Should Takara Holdings' (TSE:2531) Investment Securities Sale Prompt a Fresh Look at Its Balance Sheet?

Reviewed by Sasha Jovanovic

- In recent days, Takara Holdings reported a significant gain from the sale of investment securities, resulting in a substantial profit for the company.

- This transaction could provide Takara Holdings with greater financial flexibility and potentially support future investments or business initiatives.

- We'll explore how this realized investment gain could alter Takara Holdings' investment narrative and strengthen its balance sheet outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Takara Holdings' Investment Narrative?

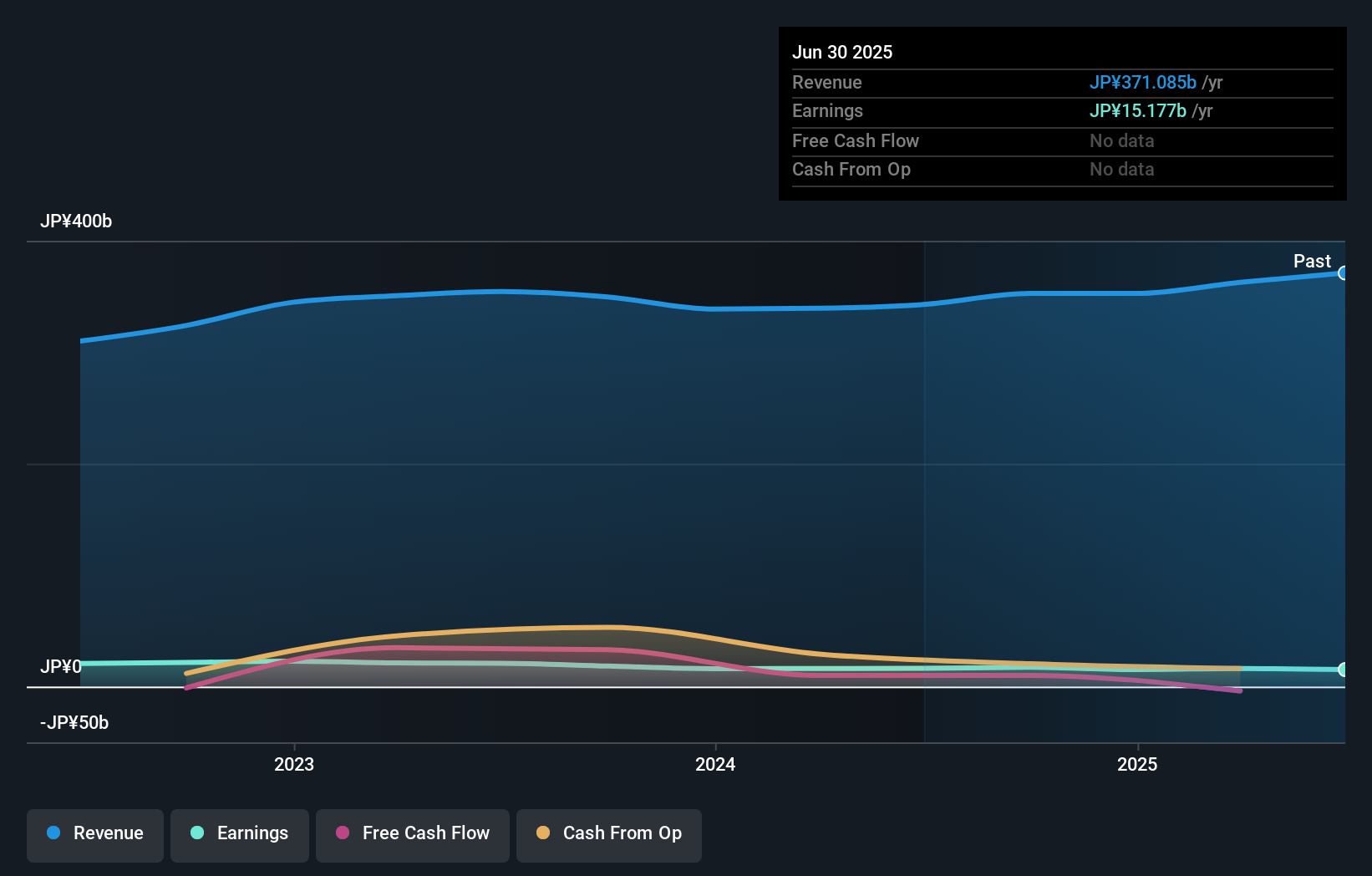

For anyone considering Takara Holdings, it's crucial to see the company as a diversified player with a strong domestic legacy and a stable, if sometimes modest, earnings profile. The recent profit from the sale of investment securities stands out as a positive, potentially boosting near-term financial flexibility at a time when core earnings growth has been sluggish and profit margins have slipped compared to last year. This added liquidity could, in the short term, ease investor concerns around dividend stability or further share buybacks. However, with shares recently removed from the Nikkei 225 and with board turnover high, some governance and index-related uncertainties still hover. Looking ahead, while this injection of profit is helpful, the company’s underlying ability to reignite organic earnings growth remains a central question for most investors weighing short-term catalysts against longer-term risk factors.

But, despite fresh profits, board turnover is an area investors should keep an eye on. Takara Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Takara Holdings - why the stock might be worth as much as ¥690!

Build Your Own Takara Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Takara Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Takara Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Takara Holdings' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takara Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2531

Takara Holdings

Manufactures and sells alcoholic beverages and seasonings in Japan, the United States, and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives