- Japan

- /

- Diversified Financial

- /

- TSE:7198

Undiscovered Gems To Explore This January 2025

Reviewed by Simply Wall St

As global markets continue to climb, with U.S. stocks nearing record highs driven by optimism around trade policies and AI investments, small-cap stocks have lagged behind their larger counterparts. In this environment, identifying promising small-cap companies that may benefit from these broader economic trends can be a rewarding strategy for investors seeking potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| ONEJOON | 9.85% | 24.95% | 4.85% | ★★★★★☆ |

| Giant Heavy Machinery Service | 17.81% | 21.88% | 48.77% | ★★★★★☆ |

| Primadaya Plastisindo | 10.46% | 15.41% | 23.92% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Shandong Longquan Pipe IndustryLtd | 34.82% | 2.24% | -22.15% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Datang Environment Industry Group (SEHK:1272)

Simply Wall St Value Rating: ★★★★★★

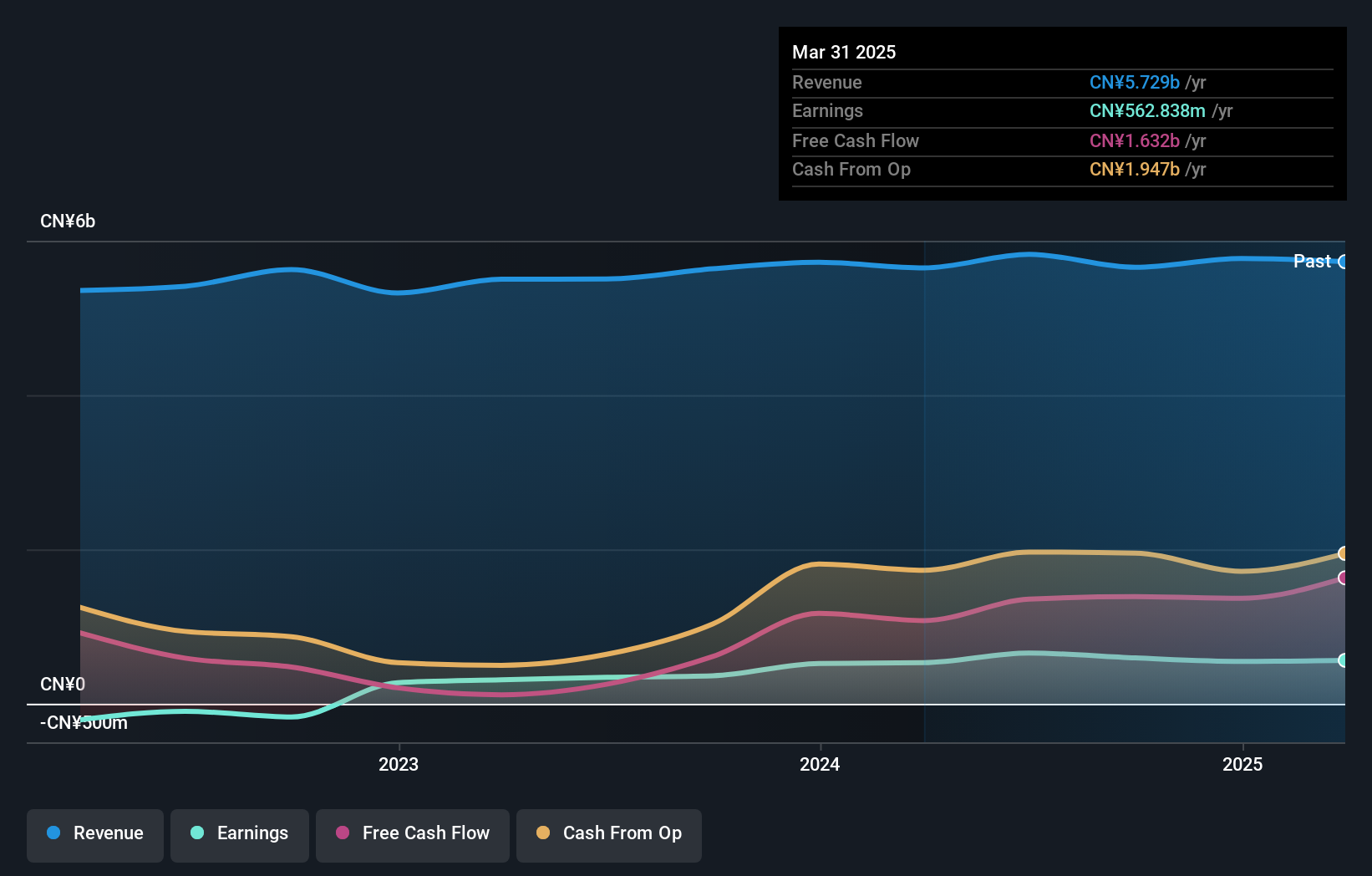

Overview: Datang Environment Industry Group Co., Ltd. operates in the environmental protection industry, focusing on services such as flue gas desulfurization and denitrification, with a market cap of approximately HK$2.70 billion.

Operations: Datang Environment Industry Group generates revenue primarily through its environmental protection services. The company has a market cap of approximately HK$2.70 billion.

Datang Environment Industry Group, a smaller player in the commercial services sector, has shown impressive financial resilience. With earnings soaring by 64% over the past year, it outpaced the industry average of -4.9%. The company trades at a significant discount of 95.8% below its estimated fair value, suggesting potential undervaluation. Over five years, Datang's debt to equity ratio improved from 83.5% to 41.8%, reflecting better fiscal management and a satisfactory net debt to equity ratio of 24.4%. Recent board changes include Ms. Wang Mi's election as an employee representative director for three years starting January 2025.

MEGMILK SNOW BRANDLtd (TSE:2270)

Simply Wall St Value Rating: ★★★★★★

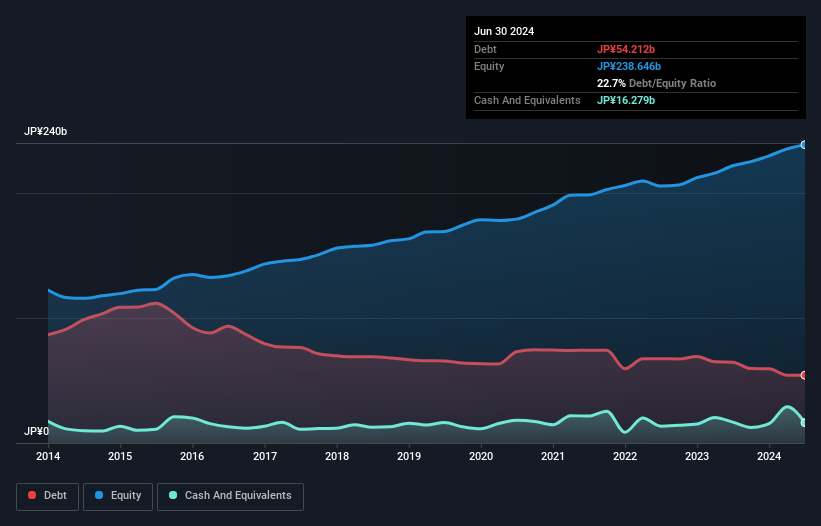

Overview: MEGMILK SNOW BRAND Co., Ltd. is a company that manufactures and sells milk, milk products, and other food products in Japan and internationally, with a market capitalization of approximately ¥177 billion.

Operations: MEGMILK SNOW BRAND generates significant revenue from its Dairy Products and Beverages and Desserts segments, with ¥274.94 billion and ¥260.77 billion respectively. The company's financial performance is influenced by these core segments, which together form the bulk of its income streams.

Megmilk Snow Brand, a notable player in the food sector, has shown impressive earnings growth of 44% over the past year, outpacing the industry average. This performance is bolstered by a satisfactory net debt to equity ratio of 13%, reflecting solid financial management. The company trades at nearly 31% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. However, it's important to note that recent results were impacted by a significant one-off gain of ¥9 billion. Looking ahead, Megmilk's earnings are projected to decrease annually by an average of 4% over the next three years.

- Dive into the specifics of MEGMILK SNOW BRANDLtd here with our thorough health report.

Gain insights into MEGMILK SNOW BRANDLtd's past trends and performance with our Past report.

SBI ARUHI (TSE:7198)

Simply Wall St Value Rating: ★★★★☆☆

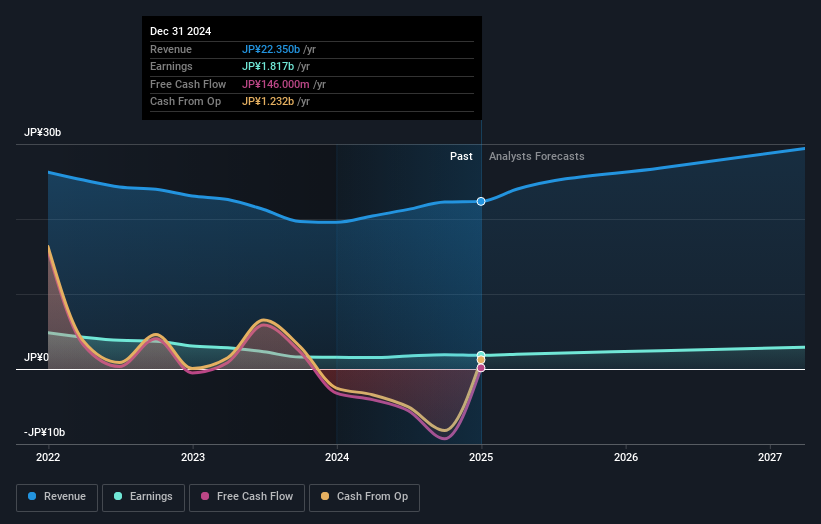

Overview: SBI ARUHI Corporation operates as a mortgage bank in Japan with a market capitalization of ¥38.74 billion.

Operations: The primary revenue stream for SBI ARUHI comes from its Housing Loan Related Business, generating ¥22.27 billion. The company's market capitalization stands at ¥38.74 billion.

SBI ARUHI stands out with its interest payments well covered by EBIT at 26.1 times, suggesting robust financial health amidst a high net debt to equity ratio of 183.1%. Trading at 42.9% below estimated fair value, it presents a potential opportunity for investors seeking undervalued stocks in the financial sector. However, while earnings grew by 20.7% last year, they lagged behind the industry average of 28.6%, indicating room for improvement in competitive performance. The recent dividend affirmation of JPY 20 per share reflects stability but suggests limited growth in shareholder returns over the past year.

- Delve into the full analysis health report here for a deeper understanding of SBI ARUHI.

Evaluate SBI ARUHI's historical performance by accessing our past performance report.

Seize The Opportunity

- Discover the full array of 4671 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7198

Reasonable growth potential with acceptable track record.

Market Insights

Community Narratives