- Sweden

- /

- Life Sciences

- /

- OM:BIOT

Exploring Three Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainty, global markets experienced notable declines, with smaller-cap indexes particularly affected. Despite these challenges, strong economic indicators like robust consumer spending and job growth in the U.S. offer a backdrop of resilience that can bode well for small-cap stocks poised for growth. In this environment, identifying promising stocks requires looking beyond immediate market volatility to focus on companies with solid fundamentals and potential for long-term success.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ABG Sundal Collier Holding | 18.07% | 0.55% | -4.76% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Lavipharm | 39.21% | 9.47% | -15.70% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Biotage (OM:BIOT)

Simply Wall St Value Rating: ★★★★★★

Overview: Biotage AB (publ) offers solutions and products for drug discovery and development, analytical testing, and water and environmental testing, with a market cap of approximately SEK12.86 billion.

Operations: Biotage generates revenue primarily from its healthcare software segment, which reported SEK 2.12 billion.

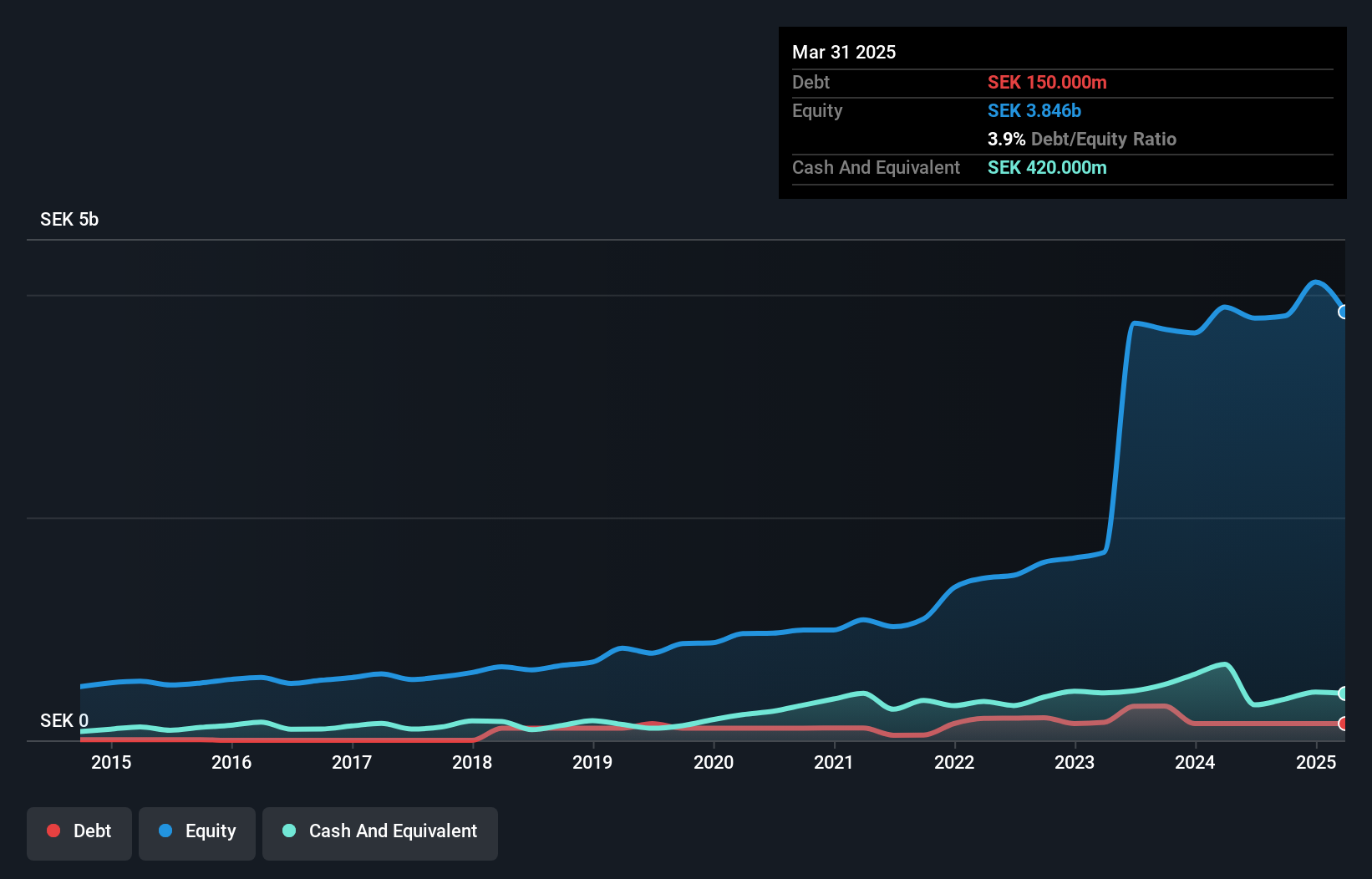

Biotage, a player in the life sciences sector, has shown promising financial health with its debt-to-equity ratio dropping from 12.6 to 3.9 over five years and cash surpassing total debt. The company reported SEK 490 million in sales for Q3 2024, up from SEK 449 million the previous year, with net income at SEK 45 million compared to SEK 38 million. Trading at a substantial discount of around 45% below estimated fair value, Biotage's earnings have grown annually by about 7.3% over five years and are well-positioned with EBIT covering interest payments by a factor of over twenty-three times.

- Delve into the full analysis health report here for a deeper understanding of Biotage.

Evaluate Biotage's historical performance by accessing our past performance report.

Yindu Kitchen Equipment (SHSE:603277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yindu Kitchen Equipment Co., Ltd focuses on the research, development, production, and sale of commercial catering equipment both in China and internationally, with a market cap of CN¥10.34 billion.

Operations: Yindu Kitchen Equipment generates revenue primarily from the sale of commercial catering equipment in China and international markets. The company has a market cap of CN¥10.34 billion.

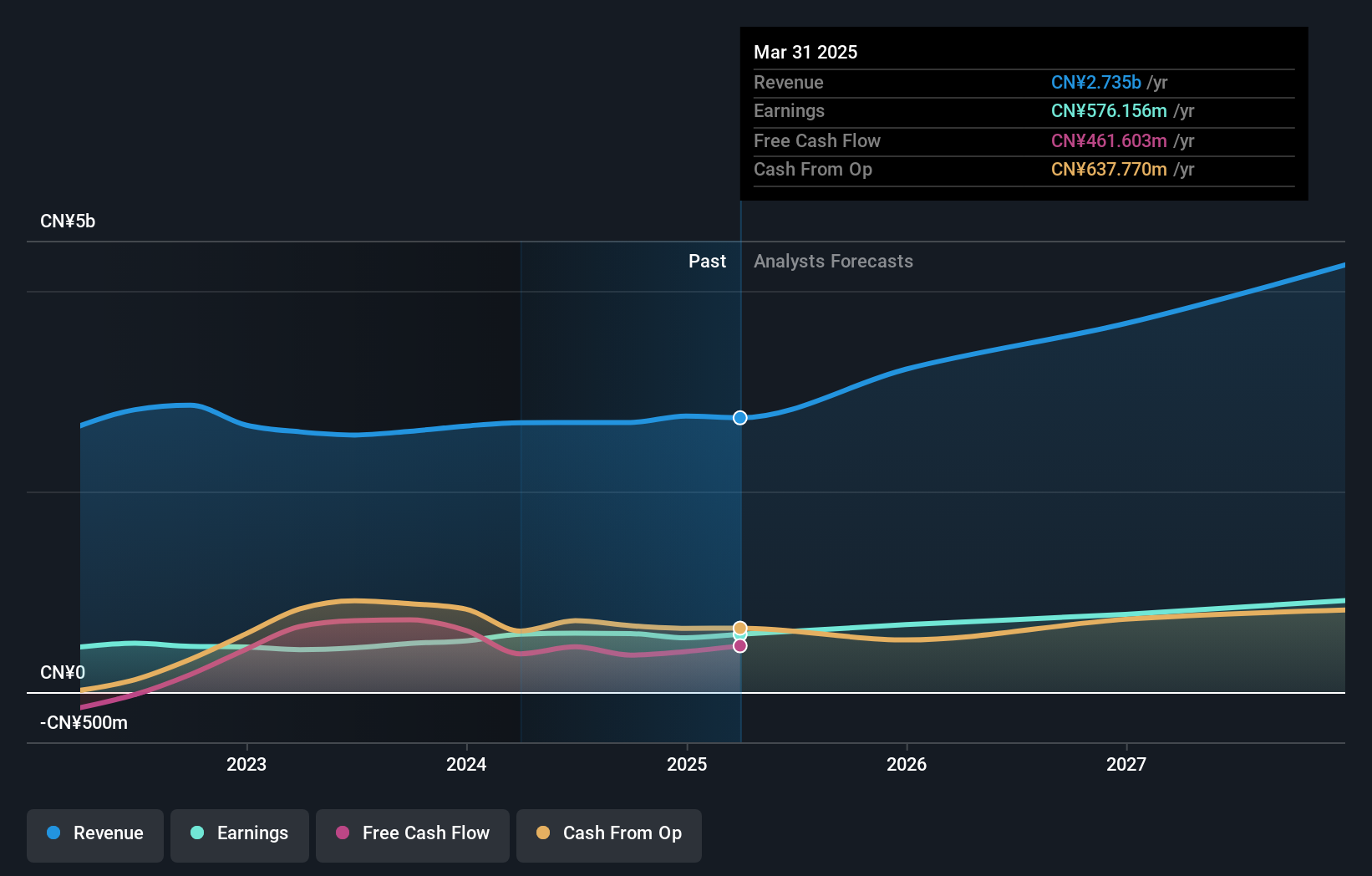

Yindu Kitchen Equipment, a promising player in its industry, showcases solid financial health with more cash than debt and high-quality earnings. Trading at a price-to-earnings ratio of 17.7x, it offers good value compared to the broader CN market at 35.5x. The company's earnings growth over the past year hit 20%, outpacing the Machinery industry's -0.06%. For the nine months ending September 2024, Yindu reported sales of CNY 2.09 billion and net income of CNY 479 million, up from CNY 407 million last year, reflecting strong operational performance amidst competitive pressures.

Itoham Yonekyu Holdings (TSE:2296)

Simply Wall St Value Rating: ★★★★★★

Overview: Itoham Yonekyu Holdings Inc. is a company that manufactures and sells processed meat and precooked food products in Japan, with a market capitalization of ¥225.80 billion.

Operations: The primary revenue streams for Itoham Yonekyu Holdings derive from the sale of processed meat and precooked food products. A notable financial trend is its net profit margin, which reflects the company's profitability after accounting for all expenses.

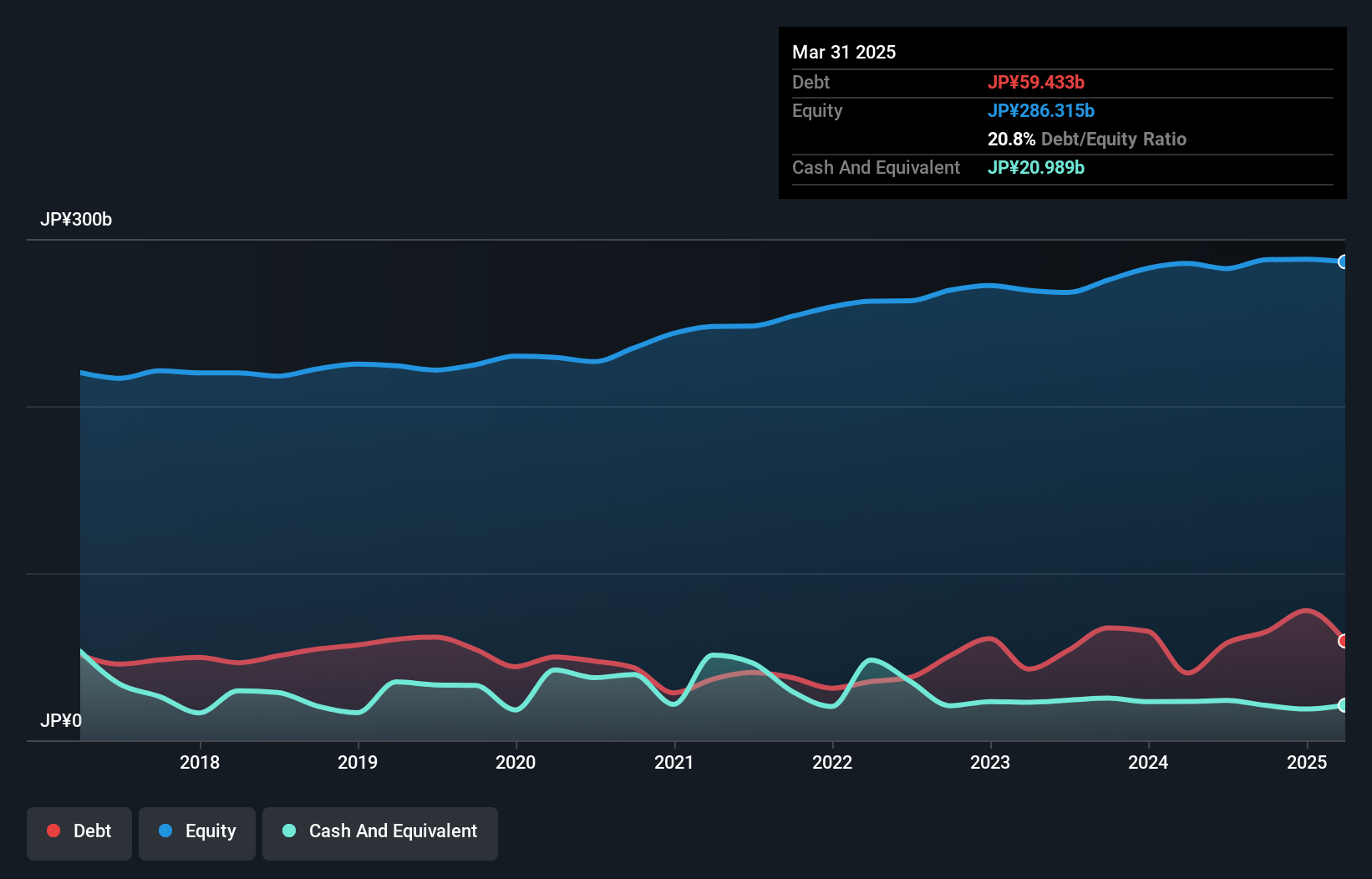

Itoham Yonekyu Holdings, a smaller player in the food industry, has shown steady earnings growth of 1.8% annually over the past five years, although it trails behind the industry's 19.5% pace. With a net debt to equity ratio of 15.4%, its financial structure is deemed satisfactory, and interest payments are comfortably covered by EBIT at 13 times over. Despite recent downward revisions in earnings guidance for FY2025—now expecting sales of ¥985 billion and operating profit of ¥22.5 billion—the company remains profitable with positive free cash flow reported recently at ¥8,666 million as of September 2024.

Summing It All Up

- Click through to start exploring the rest of the 4618 Undiscovered Gems With Strong Fundamentals now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biotage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOT

Biotage

Provides solutions and products in the areas of drug discovery and development, analytical testing, and water and environmental testing.

Flawless balance sheet and good value.