- Japan

- /

- Medical Equipment

- /

- TSE:7741

How the Sale of C2 CryoBalloon Technology at HOYA (TSE:7741) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier this week, PENTAX Medical, a division of HOYA Group, announced the sale of its C2 CryoBalloon™ technology to Merit Medical Systems, expanding Merit’s Endoscopy portfolio for gastrointestinal conditions.

- This move highlights HOYA’s intent to concentrate resources on its core flexible reusable endoscopy solutions, streamlining its operational priorities within medical technology.

- We’ll explore how HOYA’s sharpened focus on core offerings may shape the company’s investment narrative going forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is HOYA's Investment Narrative?

To be confident in HOYA as a shareholder, you need to believe in its disciplined approach to refining its medical technology portfolio and allocating capital efficiently. The recent sale of the C2 CryoBalloon™ technology aligns with HOYA’s strategy to sharpen its focus on core flexible endoscopy products, which may support longer-term margin expansion and operational clarity. However, this sale doesn’t appear to materially alter the most pressing short-term catalysts, such as the acceptance of new PENTAX Medical product launches or the ongoing share buyback program, both of which have underpinned recent momentum. Risks remain, particularly regarding HOYA’s premium valuation versus industry peers and whether the streamlined portfolio can maintain the revenue growth needed to justify that premium. The decision to divest C2 CryoBalloon™ reinforces a commitment to core strengths, but raises questions about future innovation pipelines and competitive positioning.

On the other hand, HOYA’s valuation premium brings extra pressure to deliver solid, sustained growth.

Exploring Other Perspectives

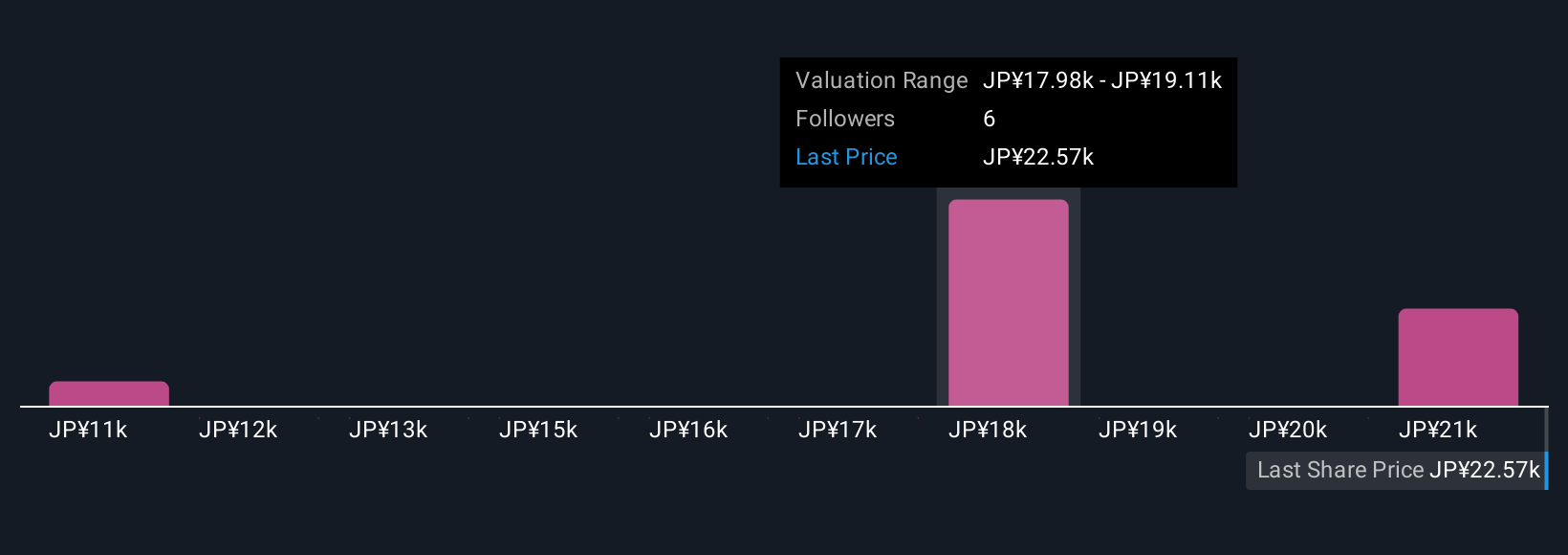

Explore 4 other fair value estimates on HOYA - why the stock might be worth 49% less than the current price!

Build Your Own HOYA Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HOYA research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free HOYA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HOYA's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HOYA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7741

HOYA

A med-tech company, provides high-tech and medical products worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives