Nisshin OilliO (TSE:2602): Evaluating Valuation After Full-Year Profit Forecast Cut Due to Rising Costs and Softer Demand

Reviewed by Simply Wall St

Nisshin OilliO GroupLtd (TSE:2602) has updated its full-year outlook, lowering earnings forecasts because of increasing cost pressures across its supply chain and softer demand for household-use products. Investors are watching closely as international biofuel demand and currency shifts continue to weigh on profits.

See our latest analysis for Nisshin OilliO GroupLtd.

Despite the downgrade in profit outlook, Nisshin OilliO GroupLtd’s shares have demonstrated resilience, with a 1-year total shareholder return of 4.2% and a remarkable rise of over 100% in five years. The company recently affirmed its dividend, moved ahead with a sizeable share buyback, and expanded its stock incentive plan even as operational headwinds grew. This shows management’s confidence in long-term value. Momentum has cooled somewhat after last year’s strong run. However, these capital actions suggest that leadership remains focused on rewarding investors and navigating uncertainty.

If company updates like these have you thinking about what else is out there, it may be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a 34% discount to analyst price targets and long-term returns still strong, the question is whether the recent profit warning has created a genuine value opportunity or if the market already reflects the risk and outlook ahead.

Price-to-Earnings of 6.8x: Is it justified?

With Nisshin OilliO GroupLtd trading at a price-to-earnings (P/E) ratio of just 6.8x, the market is valuing its shares far below both industry peers and historical norms. The last close price stands at ¥5,130, significantly undercutting the food industry average P/E multiple.

The P/E multiple measures investor willingness to pay for each yen of company earnings. In mature sectors like food, a moderate-to-high P/E is often warranted for resilient earnings. In this case, the current multiple appears very low relative to the company’s recent earnings momentum and profit growth.

Nisshin OilliO’s P/E of 6.8x not only trails the average for Japanese food peers (11.2x), but is also less than half the Japan market average (14.3x). According to valuation signals, the fair P/E ratio is estimated at 11.7x. This level suggests substantial upside if the market re-rates the stock for its earnings profile.

Explore the SWS fair ratio for Nisshin OilliO GroupLtd

Result: Price-to-Earnings of 6.8x (UNDERVALUED)

However, continued cost inflation or weaker biofuel demand could challenge Nisshin OilliO GroupLtd's recovery and may prevent shares from reaching higher valuations in the near term.

Find out about the key risks to this Nisshin OilliO GroupLtd narrative.

Another View: What Does the SWS DCF Model Say?

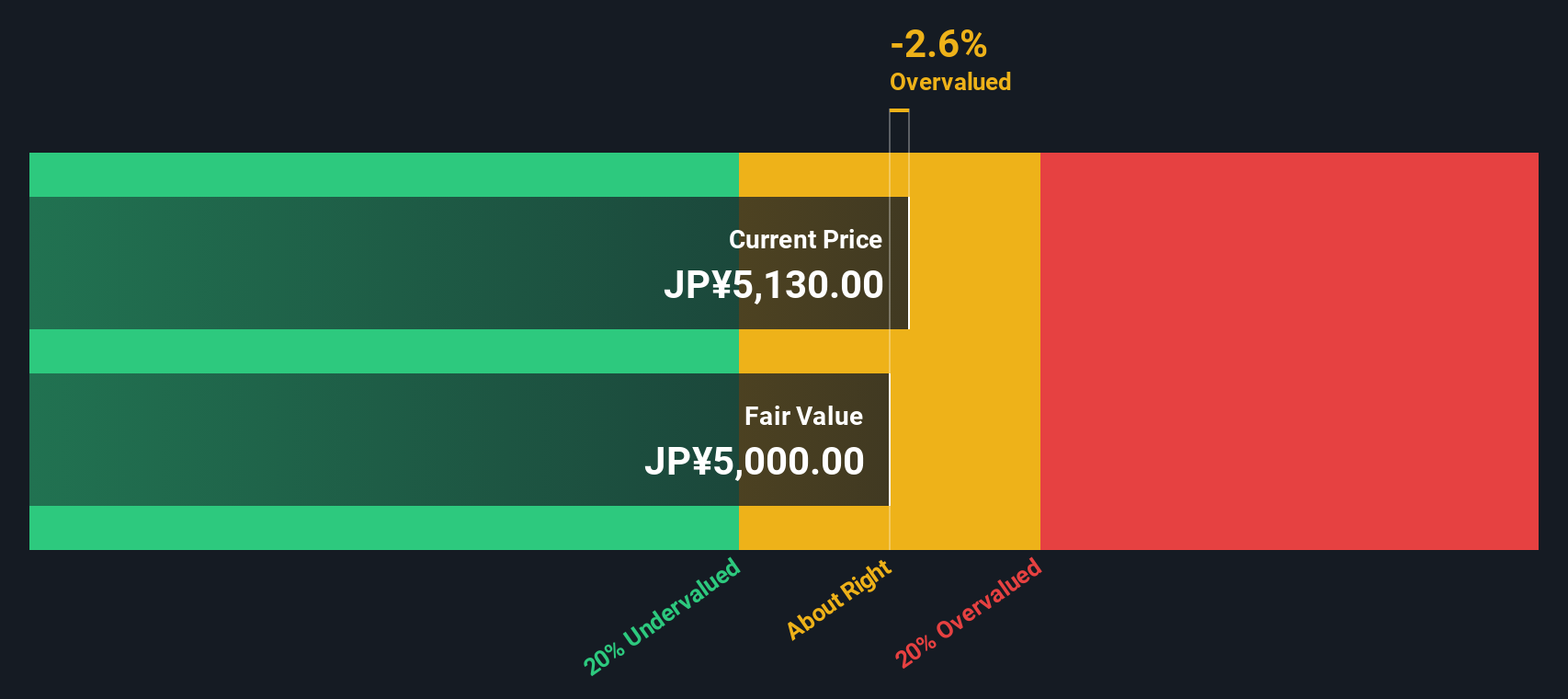

While multiples suggest Nisshin OilliO GroupLtd offers clear value, our SWS DCF model points to a different reality. The DCF result estimates the fair value at ¥5,000 per share, which is just below the current price of ¥5,130. This method indicates the shares may not be as undervalued as multiples suggest. This prompts the question: which approach best captures the real opportunity here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nisshin OilliO GroupLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nisshin OilliO GroupLtd Narrative

If you see the potential differently, or want to test your own ideas against the numbers, you can build your own analysis quickly and easily using Do it your way.

A great starting point for your Nisshin OilliO GroupLtd research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for Your Next Smart Move?

Sharpen your investing game with ideas that could transform your portfolio. Tap into smart stock picks others might be missing, and position yourself ahead of tomorrow’s trends.

- Capitalize on growth by evaluating these 25 AI penny stocks, which are driving innovation and reshaping entire industries with artificial intelligence breakthroughs.

- Strengthen your income strategy by targeting these 16 dividend stocks with yields > 3%, offering attractive yields for consistent returns in all market conditions.

- Seize tomorrow’s breakthroughs by investigating these 26 quantum computing stocks, pioneering developments in quantum technology and computing disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nisshin OilliO GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2602

Nisshin OilliO GroupLtd

Engages in foods and ingredients business in Japan, rest of Asia, and internationally.

Proven track record average dividend payer.

Market Insights

Community Narratives