- Japan

- /

- Healthcare Services

- /

- TSE:6099

Uncovering Undiscovered Gems on None Exchange December 2024

Reviewed by Simply Wall St

Amid a backdrop of mixed performances in major stock indices, with the S&P 500 and Nasdaq Composite reaching record highs while the Russell 2000 declined, investors are closely watching economic indicators like job growth and Federal Reserve policies that could impact small-cap stocks. As global markets navigate these dynamics, identifying promising opportunities requires focusing on companies with strong fundamentals and potential for growth within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

China Sunshine Paper Holdings (SEHK:2002)

Simply Wall St Value Rating: ★★★★☆☆

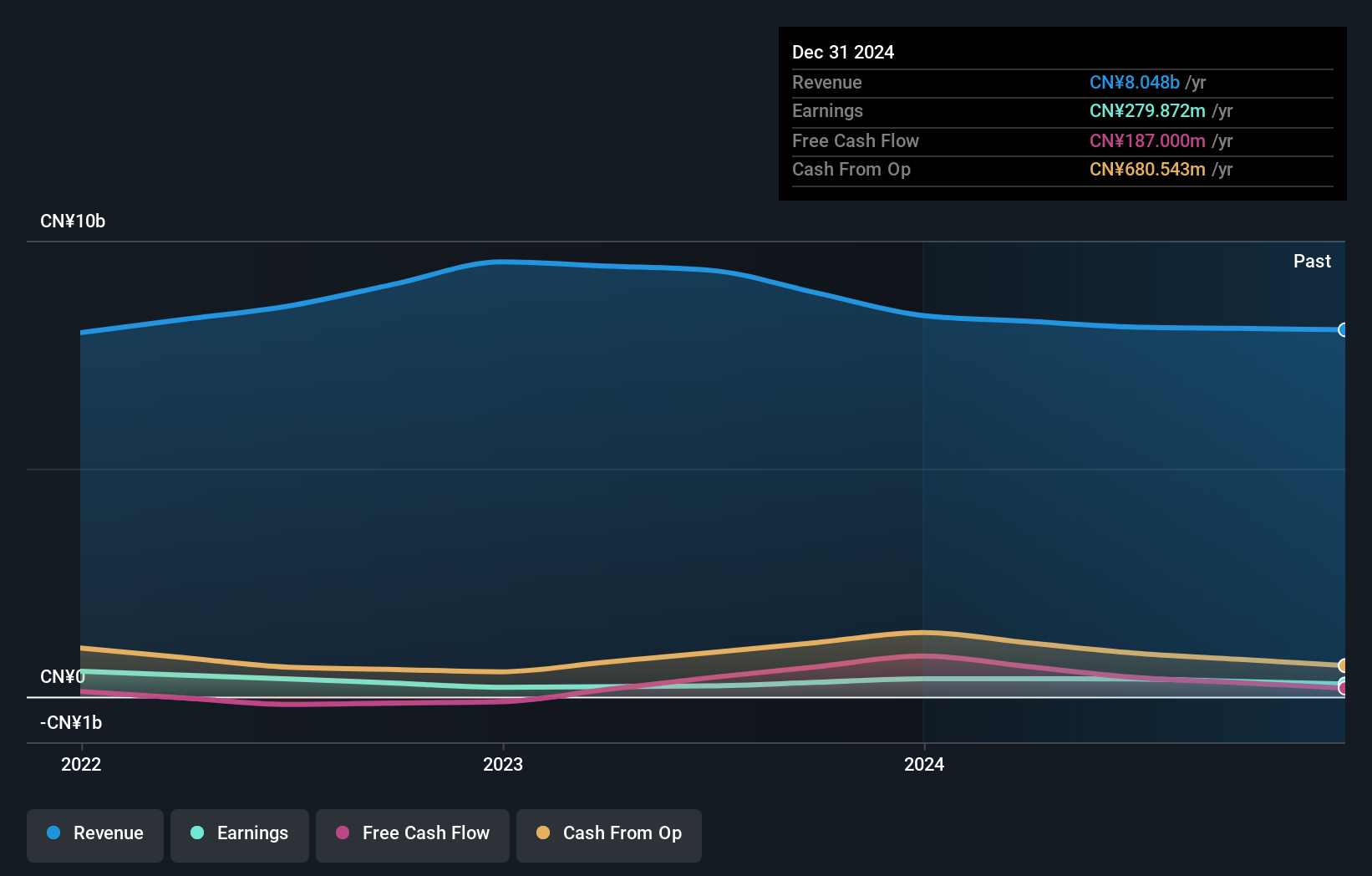

Overview: China Sunshine Paper Holdings Company Limited, along with its subsidiaries, engages in the production and sale of paper products both within China and internationally, with a market capitalization of HK$2.01 billion.

Operations: China Sunshine Paper Holdings generates revenue primarily from its paper products, with significant contributions from coated-white top linerboard (CN¥1.97 billion) and specialised paper products (CN¥1.71 billion). Additionally, the company derives income from electricity and steam sales amounting to CN¥1.33 billion.

China Sunshine Paper Holdings, a notable player in the packaging industry, offers an intriguing investment profile. Despite earnings declining by 4.3% annually over the past five years, recent earnings surged by 65.5%, outpacing the industry's growth of 20.9%. Trading at 72.9% below its estimated fair value suggests potential undervaluation opportunities for investors seeking hidden value in smaller stocks. The company has successfully reduced its debt to equity ratio from 173.5% to 89.1% over five years, although it still holds a high net debt to equity ratio of 62.8%. Notably, interest payments are well covered with EBIT at a healthy coverage of 4.6x.

- Unlock comprehensive insights into our analysis of China Sunshine Paper Holdings stock in this health report.

Gain insights into China Sunshine Paper Holdings' past trends and performance with our Past report.

Shenzhen Q&D Circuits (SZSE:301628)

Simply Wall St Value Rating: ★★★★★☆

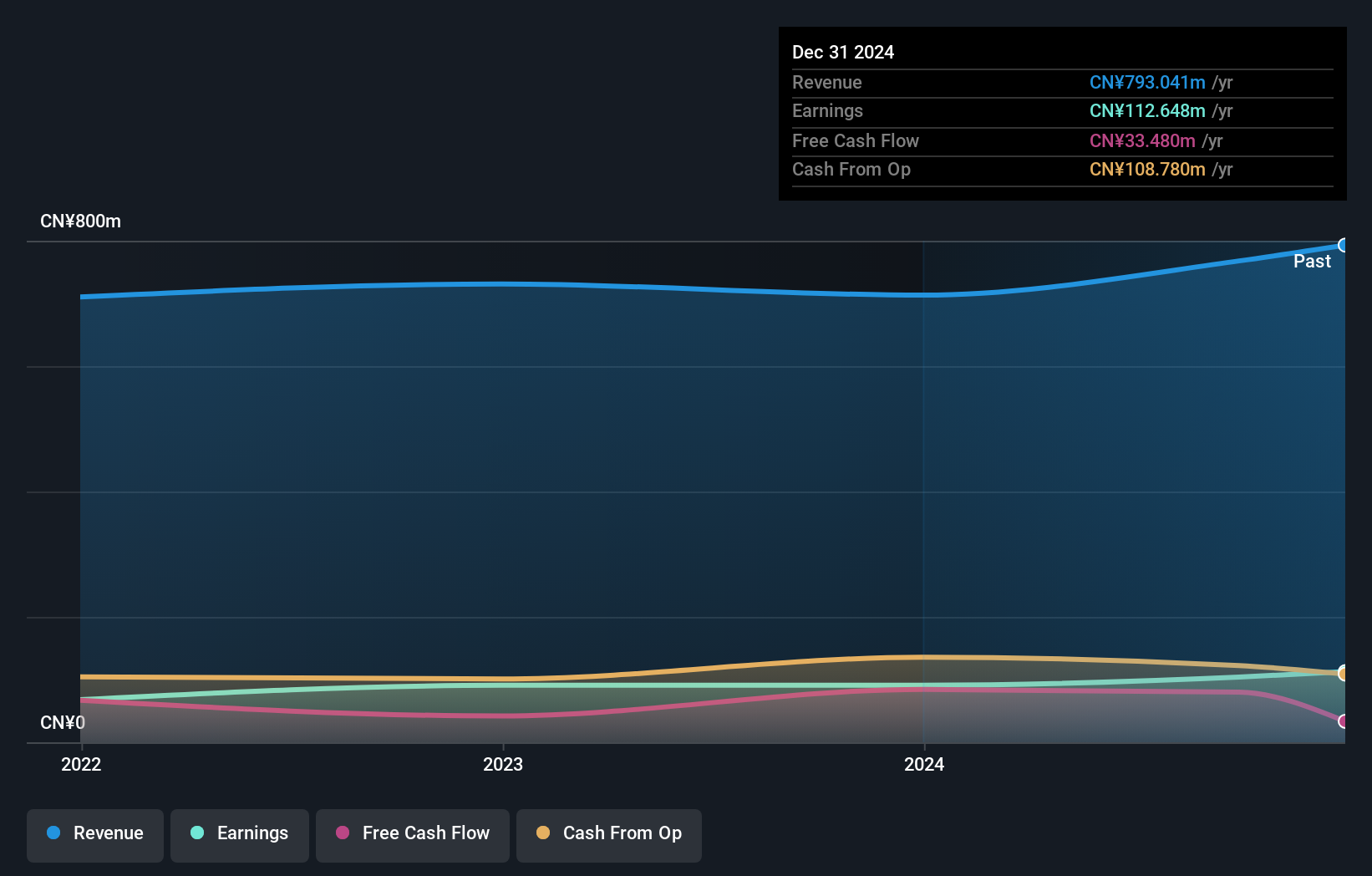

Overview: Shenzhen Q&D Circuits Co., Ltd. is engaged in the manufacturing and distribution of electronic components, with a market capitalization of CN¥6.56 billion.

Operations: Shenzhen Q&D Circuits generates revenue primarily from the sale of electronic components, totaling CN¥767.83 million.

Shenzhen Q&D Circuits, a notable player in the electronic industry, has demonstrated robust growth with earnings rising by 14.2% over the past year, surpassing the industry's 1.8%. This company recently completed an IPO raising CNY 531 million and joined key indices on the Shenzhen Stock Exchange. For nine months ending September 2024, sales reached CNY 585 million while net income was CNY 79.66 million, reflecting a solid performance compared to last year's figures of CNY 530.4 million and CNY 66.74 million respectively. Despite its illiquid shares, interest payments are well covered by EBIT at an impressive multiple of over three hundred times.

- Navigate through the intricacies of Shenzhen Q&D Circuits with our comprehensive health report here.

Elan (TSE:6099)

Simply Wall St Value Rating: ★★★★☆☆

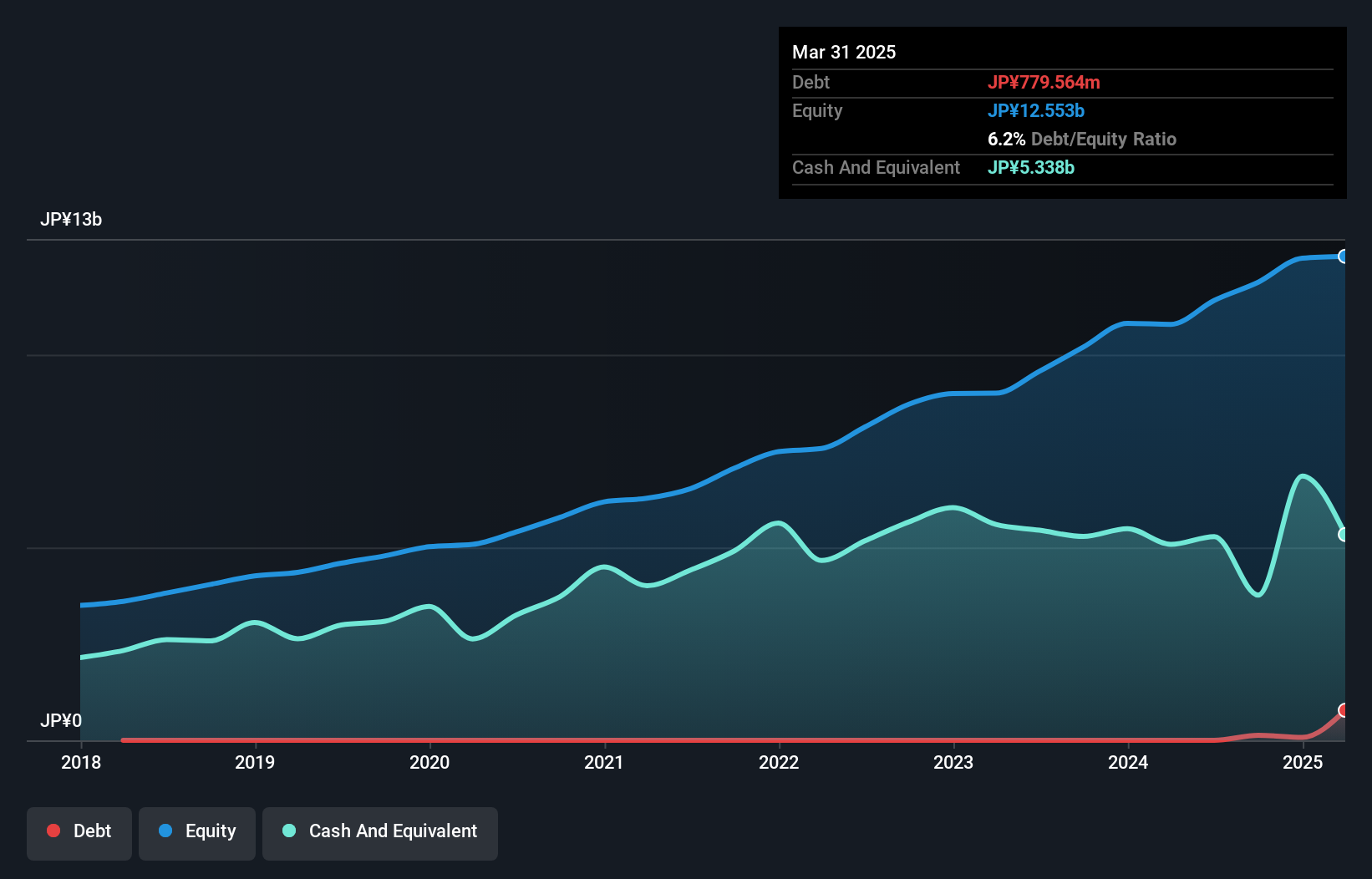

Overview: Elan Corporation operates in the nursing care sector primarily in Japan, with a market capitalization of ¥45.17 billion.

Operations: Elan generates revenue primarily from its Nursing and Medical Care Related Business, amounting to ¥45.85 billion.

Elan, a nimble player in the healthcare sector, recently caught attention with M3 Inc.'s acquisition of a 55% stake for ¥35 billion (US$). This move followed Elan's impressive earnings growth of 11.6%, outpacing the industry's 8.3%. The company has more cash than its total debt, indicating strong financial health despite a volatile share price over the past three months. With free cash flow remaining positive and high-quality earnings reported, Elan seems poised for continued performance improvements as it now becomes part of M3's consolidated operations while maintaining its listing on the TSE Prime Market.

- Take a closer look at Elan's potential here in our health report.

Assess Elan's past performance with our detailed historical performance reports.

Where To Now?

- Explore the 4645 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6099

Excellent balance sheet and good value.

Market Insights

Community Narratives