- Japan

- /

- Medical Equipment

- /

- TSE:6869

Has Sysmex’s Share Price Drop Created a New Opportunity for Investors in 2025?

Reviewed by Simply Wall St

Are you watching Sysmex and trying to figure out if now is the time to make a move? You are not alone. This stock has sparked plenty of debate lately, and for good reason. After all, Sysmex’s share price has been through quite a ride. The company is now trading at 1,874.5, but that comes after a drop of 33.7% year to date and losses of nearly 43% over the past five years. Even in the past month alone, the share price dipped by 4.8%. With such long-term underperformance, many investors are asking whether the market’s view is too bearish or if there is still more downside risk yet to play out.

The mood around Sysmex has been shaped by significant market developments, especially in the broader healthcare equipment industry. These shifts have affected risk perceptions and could be part of the reason for the company’s recent momentum, or lack thereof. Despite these challenges, there have been hints of stabilization in the short term, which is keeping valuation-watchers on their toes.

When we evaluate Sysmex’s value score, things get even more interesting. On a scale created by running six valuation checks, Sysmex scores a 3, meaning it is considered undervalued by half of the methods most investors use. Of course, how much weight you put on each of these metrics matters.

So how do all these valuation methods really stack up? Let’s break down each one and see where Sysmex stands. At the end, we will reveal a smarter, more comprehensive way to look at valuation that too many investors overlook.

Why Sysmex is lagging behind its peersApproach 1: Sysmex Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and then discounting those amounts back to today’s value. This gives a sense of what the business is truly worth, based on its ability to generate cash in the years ahead.

For Sysmex, the most recent Free Cash Flow (FCF) stands at ¥27.43 billion. Analyst estimates cover the next five years and predict steady FCF growth, with projections increasing to ¥61.25 billion by 2030. Beyond these analyst reports, further growth forecasts are extrapolated, reaching upwards of ¥76.06 billion by 2035. All these flows are considered in the model. For conservative investors, the nearer-term projections are most relevant.

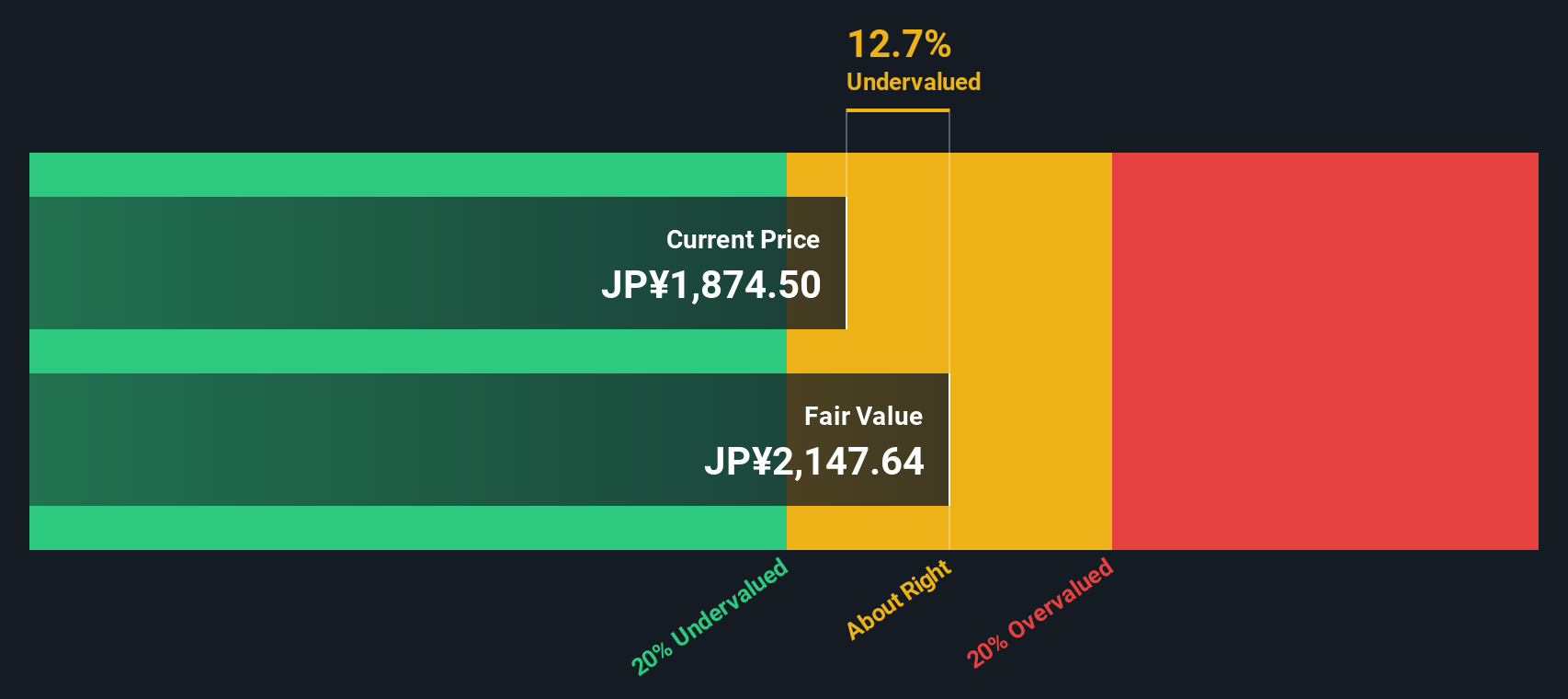

After crunching these cash flow projections using the 2 Stage Free Cash Flow to Equity model, the resulting intrinsic value per share of Sysmex is estimated to be ¥2,147.64. With the current share price sitting at ¥1,874.5, DCF analysis suggests the stock is 12.7% undervalued based on these fundamental projections.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Sysmex.

Approach 2: Sysmex Price vs Earnings

The price-to-earnings (PE) ratio is one of the most widely used valuation metrics for profitable businesses because it directly links a company’s current share price to its earnings power. For investors, a fair PE ratio typically factors in expectations for future growth, how reliably those earnings are expected to continue, and the overall risk profile of the business and its industry.

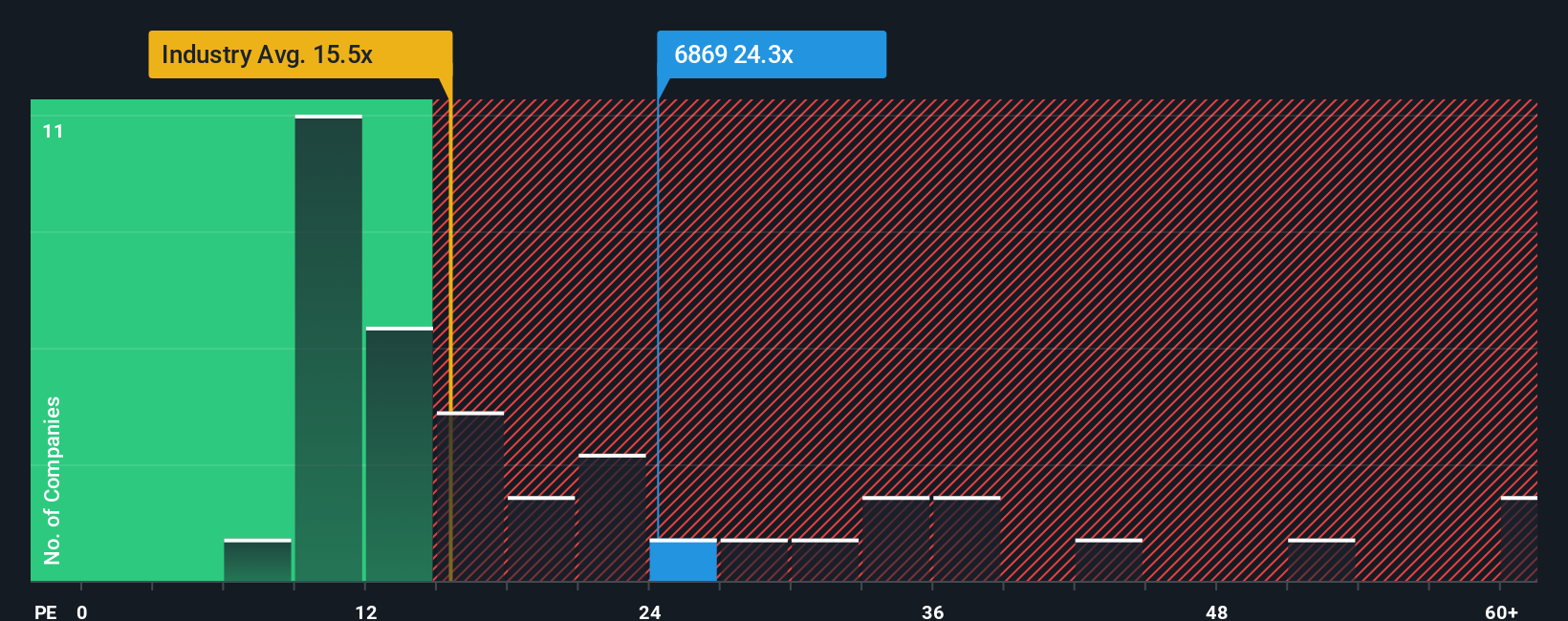

Sysmex currently trades at a PE ratio of 24.8x. To put that in context, the average for the Medical Equipment industry is around 16.5x, while the average among Sysmex's close peers is about 19.8x. This suggests that, on a surface level, Sysmex is priced higher than many of its counterparts.

However, Simply Wall St’s proprietary “Fair Ratio” goes a step further. The Fair Ratio for Sysmex is calculated as 27.4x, which represents the multiple one would reasonably pay given the company’s future earnings potential, risk profile, profitability, and industry standing. Unlike basic peer or industry comparisons, the Fair Ratio adjusts for Sysmex’s specific growth outlook, risk factors, and company quality, providing a more tailored benchmark for valuation.

Comparing Sysmex’s actual PE ratio of 24.8x with its Fair Ratio of 27.4x, the stock appears undervalued by this measure, as it is trading at a discount to what would be considered fair given its fundamentals.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Sysmex Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story about a company like Sysmex, connecting your view on its future to numbers such as fair value, projected revenue, earnings, and margins. Rather than just looking at stats in isolation, Narratives align the company’s story with your financial forecast and show what you think its shares are really worth.

Narratives are available right now on Simply Wall St’s Community page, a tool used by millions of investors to make smarter decisions. With Narratives, you can easily see whether you believe it’s time to buy, hold, or sell, by comparing your Fair Value to the current Price, all in one place. What sets Narratives apart is their dynamic nature; as new news or earnings hit, your narrative and fair value update automatically, keeping your investment logic current with real-world events.

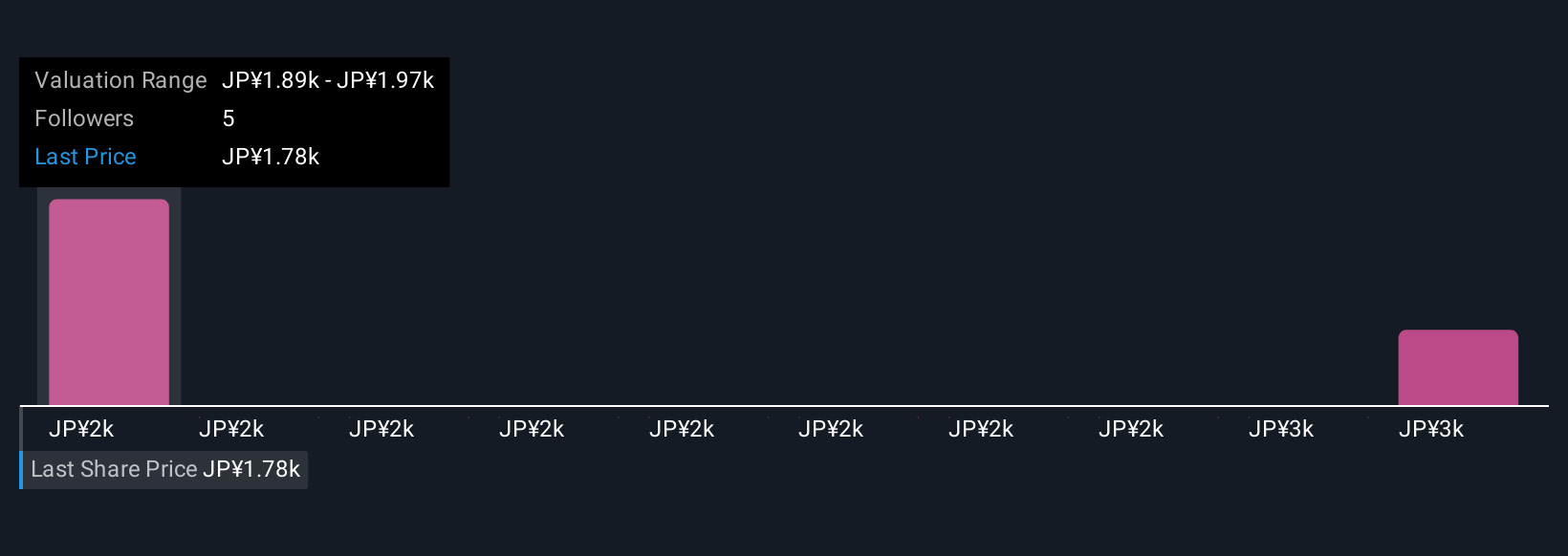

For example, some investors in the community believe Sysmex’s fair value is much higher than today’s price, while others see less potential. Narratives make it easy to see and compare these distinct perspectives at a glance.

Do you think there's more to the story for Sysmex? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6869

Sysmex

Engages in the development, manufacture, and sale of diagnostic instruments, reagents, and related software.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives