- Japan

- /

- Medical Equipment

- /

- TSE:7741

Can HOYA (TSE:7741) Sustain Its Infection Prevention Edge With New Sterilizable Duodenoscope Launch?

Reviewed by Sasha Jovanovic

- In September 2025, PENTAX Medical, a division of HOYA, together with Advanced Sterilization Products (ASP), announced the U.S. launch of the Sterilizable DEC™ Duodenoscope, a reusable endoscope designed for enhanced infection control through rapid, complete sterilization in just 68 minutes using ASP's STERRAD™ System.

- This innovation directly addresses healthcare providers' long-standing concerns about cross-contamination in endoscopy procedures, offering a sustainable and operationally efficient alternative to single-use scopes.

- We'll explore how the introduction of this advanced sterilizable duodenoscope could shape HOYA's investment narrative through its focus on infection prevention solutions.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is HOYA's Investment Narrative?

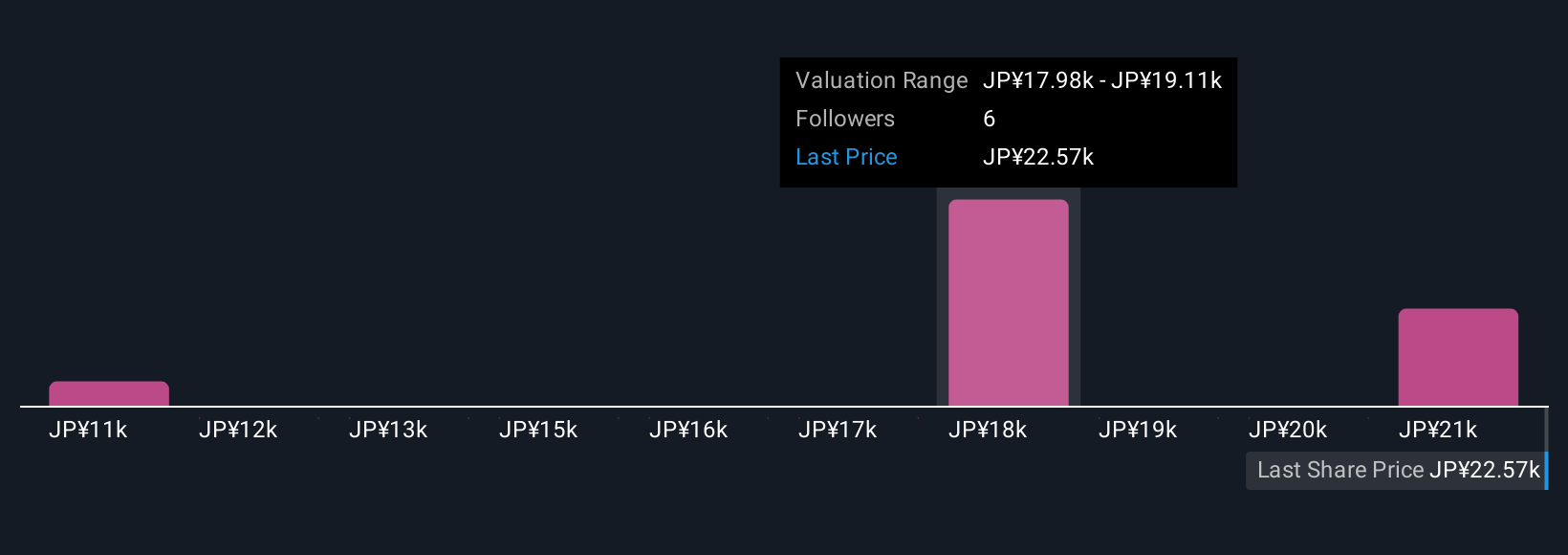

For HOYA shareholders, the investment story centers on a high-performing business with a healthy blend of innovation, income, and capital returns. The latest launch of the Sterilizable DEC™ Duodenoscope by PENTAX Medical stands out as a timely response to the industry’s increasing focus on infection prevention and sustainable healthcare solutions, potentially strengthening HOYA’s growth narrative. In the near term, this new product could heighten investor optimism around HOYA’s medical device segment, particularly as healthcare providers are under pressure to improve safety and efficiency. Alongside this, HOYA’s completed share buyback and progressive dividend policy keep shareholder returns in focus. However, with the valuation currently above analyst fair value estimates and the stock trading at a premium to industry peers, existing risks around pricing and market expectations remain. The launch may help support sentiment, but it does not erase competitive pressures or the need to see meaningful revenue contribution from new products.

But keep in mind, premium valuation adds pressure to deliver on commercial adoption.

Exploring Other Perspectives

Explore 4 other fair value estimates on HOYA - why the stock might be worth 48% less than the current price!

Build Your Own HOYA Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HOYA research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free HOYA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HOYA's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HOYA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7741

HOYA

A med-tech company, provides high-tech and medical products worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives