- Japan

- /

- Medical Equipment

- /

- TSE:6849

Nihon Kohden (TSE:6849): Evaluating Valuation Following Launch of AlarmSense Analytics Platform for Hospitals

Reviewed by Kshitija Bhandaru

Nihon Kohden (TSE:6849) just introduced AlarmSense, a cloud-based analytics platform designed to help hospitals address alarm fatigue and improve staff workflow. The new solution focuses on optimizing alarm management and supporting long-term hospital strategies.

See our latest analysis for Nihon Kohden.

AlarmSense’s debut lands at a time when Nihon Kohden’s one-year total shareholder return sits slightly negative, even as broader healthcare technology excitement remains high. Recent price momentum has been soft, but strategic innovations like this suggest long-term growth potential could be gaining traction again.

Given how tech is reshaping healthcare delivery, you might want to see which other medical innovators are making moves. Check out See the full list for free..

With shares trading at a notable discount to analyst targets despite recent innovation, is this a chance to buy Nihon Kohden before the market realizes its growth potential, or is everything already priced in?

Price-to-Earnings of 20.7x: Is it justified?

Nihon Kohden shares are trading at a price-to-earnings (P/E) ratio of 20.7x, which is notably higher than both the peer and industry averages. At the last close of ¥1,711, the stock appears expensive relative to its sector backdrop.

The price-to-earnings ratio reflects the relationship between the current share price and the company’s earnings per share, serving as a common benchmark for valuing companies. A higher ratio often signals that investors expect superior growth, but it can also suggest the market is assigning a premium that may not be backed up by fundamentals.

In this case, Nihon Kohden's P/E of 20.7x not only outpaces the Japanese Medical Equipment industry average (15.7x), but also exceeds the peer group’s 19.7x. However, when measured against the estimated "fair" P/E of 22.9x, the market could shift toward this level if the company delivers on future growth expectations.

Explore the SWS fair ratio for Nihon Kohden

Result: Price-to-Earnings of 20.7x (ABOUT RIGHT)

However, ongoing share price underperformance and high valuation multiples may weigh on sentiment if future growth or profitability fails to meet expectations.

Find out about the key risks to this Nihon Kohden narrative.

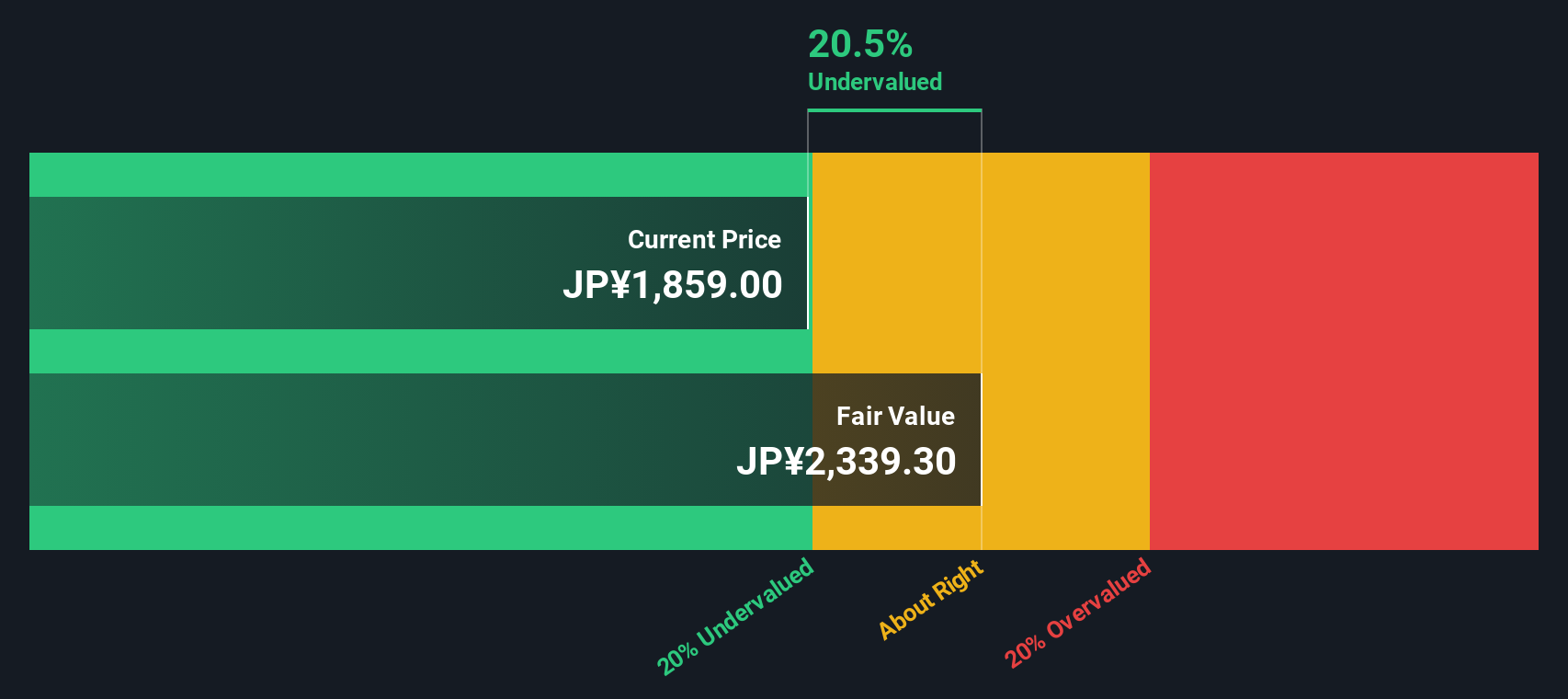

Another View: Discounted Cash Flow Says Undervalued

Our DCF model currently values Nihon Kohden shares at ¥2,334.96, which is over 26% above today's trading level. This approach focuses on future cash flows instead of earnings multiples and offers a different perspective on value. Could the market be overlooking hidden upside here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nihon Kohden for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nihon Kohden Narrative

If you want to dig deeper or come to your own conclusions, you can build a fresh perspective on Nihon Kohden in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Nihon Kohden.

Looking for more investment ideas?

Don't let opportunities pass you by. Take the next step to sharpen your portfolio with handpicked stocks that align with various market trends and financial goals.

- Maximize your potential for high returns by checking out these 900 undervalued stocks based on cash flows, which highlights stocks with strong upside based on cash flows and solid fundamentals.

- Boost your passive income by reviewing these 19 dividend stocks with yields > 3%, featuring stocks offering yields above 3 percent and providing the stability dividend investors seek.

- Explore the promise of next-generation technology by targeting these 24 AI penny stocks, which are driving progress in artificial intelligence with game-changing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nihon Kohden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6849

Nihon Kohden

Engages in development, manufacturing, sale, maintenance, and consultation of medical electronic equipment, and related systems and products in Japan, Americas, Europe, rest of Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives