Earnings Not Telling The Story For KENKO Mayonnaise Co.,Ltd. (TSE:2915) After Shares Rise 27%

KENKO Mayonnaise Co.,Ltd. (TSE:2915) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 63% in the last year.

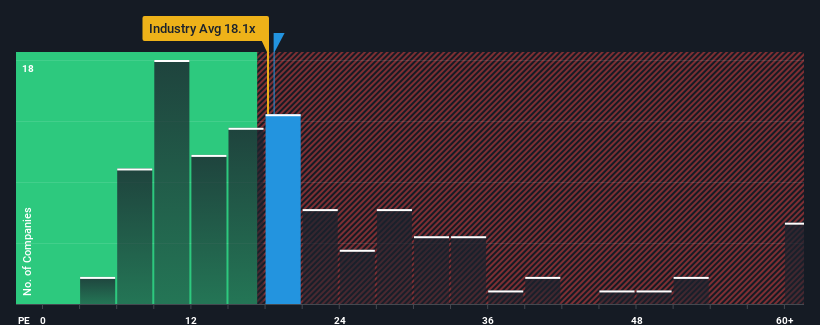

Since its price has surged higher, KENKO MayonnaiseLtd may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.6x, since almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been advantageous for KENKO MayonnaiseLtd as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for KENKO MayonnaiseLtd

Is There Enough Growth For KENKO MayonnaiseLtd?

In order to justify its P/E ratio, KENKO MayonnaiseLtd would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 207%. As a result, it also grew EPS by 29% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings growth is heading into negative territory, declining 6.6% per annum over the next three years. With the market predicted to deliver 9.9% growth per year, that's a disappointing outcome.

In light of this, it's alarming that KENKO MayonnaiseLtd's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Final Word

KENKO MayonnaiseLtd's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of KENKO MayonnaiseLtd's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 1 warning sign for KENKO MayonnaiseLtd that you should be aware of.

You might be able to find a better investment than KENKO MayonnaiseLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade KENKO MayonnaiseLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KENKO MayonnaiseLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2915

KENKO MayonnaiseLtd

Engages in the manufacture and sale of salads and delicatessen, mayonnaise, dressings, sauces, and egg products in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives