- Japan

- /

- Healthtech

- /

- TSE:2413

M3, Inc. (TSE:2413) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

M3, Inc. (TSE:2413) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

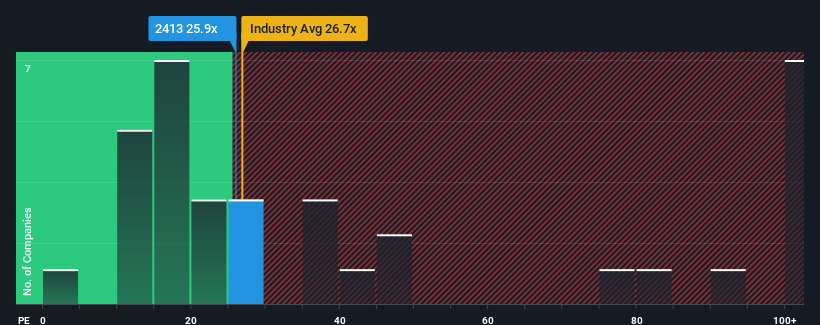

Since its price has surged higher, M3 may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 25.9x, since almost half of all companies in Japan have P/E ratios under 13x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, M3's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for M3

How Is M3's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like M3's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 6.5% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 9.4% per year during the coming three years according to the analysts following the company. With the market predicted to deliver 9.6% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's curious that M3's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From M3's P/E?

M3's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of M3's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for M3 with six simple checks.

If you're unsure about the strength of M3's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade M3, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2413

M3

Provides medical-related services primarily to physicians and other healthcare professionals through Internet.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives