Statutory Profit Doesn't Reflect How Good Itoham Yonekyu Holdings' (TSE:2296) Earnings Are

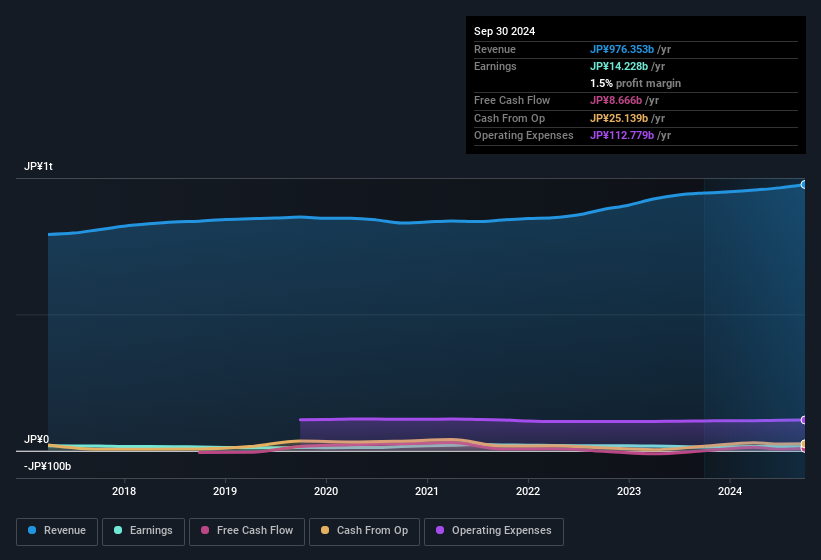

The subdued stock price reaction suggests that Itoham Yonekyu Holdings Inc.'s (TSE:2296) strong earnings didn't offer any surprises. Our analysis suggests that investors might be missing some promising details.

Check out our latest analysis for Itoham Yonekyu Holdings

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Itoham Yonekyu Holdings' profit was reduced by JP¥2.8b, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. If Itoham Yonekyu Holdings doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Itoham Yonekyu Holdings' Profit Performance

Unusual items (expenses) detracted from Itoham Yonekyu Holdings' earnings over the last year, but we might see an improvement next year. Because of this, we think Itoham Yonekyu Holdings' earnings potential is at least as good as it seems, and maybe even better! Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. While conducting our analysis, we found that Itoham Yonekyu Holdings has 1 warning sign and it would be unwise to ignore it.

This note has only looked at a single factor that sheds light on the nature of Itoham Yonekyu Holdings' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2296

Itoham Yonekyu Holdings

Engages in the manufacture and sale of processed meat and processed/precooked food products in Japan.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026