- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3416

3 Global Dividend Stocks Yielding Over 3%

Reviewed by Simply Wall St

As global markets experience fluctuations driven by inflation data and interest rate speculation, investors are keenly observing economic indicators and market trends to navigate these uncertain times. Amidst this backdrop, dividend stocks yielding over 3% present an attractive opportunity for those seeking steady income streams in a volatile environment.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.75% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.63% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.68% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.69% | ★★★★★★ |

| NCD (TSE:4783) | 4.65% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 3.96% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

| Daicel (TSE:4202) | 4.40% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

Click here to see the full list of 1348 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

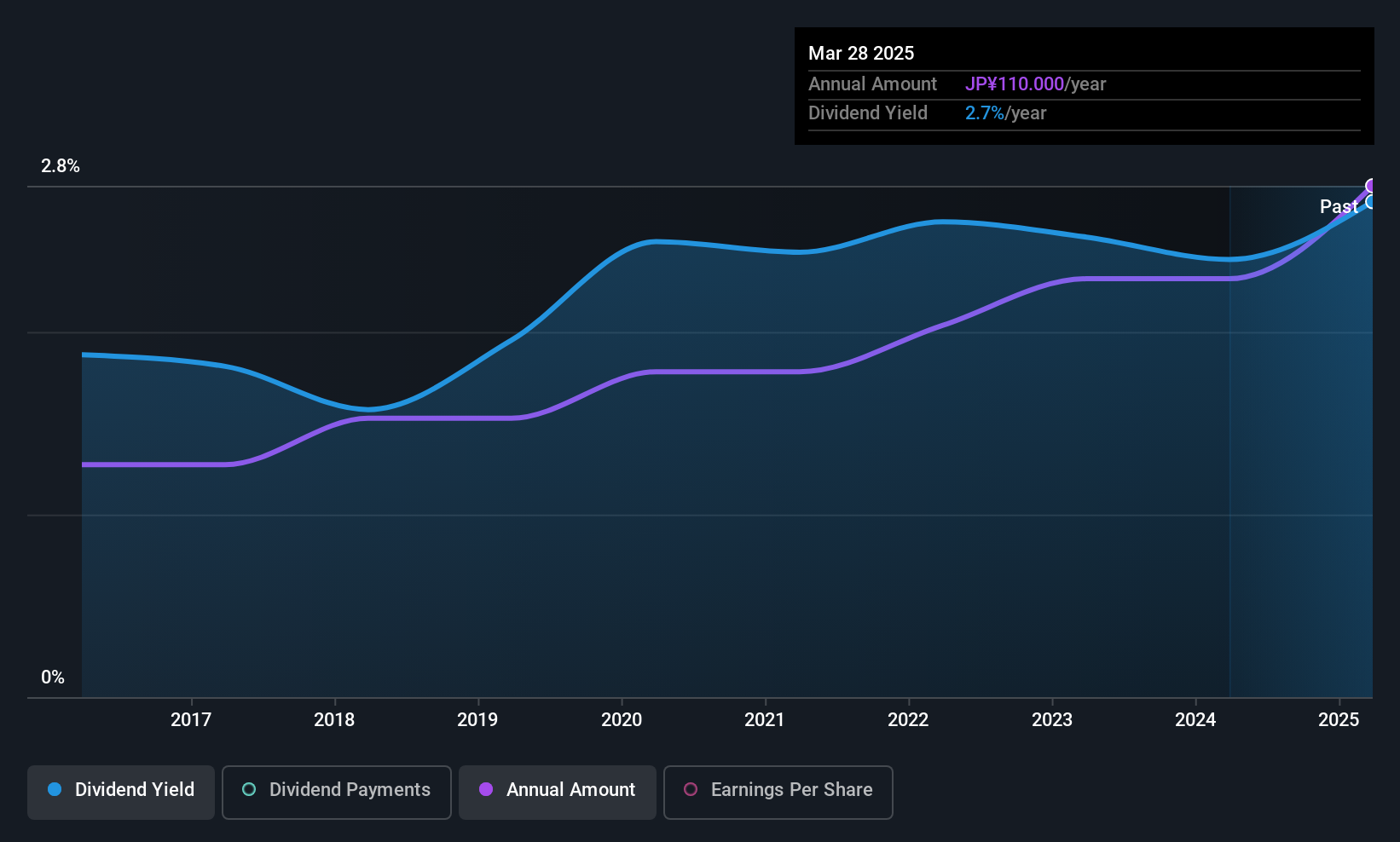

Kyokuyo (TSE:1301)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kyokuyo Co., Ltd. operates in the marine products, fresh foods, processed food, and logistics sectors both in Japan and internationally, with a market cap of ¥56.95 billion.

Operations: Kyokuyo Co., Ltd.'s revenue is derived from its operations in marine products, fresh foods, processed food, and logistics both domestically and abroad.

Dividend Yield: 3.1%

Kyokuyo's dividend payments have been reliable and stable over the past decade, with consistent growth. However, the dividend yield of 3.07% is below the top quartile in Japan, and dividends are not covered by free cash flow or operating cash flow. Despite a low payout ratio of 25.8%, indicating coverage by earnings, financial position concerns arise due to debt not being well covered by operating cash flow. The price-to-earnings ratio stands at 9.7x, below the market average.

- Delve into the full analysis dividend report here for a deeper understanding of Kyokuyo.

- Upon reviewing our latest valuation report, Kyokuyo's share price might be too optimistic.

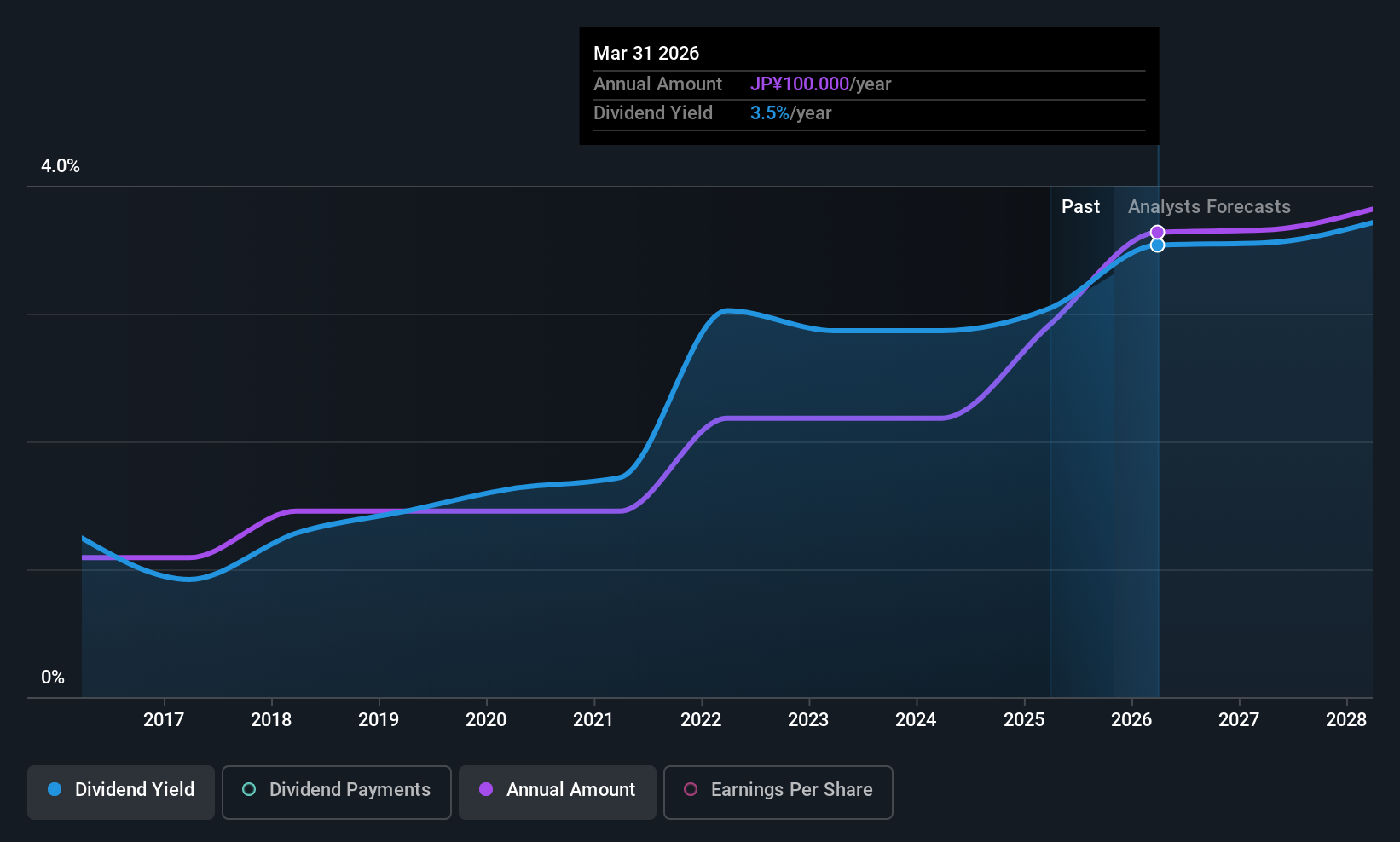

MEGMILK SNOW BRANDLtd (TSE:2270)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MEGMILK SNOW BRAND Co., Ltd. is a company that manufactures and sells milk, milk products, and other food products both in Japan and internationally, with a market capitalization of approximately ¥183.95 billion.

Operations: MEGMILK SNOW BRAND Ltd. generates its revenue primarily from Dairy Products (¥279.47 billion) and Beverages and Desserts (¥262.97 billion), along with contributions from Feedstuffs and Seed (¥49.49 billion).

Dividend Yield: 3.4%

MEGMILK SNOW BRAND's dividends have been stable and growing over the past decade, with a recent affirmation of JPY 100 per share for the year ending March 2026. Despite a low payout ratio of 30.4%, indicating coverage by earnings, dividends are not well covered by free cash flows due to a high cash payout ratio of 169.1%. The dividend yield of 3.35% is below top-tier payers in Japan, but shares trade at good value compared to peers.

- Navigate through the intricacies of MEGMILK SNOW BRANDLtd with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of MEGMILK SNOW BRANDLtd shares in the market.

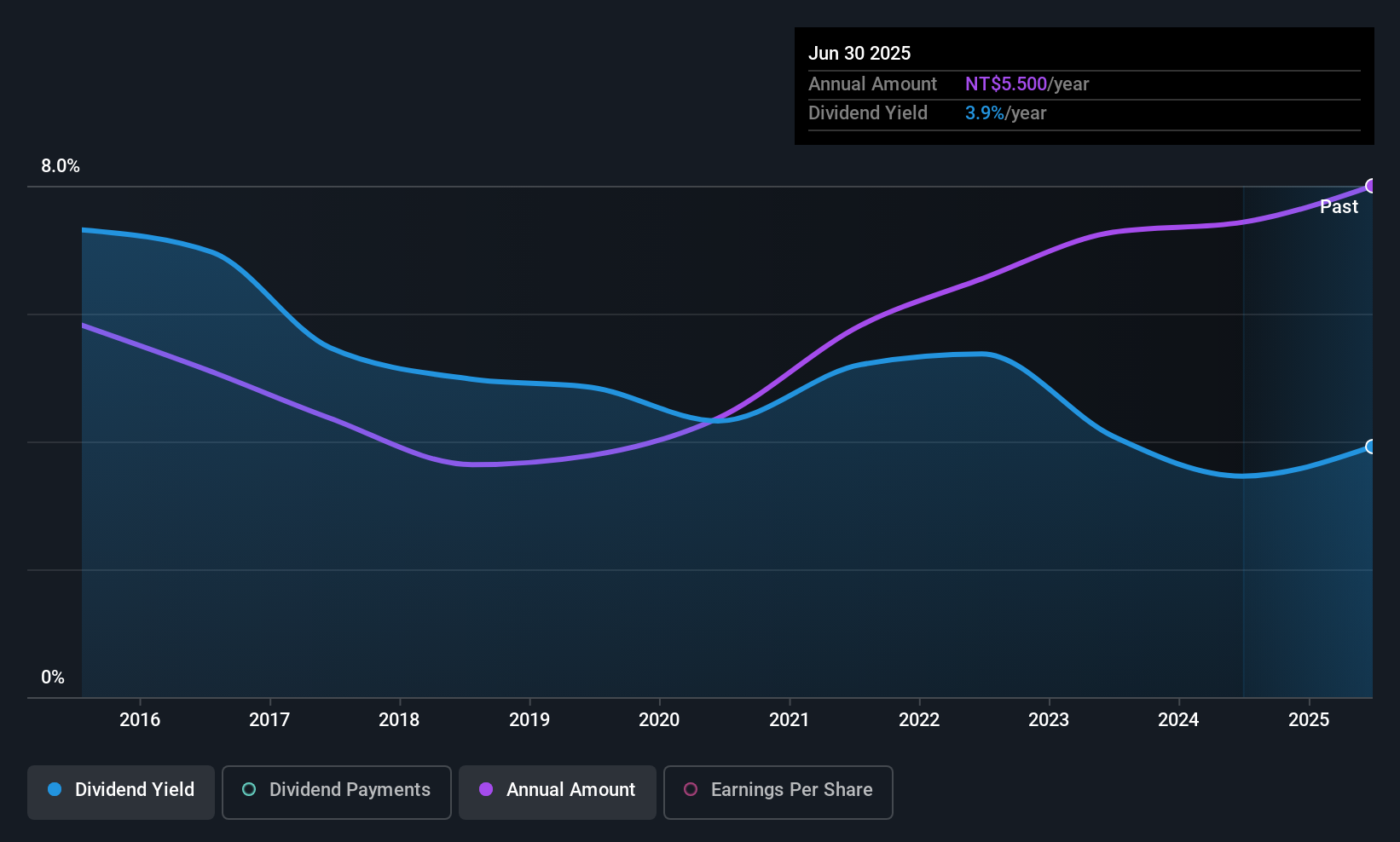

Winmate (TWSE:3416)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Winmate Inc. specializes in the research, development, manufacture, and sales of rugged display equipment and rugged mobile computers globally, with a market capitalization of NT$13.28 billion.

Operations: Winmate Inc.'s revenue is primarily derived from its Liquid Crystal Display Application Equipment and Embedded System Modules, totaling NT$3.25 billion.

Dividend Yield: 3.2%

Winmate's dividend payments have been stable and growing over the past decade, supported by earnings and cash flows with payout ratios of 82.4% and 89.2%, respectively. Despite a recent decrease in net income, dividends remain reliable, though the yield of 3.22% is below top-tier payers in Taiwan. The company approved a TWD 5.5 per share dividend for 2024, including distributions from capital surplus, indicating continued shareholder returns amidst revenue growth challenges.

- Click to explore a detailed breakdown of our findings in Winmate's dividend report.

- The analysis detailed in our Winmate valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Unlock more gems! Our Top Global Dividend Stocks screener has unearthed 1345 more companies for you to explore.Click here to unveil our expertly curated list of 1348 Top Global Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winmate might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3416

Winmate

Engages in the research and development, manufacture, and sales of rugged display equipment and rugged mobile computer in Europe, Asia, the United States, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives