- Japan

- /

- Healthcare Services

- /

- TSE:2784

Is Alfresa Holdings’ Government-Backed Biosimilar Venture Shifting Its Long-Term Narrative (TSE:2784)?

Reviewed by Sasha Jovanovic

- Alfresa Holdings, together with Kidswell Bio, Chiome Bioscience, and Mycenax Biotech, recently announced a basic agreement to create a joint venture for domestic biosimilar drug manufacturing, backed by a Japanese Ministry of Health, Labour and Welfare subsidy program.

- This collaboration is designed to build a comprehensive value chain in the biopharmaceuticals sector, aiming to bolster Japan’s domestic supply and export capabilities for biosimilars while advancing workforce development in the field.

- We’ll examine how expanding into biosimilar manufacturing with government support influences Alfresa Holdings’ longer-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Alfresa Holdings' Investment Narrative?

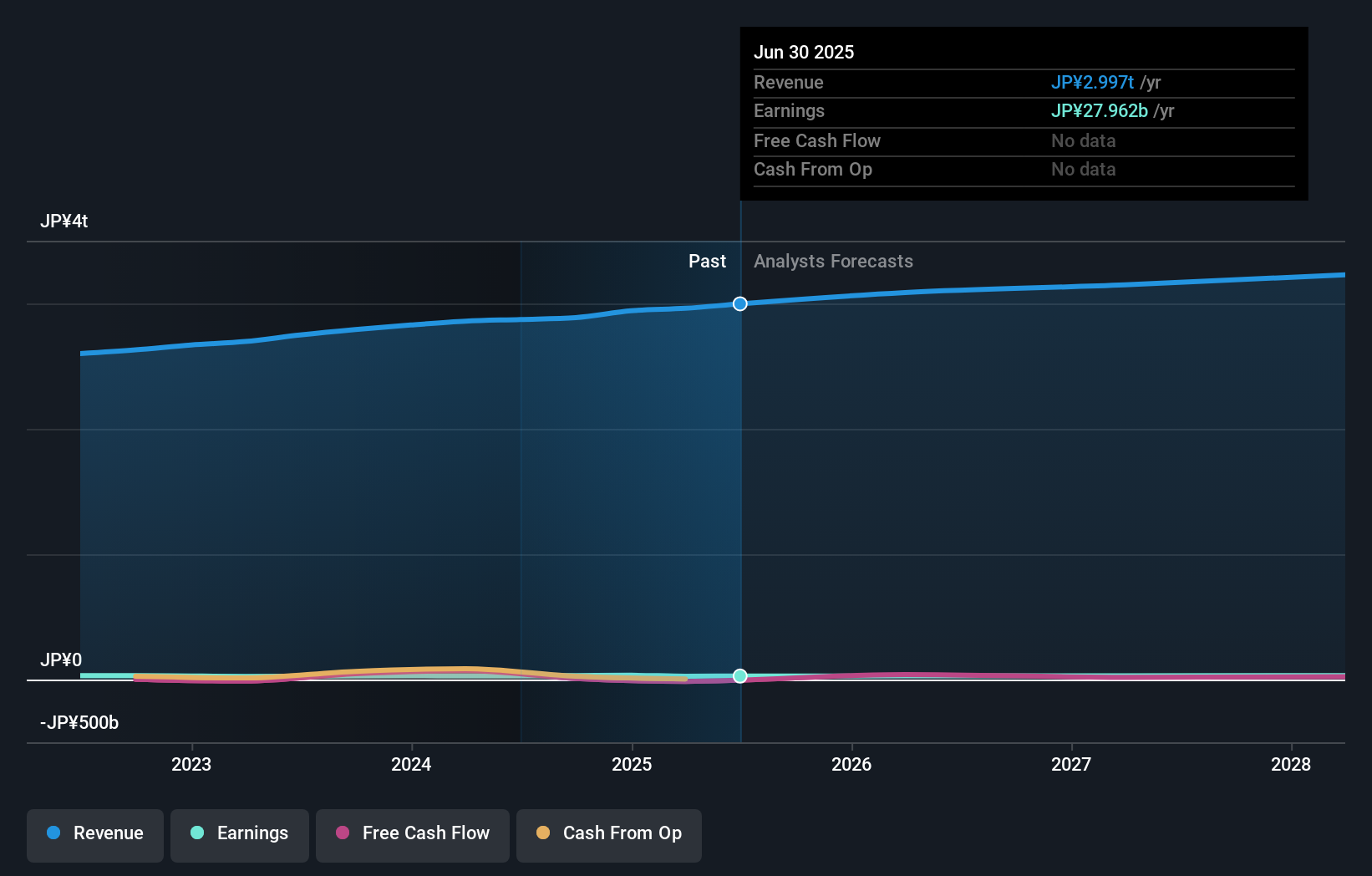

To be a shareholder in Alfresa Holdings, you need conviction in its ability to evolve beyond Japan's mature pharmaceutical distribution business into the higher-value realm of biopharmaceuticals. The newly announced biosimilar joint venture, supported by a government subsidy, marks a potentially material shift in the near-term investment story. This move could become a meaningful short-term catalyst, as it addresses supply chain resilience and adds an innovative manufacturing strand to Alfresa’s core business, which previously suffered from slow earnings growth and profit margin pressures. Alongside continued dividend hikes and solid governance, this initiative may help differentiate Alfresa from slow-growing peers. However, execution risks, especially regarding the timeline, regulatory outcomes, and capital requirements of this venture, become more central, now that the company is taking on a more ambitious role in biosimilars. Short-term performance could be more volatile as investors reassess these new opportunities and challenges.

On the other hand, increased exposure to biopharmaceutical manufacturing brings new execution and regulatory risks that investors should not ignore.

Exploring Other Perspectives

Explore another fair value estimate on Alfresa Holdings - why the stock might be a potential multi-bagger!

Build Your Own Alfresa Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alfresa Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alfresa Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alfresa Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2784

Alfresa Holdings

Through its subsidiaries, engages in the manufacture, wholesale, marketing, and import/export of pharmaceuticals, diagnostic reagents, and medical devices/equipment in Japan and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives