Will Climate-Resilient Hops Technology Shift Kirin Holdings Company’s (TSE:2503) Long-Term Sustainability Narrative

Reviewed by Sasha Jovanovic

- Kirin Holdings Company recently unveiled a new seedling cultivation technology that boosts heat and drought tolerance in hops without compromising flavor, addressing challenges from climate change in key beer ingredients.

- This breakthrough leverages acquired resilience techniques instead of genetic modification, aiming to help ensure a more sustainable and stable beer supply chain.

- Next, we’ll explore how this climate-resilient innovation shapes Kirin’s investment narrative as the company prioritizes long-term sustainability.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Kirin Holdings Company's Investment Narrative?

For Kirin Holdings, the investment story is closely tied to how the company balances innovation, earnings growth, and the realities of its core beverage market. The recent unveiling of climate-resilient hop technology is a forward-looking move, reflecting Kirin’s sustained focus on sustainability and supply chain stability as part of its long-term vision. However, this breakthrough, while impressive, is unlikely to materially shift the biggest short-term catalysts or risks for shareholders just yet. The market’s optimism is already reflected in Kirin’s premium valuation relative to peers, with catalysts around near-term revenue and profit margin recovery still front and center. At the same time, slowing revenue growth and slimmer profit margins continue to weigh on expectations and could introduce downside risk if operating improvements do not follow. For now, the climate innovation strengthens Kirin’s narrative and may support investor confidence, but it will take time before the financial benefits become substantial.

But be aware, slowing revenue growth is a risk that shouldn't be overlooked. Kirin Holdings Company's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

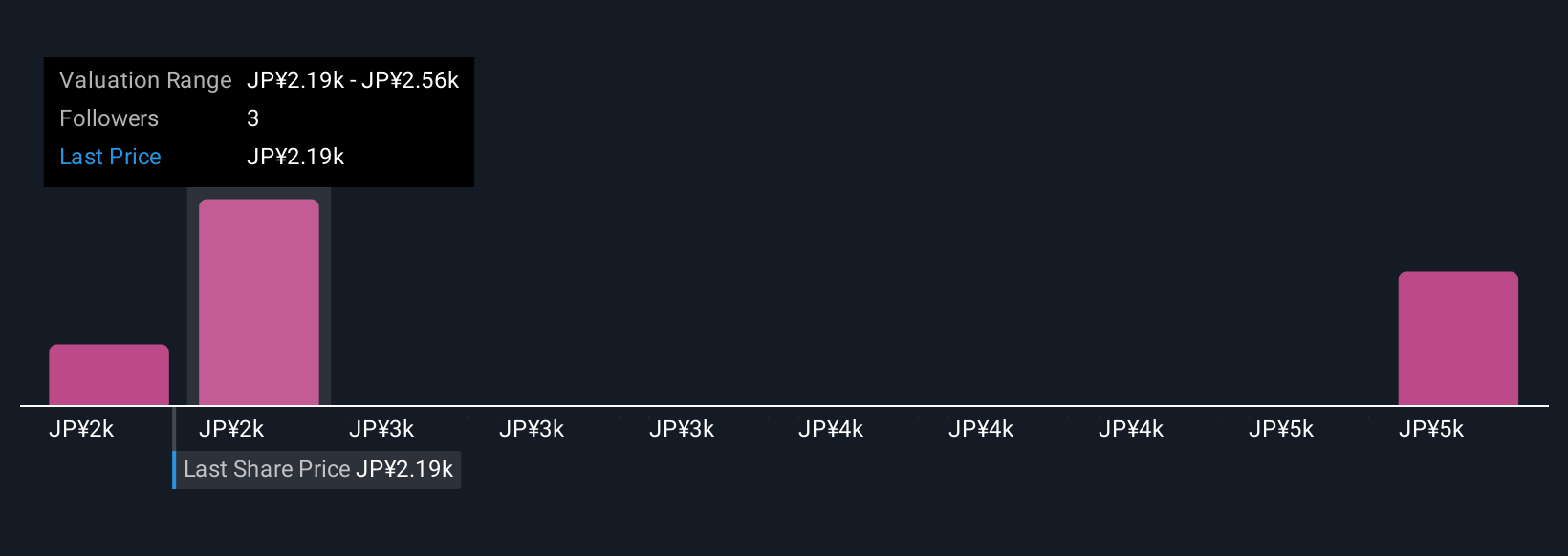

Explore 3 other fair value estimates on Kirin Holdings Company - why the stock might be worth 18% less than the current price!

Build Your Own Kirin Holdings Company Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kirin Holdings Company research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Kirin Holdings Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kirin Holdings Company's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kirin Holdings Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2503

Kirin Holdings Company

Engages in food and beverages, alcoholic beverages, pharmaceuticals, and health science businesses.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives