Nichirei (TSE:2871) Valuation in Focus After Analyst Downgrade and Target Price Cut

Reviewed by Kshitija Bhandaru

Nichirei (TSE:2871) shares saw renewed attention after domestic major analysts downgraded the company to the middle tier. A reduction in its target price also sparked conversations among investors about future prospects.

See our latest analysis for Nichirei.

Following the analyst downgrade, Nichirei’s share price has edged lower over the year, now sitting at ¥1,745, with a year-to-date share price return of -13.6%. While momentum has faded recently, long-term investors are still well ahead with a 59.2% three-year total shareholder return and 44.4% over five years. This demonstrates the company’s staying power even as sentiment shifts.

If you’re curious where else sustained returns can be found, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Given the recent analyst downgrade and shifting share price, investors are left wondering whether Nichirei now offers hidden value at these levels or if the market is already factoring in its future growth potential.

Price-to-Earnings of 18.3x: Is it justified?

Nichirei is trading at a price-to-earnings (P/E) ratio of 18.3, which is notably higher than the Japanese food industry average of 16.4. Despite a recent slide in share price, this signals that the stock commands a premium to its sector peers right now.

The P/E ratio compares a company's current share price to its per-share earnings and serves as a snapshot of how much investors are willing to pay for each yen of profitability. In consumer staples like food production, this multiple can also reflect perceived earnings stability or growth opportunities.

Currently, Nichirei's P/E ratio suggests the market is either pricing in superior prospects or overlooking near-term earnings softness. Interestingly, the company's ratio is below its peer group average (19.6x), which indicates it is attractively positioned in the sector even though it trades above the broader industry average.

Although it carries a premium to the food industry, compared to Simply Wall St's estimate of a fair P/E ratio (21.2x), the current valuation still leaves room for upside if the market adjusts its expectations in the future. Investors watching earnings trends, return on equity, and sector momentum may be interested to see if this premium narrows or widens.

Explore the SWS fair ratio for Nichirei

Result: Price-to-Earnings of 18.3x (ABOUT RIGHT)

However, weaker annual net income growth and ongoing share price underperformance remain risks that could weigh on sentiment or signal deeper challenges ahead.

Find out about the key risks to this Nichirei narrative.

Another View: What Does a Different Model Say?

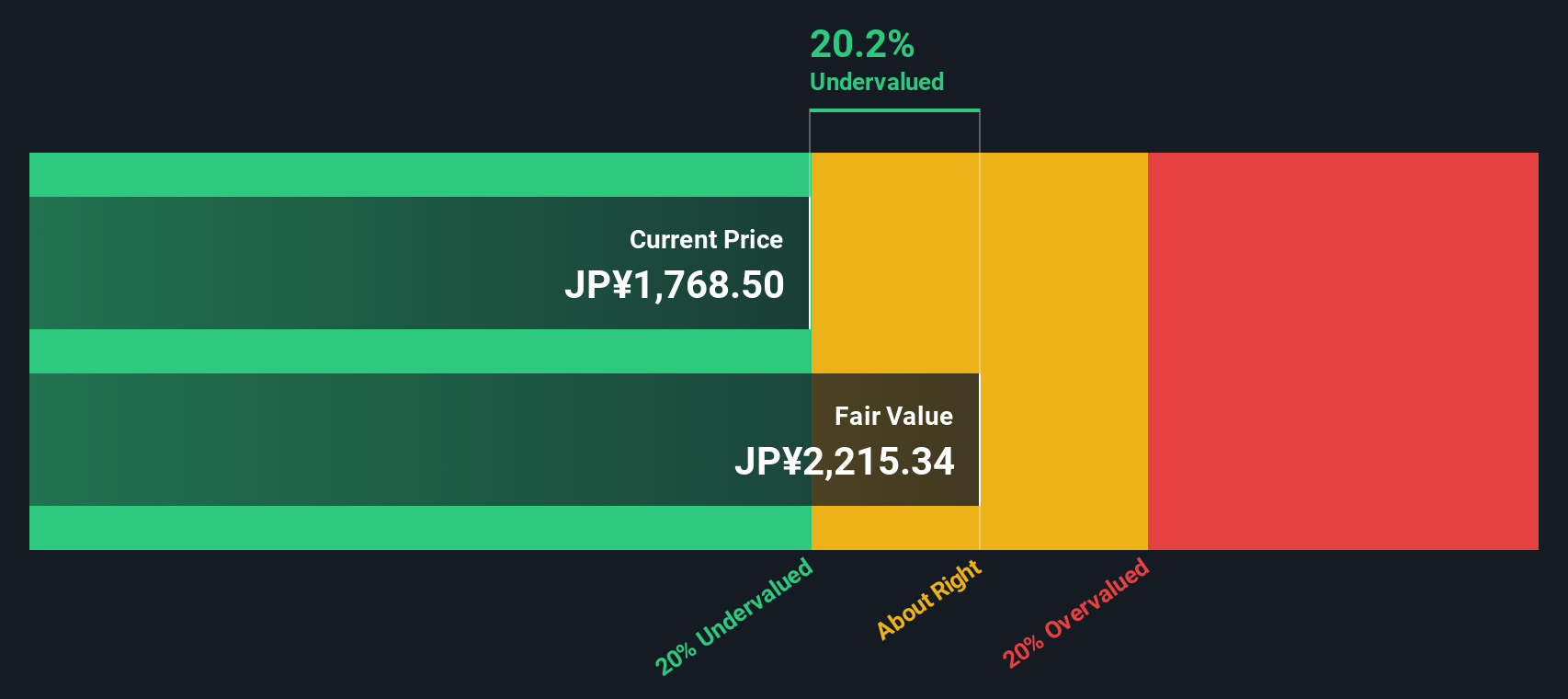

Taking a look through our DCF model, Nichirei’s shares appear to be trading at a considerable discount, about 21% below its estimated fair value. This points toward potential undervaluation. However, it’s worth asking: does the market know something a spreadsheet cannot capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nichirei for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nichirei Narrative

If you want to dig deeper or have your own view on Nichirei’s prospects, it’s easy to build your own take based on the data in just a few minutes. Do it your way

A great starting point for your Nichirei research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for the obvious picks. Stay ahead by checking out tailored opportunities that could take your portfolio further and help you outperform the crowd. Don’t let these stand-out ideas pass you by. Here’s what you could be acting on right now:

- Boost your income stream by jumping into these 18 dividend stocks with yields > 3% offering robust yields above 3% for reliable returns.

- Seize the growth potential of artificial intelligence by pursuing these 25 AI penny stocks tapping into transformative technology trends before the masses catch on.

- Capitalize on rapid innovation by following these 26 quantum computing stocks blazing a trail in the race toward quantum breakthroughs and future-defining industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nichirei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2871

Nichirei

Through its subsidiaries, engages in the processed food, logistics, marine products, meat and poultry products, bioscience, and real estate businesses in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives