Coca-Cola Bottlers Japan Holdings Inc. Just Missed Earnings - But Analysts Have Updated Their Models

Coca-Cola Bottlers Japan Holdings Inc. (TSE:2579) came out with its annual results last week, and we wanted to see how the business is performing and what industry forecasters think of the company following this report. It was not a great result overall. While revenues of JP¥893b were in line with analyst predictions, earnings were less than expected, missing statutory estimates by 16% to hit JP¥40.76 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Coca-Cola Bottlers Japan Holdings

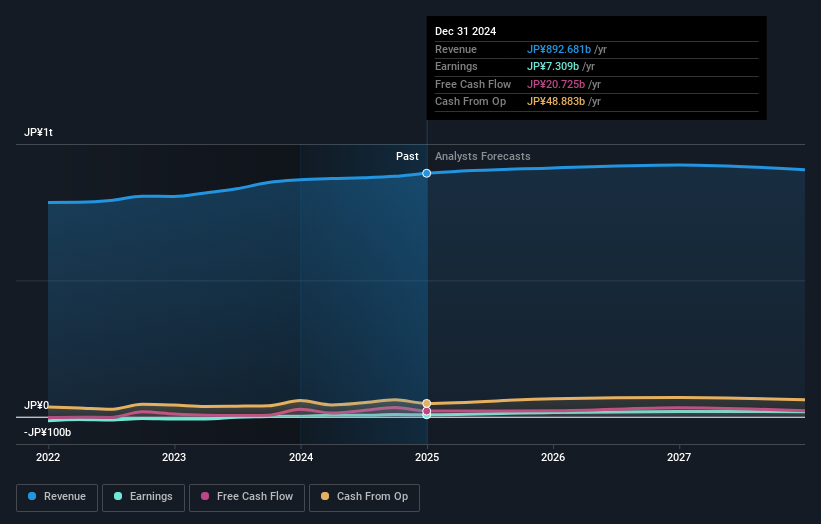

After the latest results, the eight analysts covering Coca-Cola Bottlers Japan Holdings are now predicting revenues of JP¥912.3b in 2025. If met, this would reflect a reasonable 2.2% improvement in revenue compared to the last 12 months. Per-share earnings are expected to jump 121% to JP¥89.30. Before this earnings report, the analysts had been forecasting revenues of JP¥913.4b and earnings per share (EPS) of JP¥93.56 in 2025. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but the analysts did make a small dip in their earnings per share forecasts.

Althoughthe analysts have revised their earnings forecasts for next year, they've also lifted the consensus price target 5.1% to JP¥2,579, suggesting the revised estimates are not indicative of a weaker long-term future for the business. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Coca-Cola Bottlers Japan Holdings at JP¥3,350 per share, while the most bearish prices it at JP¥2,000. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Coca-Cola Bottlers Japan Holdings' past performance and to peers in the same industry. The analysts are definitely expecting Coca-Cola Bottlers Japan Holdings' growth to accelerate, with the forecast 2.2% annualised growth to the end of 2025 ranking favourably alongside historical growth of 0.9% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 2.0% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Coca-Cola Bottlers Japan Holdings is expected to grow at about the same rate as the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. They also reconfirmed their revenue estimates, with the company predicted to grow at about the same rate as the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple Coca-Cola Bottlers Japan Holdings analysts - going out to 2027, and you can see them free on our platform here.

Plus, you should also learn about the 1 warning sign we've spotted with Coca-Cola Bottlers Japan Holdings .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2579

Coca-Cola Bottlers Japan Holdings

Engages in the purchases, sales, bottling, packaging, distribution and marketing of carbonated beverages, coffee beverages, tea-based beverages, mineral water, and other soft drinks in Japan.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives