★★★★☆

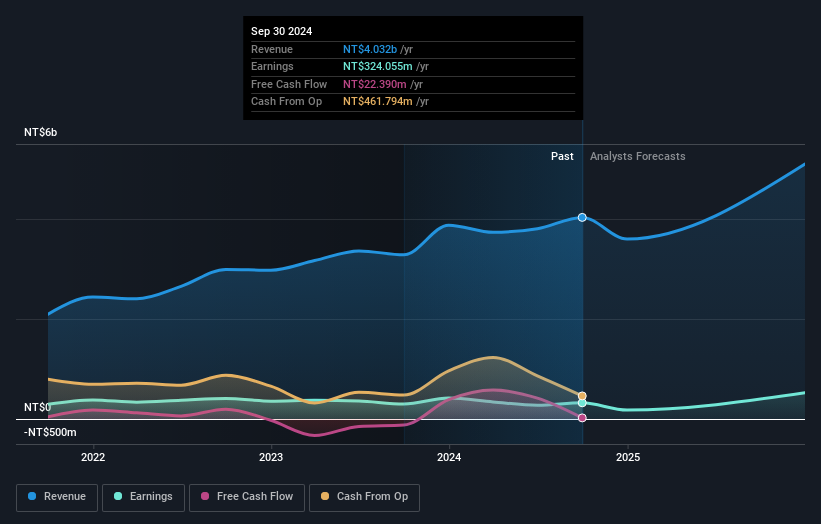

Overview: CHC Healthcare Group, along with its subsidiaries, is involved in the trading of pharmaceutical products and health food across Taiwan, China, and international markets with a market cap of NT$9.11 billion.

Operations: The company generates revenue primarily from its wholesale medical equipment segment, amounting to NT$4.03 billion.

Insider Ownership: 12.4%

CHC Healthcare Group's revenue is expected to grow 24.5% annually, surpassing the Taiwan market average of 11.3%. Earnings are forecast to increase significantly at 62.26% per year, outpacing the market's 17.9%. Despite this growth potential, its dividend yield of 3.55% is not well supported by earnings or cash flow, and debt coverage by operating cash flow remains weak. Recent updates were discussed in a special call on November 25, 2024, with no significant insider trading activity reported recently.

- Take a closer look at CHC Healthcare Group's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, CHC Healthcare Group's share price might be too optimistic.

Taking Advantage

- Gain an insight into the universe of 1451 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade ZeusLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ZeusLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A079370

ZeusLtd

Provides semiconductor, robot, and display total solutions in South Korea and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives