- Japan

- /

- Healthcare Services

- /

- TSE:3154

Optimistic Investors Push Medius Holdings Co., Ltd. (TSE:3154) Shares Up 26% But Growth Is Lacking

Despite an already strong run, Medius Holdings Co., Ltd. (TSE:3154) shares have been powering on, with a gain of 26% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

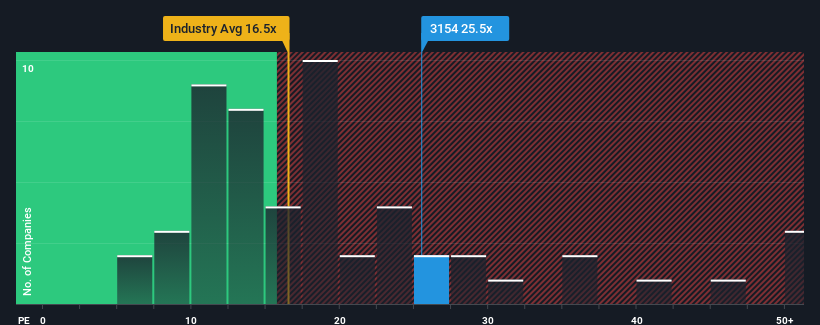

After such a large jump in price, Medius Holdings may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 25.5x, since almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 9x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Medius Holdings' financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for Medius Holdings

What Are Growth Metrics Telling Us About The High P/E?

Medius Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 24%. The last three years don't look nice either as the company has shrunk EPS by 58% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 9.6% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Medius Holdings is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Shares in Medius Holdings have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Medius Holdings currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Medius Holdings that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3154

Average dividend payer with mediocre balance sheet.

Market Insights

Community Narratives