Asahi (TSE:2502): Evaluating Valuation After Recent Modest Share Price Decline

Reviewed by Kshitija Bhandaru

See our latest analysis for Asahi Group Holdings.

Zooming out, Asahi Group Holdings’ recent modest declines follow a year in which momentum has faded. The 1-year total shareholder return is slightly negative, and longer-term gains now appear more subdued. While some investors are growing cautious, others see valuations as catching up with fundamentals.

If you’re curious about where else opportunity might be building, this could be a good moment to broaden your investing radar and discover fast growing stocks with high insider ownership

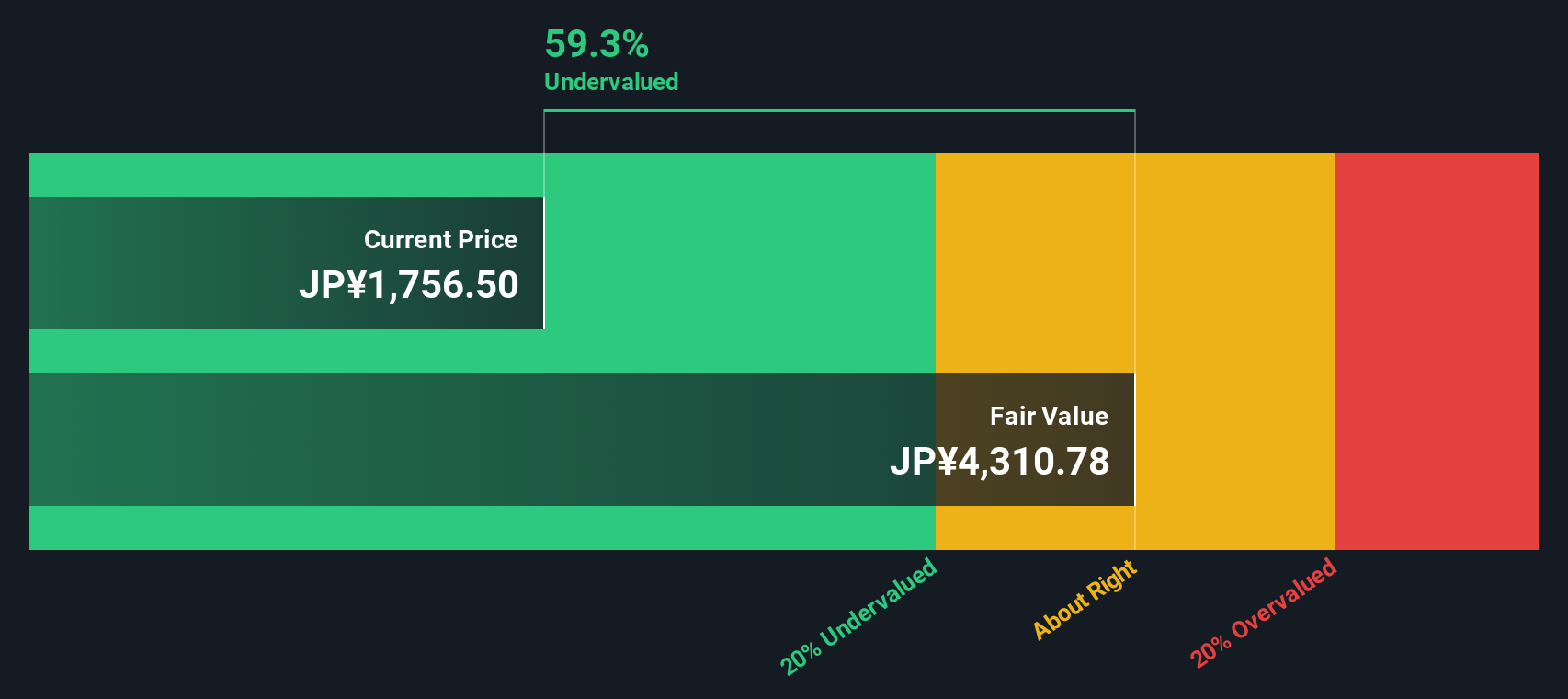

Asahi’s shares now trade at a significant discount to both analyst targets and some intrinsic value estimates. This raises the question: is this a prime entry point, or is the market simply reflecting slower future growth?

Price-to-Earnings of 14.7x: Is it justified?

Asahi Group Holdings is currently trading at a price-to-earnings (P/E) ratio of 14.7x, which is notably below both its industry average and the broader peer set. This suggests the market may be discounting the company’s near-term prospects or has yet to recognize its true earnings power.

The P/E ratio compares a company’s share price to its annual net earnings and serves as a gauge for how much investors are willing to pay per yen of profit. For established consumer staples like Asahi, the P/E often reflects expected growth, profitability, and perceived risk in a sector known for stable but moderate expansion.

When measured against the Asian Beverage industry average of 19.5x and a peer average of 55.3x, Asahi’s valuation appears potentially conservative. The current P/E is well below these benchmarks and also sits beneath the estimated fair P/E of 25.1x, which may indicate further room for market reassessment if growth and quality are sustained.

Explore the SWS fair ratio for Asahi Group Holdings

Result: Price-to-Earnings of 14.7x (UNDERVALUED)

However, risks remain, including the potential for weaker revenue growth or market sentiment shifts. Either of these factors could challenge the current undervaluation thesis.

Find out about the key risks to this Asahi Group Holdings narrative.

Another View: Discounted Cash Flow

Looking at our DCF model provides a different perspective. On this measure, Asahi Group Holdings appears deeply undervalued, trading at a substantial 60% discount to its estimated intrinsic value. Could this gap signal a market oversight, or is there another risk beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Asahi Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Asahi Group Holdings Narrative

If you have your own perspective or want to dig deeper into the numbers, you can craft your own view in just a few minutes. Do it your way

A great starting point for your Asahi Group Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Uncover companies that match your goals, gain an informed edge, and make your next move count with these powerful tools:

- Tap into potential high-growth technology leaders by using these 24 AI penny stocks. This allows you to position yourself at the forefront of innovation.

- Boost your portfolio’s income with attractive yields by checking out these 19 dividend stocks with yields > 3%, which offers over 3% returns.

- Capitalize on game-changing advances in computing by spotting tomorrow’s trailblazers inside these 26 quantum computing stocks for breakthrough opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2502

Asahi Group Holdings

Manufactures and sells beer, alcohol and non-alcohol beverages, and food products in Japan, Europe, Oceania, and Southeast Asia.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives