- China

- /

- Renewable Energy

- /

- SZSE:000690

AGTech Holdings And These 2 Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced significant shifts, with small-cap stocks like those in the Russell 2000 Index leading gains but still trailing their record highs. As investors navigate these dynamic conditions marked by potential policy changes and economic indicators such as rate cuts and inflation expectations, identifying promising small-cap stocks becomes increasingly crucial for those seeking untapped growth opportunities. In this context, companies that demonstrate resilience and adaptability can stand out as potential gems amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 86.64% | 24.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| La Positiva Seguros y Reaseguros | 0.20% | 7.84% | 27.00% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

AGTech Holdings (SEHK:8279)

Simply Wall St Value Rating: ★★★★★★

Overview: AGTech Holdings Limited is an integrated technology and services company operating in the People’s Republic of China and Macau with a market capitalization of approximately HK$2.79 billion.

Operations: AGTech Holdings generates revenue primarily from its Lottery Operation and Electronic Payment and Related Services, with the latter contributing HK$364.50 million.

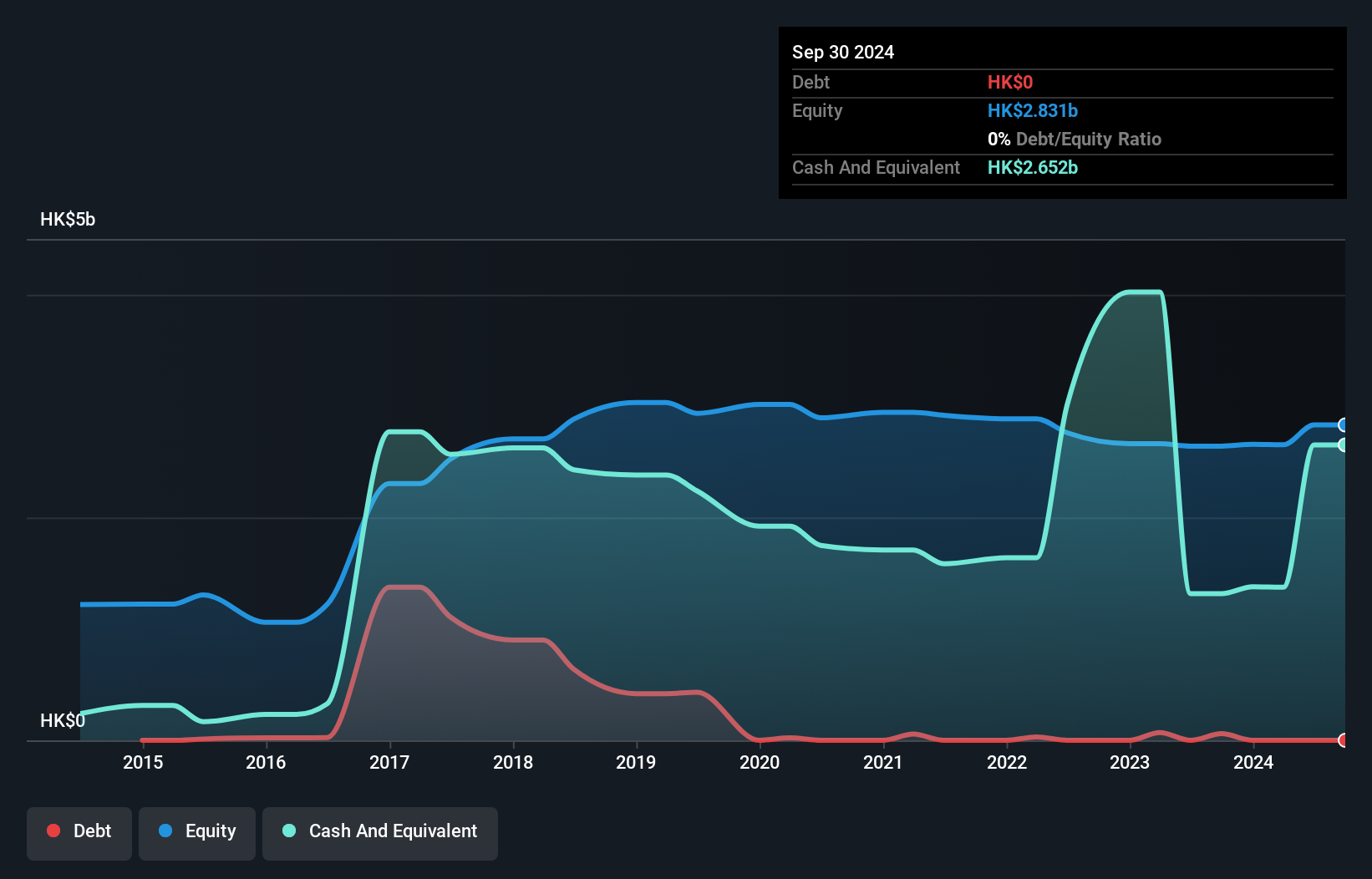

AGTech Holdings, a nimble player in its sector, has seen significant changes recently. The company reported a decrease in losses by over HK$6.9 million for the six months ending September 2024, compared to the same period last year. This improvement stems from reduced operating expenses and foreign exchange losses, alongside increased revenue from its lottery operations by around HK$11-13 million. However, electronic payment business revenues dipped due to lower tourist spending in Macau. With no debt on its books now compared to a 13.8% debt-to-equity ratio five years ago, AGTech's financial health seems robust as it navigates market fluctuations and strategic expansions like acquiring Ant Bank (Macao).

- Click to explore a detailed breakdown of our findings in AGTech Holdings' health report.

Gain insights into AGTech Holdings' historical performance by reviewing our past performance report.

Guangdong Baolihua New Energy Stock (SZSE:000690)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Baolihua New Energy Stock Co., Ltd. operates in the energy sector and has a market capitalization of CN¥10.42 billion.

Operations: The company generates revenue primarily from its energy sector operations. Financial details regarding specific revenue streams and cost breakdowns are not provided, limiting further analysis.

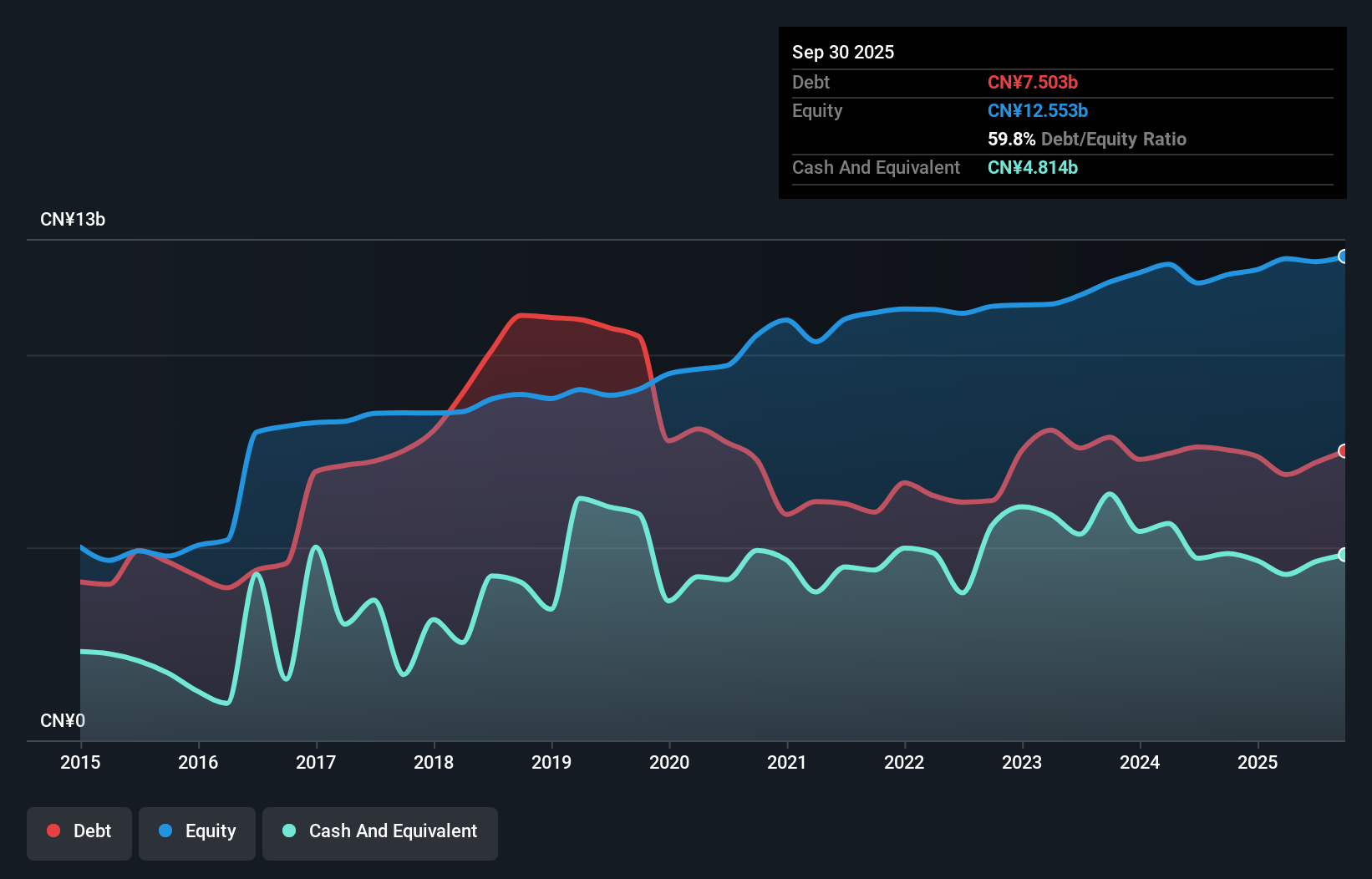

Guangdong Baolihua New Energy, a player in the renewable energy sector, has shown a mixed financial picture recently. The company reported earnings growth of 31% over the past year, outpacing industry peers with only 6.8% growth. Despite this, sales for the first nine months of 2024 were CNY 6.11 billion, down from CNY 7.70 billion in the previous year, with net income slightly lower at CNY 592 million compared to CNY 645 million last year. The firm's debt to equity ratio improved significantly from 115% to a more manageable 62.4% over five years, indicating better financial stability moving forward.

Software Service (TSE:3733)

Simply Wall St Value Rating: ★★★★★★

Overview: Software Service, Inc. offers electronic medical record systems and comprehensive hospital ordering solutions, with a market cap of ¥70.46 billion.

Operations: Software Service, Inc. generates revenue primarily through its electronic medical record systems and hospital ordering solutions. The company's financial performance is highlighted by a market cap of ¥70.46 billion.

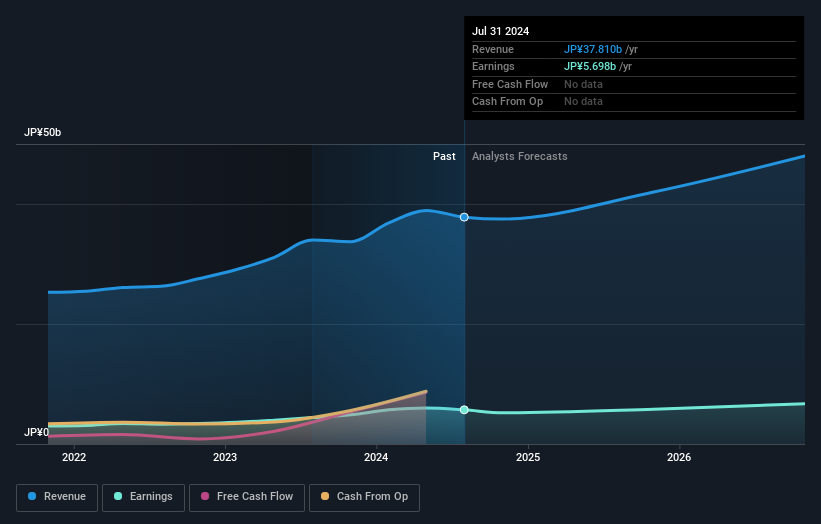

Software Service, a nimble player in the tech space, has outpaced its industry with a notable 29.6% earnings growth over the past year, compared to the Healthcare Services industry's 11.1%. This company is debt-free and has maintained high-quality earnings, which suggests robust financial health. Over five years, it transitioned from having no debt to sustaining operations without borrowing—a testament to its strong cash flow management. Trading at 64.5% below estimated fair value indicates potential undervaluation relative to peers and industry standards. With forecasts projecting annual growth of 9.1%, this entity seems poised for continued expansion in a competitive sector.

Taking Advantage

- Gain an insight into the universe of 4669 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000690

Guangdong Baolihua New Energy Stock

Guangdong Baolihua New Energy Stock Co., Ltd.

Flawless balance sheet and undervalued.