- Japan

- /

- Medical Equipment

- /

- TSE:4543

Does Expanding Reveos Adoption in the US Strengthen Terumo's Healthcare Tech Positioning (TSE:4543)?

Reviewed by Sasha Jovanovic

- The Blood Center in New Orleans recently announced it has implemented Terumo Blood and Cell Technologies' Reveos Automated Blood Processing System and Nokia Software Platform, making it only the second U.S. blood center to adopt this technology.

- This development highlights accelerating adoption of Terumo’s automated whole blood processing in the U.S., addressing platelet shortages and operational challenges faced by blood centers nationwide.

- We'll explore how expanding U.S. adoption of Reveos could impact Terumo’s outlook and reinforce its advanced healthcare technology positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Terumo Investment Narrative Recap

For shareholders in Terumo, the key driver is the company’s ability to capture structural growth from rising global healthcare demand while maintaining profitability through innovation. The Blood Center in New Orleans adopting Reveos showcases continued momentum in Terumo’s U.S. blood technologies, but the immediate effect on near-term earnings catalysts is limited given existing adoption remains modest and pricing pressure, especially from tariffs and competitive bids, remains the most important risk.

Among recent company developments, the June U.S. launch of the SOFIA Flow 88 Neurovascular Aspiration Catheter stands out, reflecting Terumo’s ongoing investment in high-margin, advanced products that reinforce the core catalyst of innovation-led volume growth. While blood technology announcements are encouraging, investors continue to watch closely for evidence that new product launches can offset pricing headwinds in mature segments.

In contrast, ongoing uncertainty about Terumo’s ability to fully pass on tariff costs to end customers could impact margins, information every investor should keep in mind as...

Read the full narrative on Terumo (it's free!)

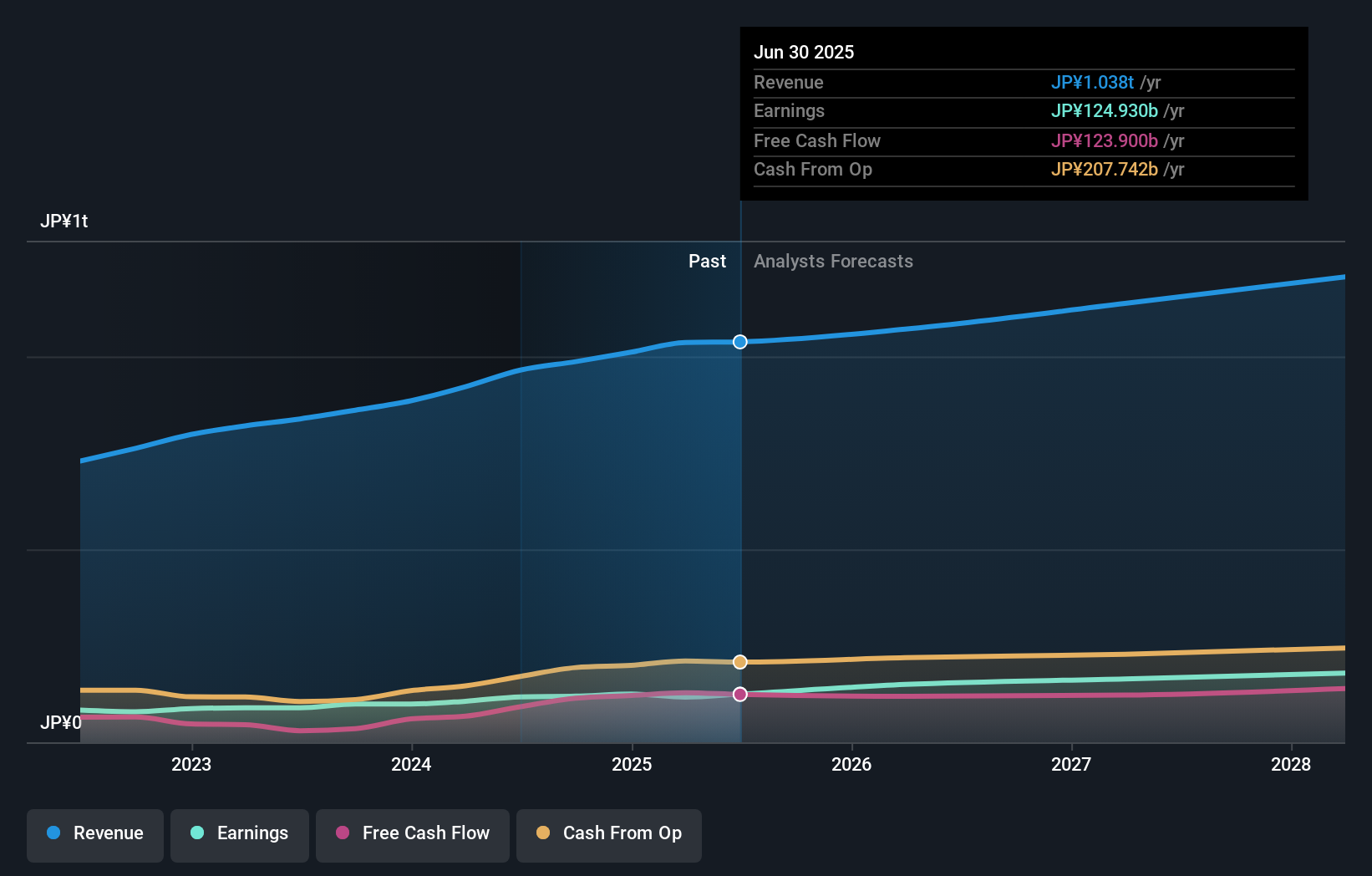

Terumo's outlook anticipates ¥1,228.6 billion in revenue and ¥180.7 billion in earnings by 2028. This projection is based on a 5.8% annual revenue growth rate and a ¥55.8 billion increase in earnings from the current ¥124.9 billion.

Uncover how Terumo's forecasts yield a ¥3289 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors have produced two fair value estimates for Terumo shares, ranging from ¥2,785 to ¥3,289. While some focus on global technology adoption as a positive catalyst, others emphasize ongoing margin risks that could shape future returns. Explore several alternative viewpoints for a richer understanding of this investment.

Explore 2 other fair value estimates on Terumo - why the stock might be worth just ¥2785!

Build Your Own Terumo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Terumo research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Terumo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Terumo's overall financial health at a glance.

No Opportunity In Terumo?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terumo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4543

Terumo

Engages in the manufacture and sale of medical products and equipment in Japan, Europe, China, the United States, Asia, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives