Is Itoham Yonekyu's Dividend Hike and Upgraded Guidance Shifting the Investment Case for TSE:2296?

Reviewed by Sasha Jovanovic

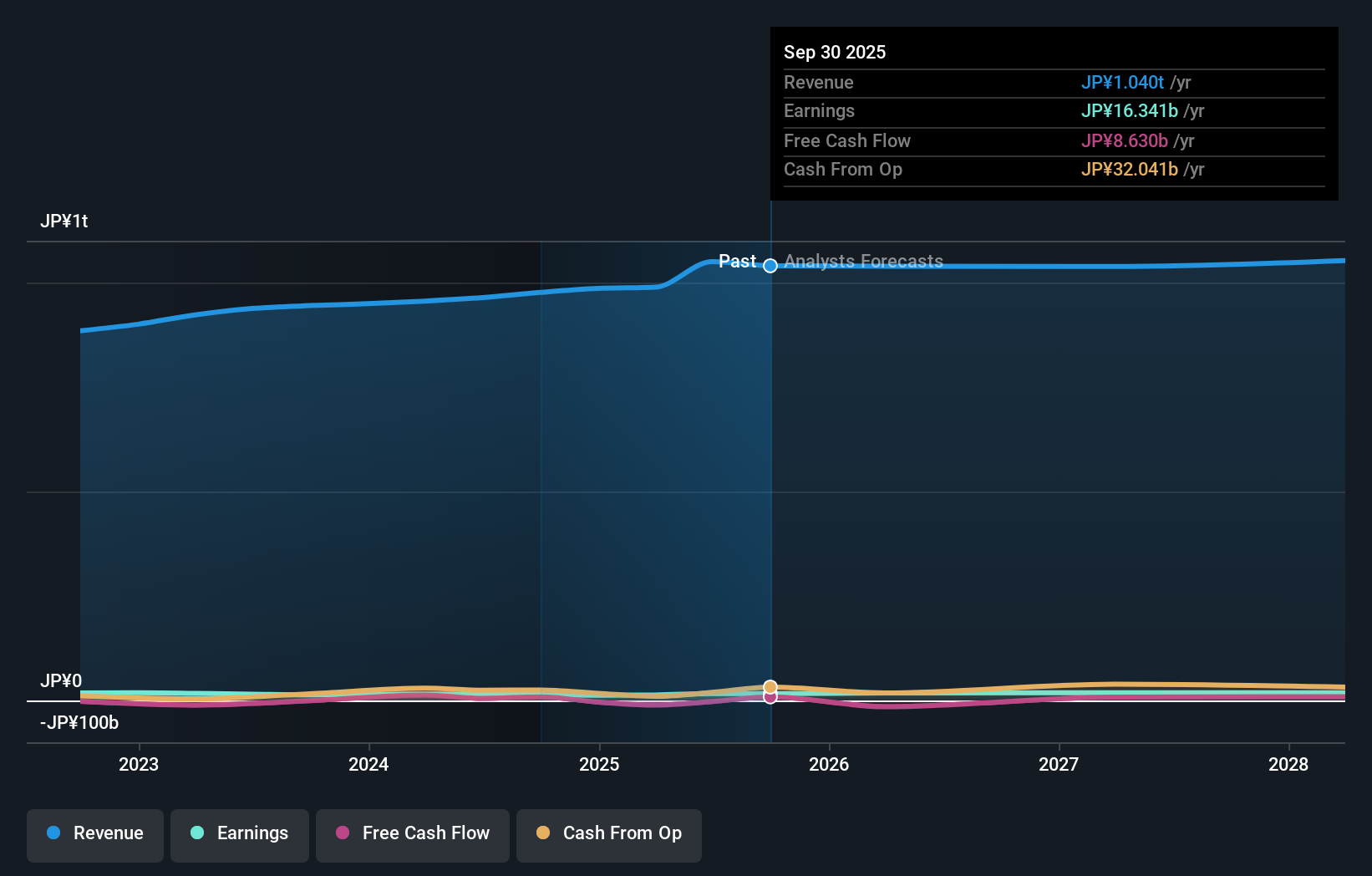

- On November 4, 2025, Itoham Yonekyu Holdings announced an interim dividend of ¥70.00 per share for the second quarter ended September 30, 2025, while also raising its consolidated earnings guidance for the fiscal year ending March 31, 2026 to reflect higher anticipated net sales and profit.

- This combination of a stable interim dividend and an upgraded earnings outlook highlights management's confidence in the company's operational momentum and financial stability.

- We’ll examine how the upgraded profit expectations for fiscal 2026 could influence the company's long-term investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Itoham Yonekyu Holdings' Investment Narrative?

To be a shareholder of Itoham Yonekyu Holdings right now, an investor needs to see value in the company’s consistent approach to dividends, stable financial performance, and its ability to lift profit guidance even in a historically low-growth sector. The recent affirmation of the interim dividend at ¥70 per share, alongside the raised full-year earnings forecast, signals management’s ongoing confidence and provides a modest near-term catalyst, potentially easing concerns about the sustainability of returns or earnings momentum. However, this improved outlook may not be enough to completely offset persistent structural risks, such as slow revenue and earnings growth compared to the broader market, a high price-to-earnings ratio relative to industry norms, and issues with board independence and management tenure. Investors should keep in mind that while the upgraded guidance is encouraging, questions around long-term growth and governance remain.

But it’s the board’s inexperience that could matter most going forward.

Exploring Other Perspectives

Explore another fair value estimate on Itoham Yonekyu Holdings - why the stock might be worth as much as ¥4041!

Build Your Own Itoham Yonekyu Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Itoham Yonekyu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Itoham Yonekyu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Itoham Yonekyu Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2296

Itoham Yonekyu Holdings

Engages in the manufacture and sale of processed meat and processed/precooked food products in Japan.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives