JMS Co.,Ltd. (TSE:7702) has announced that it will pay a dividend of ¥8.50 per share on the 9th of December. This makes the dividend yield 3.6%, which will augment investor returns quite nicely.

Check out our latest analysis for JMSLtd

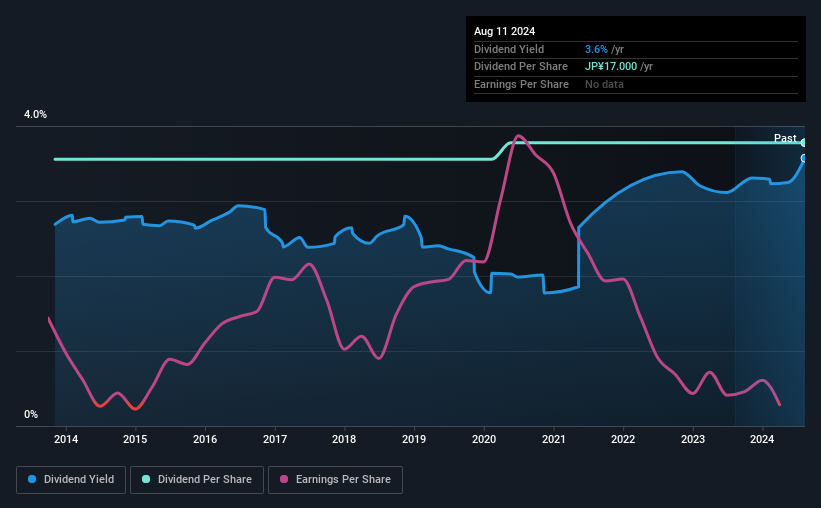

JMSLtd's Distributions May Be Difficult To Sustain

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. JMSLtd is not generating a profit, and despite this is paying out most of its free cash flow as a dividend. Paying a dividend while unprofitable is generally considered an aggressive policy, and with limited funds retained for reinvestment, growth may be slow.

Recent, EPS has fallen by 39.0%, so this could continue over the next year. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

JMSLtd Has A Solid Track Record

The company has an extended history of paying stable dividends. The dividend has gone from an annual total of ¥16.00 in 2014 to the most recent total annual payment of ¥17.00. Dividend payments have grown at less than 1% a year over this period. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, things aren't all that rosy. Over the past five years, it looks as though JMSLtd's EPS has declined at around 39% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, JMSLtd has 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about. Is JMSLtd not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7702

JMSLtd

Manufactures, sells, exports, and imports medical devices and pharmaceuticals in Japan, Singapore, Indonesia, China, the Philippines, South Korea, and internationally.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives