Calbee (TSE:2229): Evaluating Valuation Following Share Buyback and Dividend Hike Announcements

Reviewed by Simply Wall St

Calbee (TSE:2229) just revealed two major moves for shareholders: a new share repurchase program running through March 2026 and an increased year-end dividend guidance for the current fiscal year.

See our latest analysis for Calbee.

Calbee’s recent board-approved buyback and boosted dividend have helped underpin the stock’s momentum. A 9.6% gain in the past 90 days has neatly offset earlier softness. Its one-year total shareholder return is down just 1.7%, and over the last three and five years, long-term investors have been rewarded with modest but positive total returns. Overall, momentum has been picking up lately as management underscores its commitment to shareholder value.

If the renewed capital return strategy has you thinking bigger, this could be an ideal time to broaden your search and discover fast growing stocks with high insider ownership

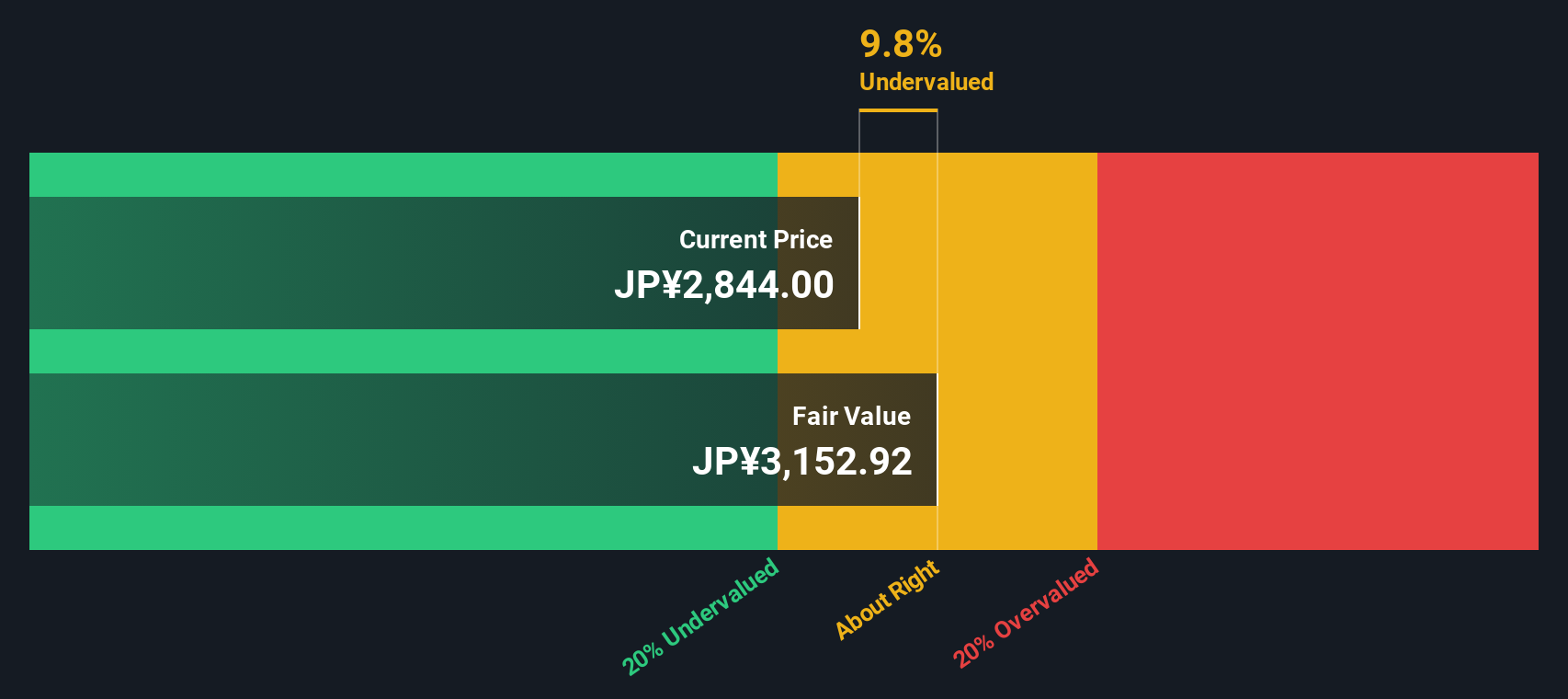

But with the company increasing its capital return and shares rebounding from recent lows, investors must now ask whether Calbee remains undervalued, or if the market is already pricing in all its future growth potential.

Price-to-Earnings of 21.7x: Is it justified?

Calbee currently trades at a price-to-earnings (P/E) ratio of 21.7x, which places the stock at a premium compared to the broader Japanese food industry. With a last close price of ¥2,960, investors are paying more for each yen of Calbee's earnings than many food sector peers.

The P/E ratio measures how much investors are willing to pay today for a unit of future earnings. In consumer staples like food, this metric is crucial as it often reflects expectations for stable profit growth or defensiveness in volatile markets.

However, Calbee’s P/E of 21.7x is above the Japanese food industry average of 16.5x and also exceeds the estimated fair P/E ratio of 19x that the market could move towards. While this suggests that the market is optimistic about Calbee’s profit outlook, it is important to note that paying a premium may require strong confidence in Calbee’s growth story or margin improvements.

Explore the SWS fair ratio for Calbee

Result: Price-to-Earnings of 21.7x (OVERVALUED)

However, slowing revenue growth or disappointing profit margins could quickly undermine optimism and prompt investors to reassess Calbee’s valuation premium.

Find out about the key risks to this Calbee narrative.

Another View: The SWS DCF Model

While Calbee looks expensive at 21.7x earnings, our DCF model provides a different perspective. According to our DCF analysis, the stock is actually trading about 5.7% below its estimated fair value. This suggests that the market may be overlooking Calbee’s underlying cash flow potential. Is the market’s caution misplaced or is the premium deserved?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Calbee for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Calbee Narrative

If you have a different perspective or would rather dive into the data on your own terms, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your Calbee research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give yourself every advantage and maximize your research by checking out unique investment opportunities that stand out on Simply Wall Street’s powerful stock screener platform.

- Tap into technology’s next wave and find opportunity among these 25 AI penny stocks using artificial intelligence to accelerate growth and innovation across industries.

- Unlock hidden potential and hunt for value with these 879 undervalued stocks based on cash flows featuring companies trading below their intrinsic worth based on cash flow analysis.

- Boost your portfolio’s resilience and income by targeting these 16 dividend stocks with yields > 3% delivering reliable yields above 3 percent for steady cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2229

Calbee

Engages in the production and sale of snacks and other food products in Japan, North America, Greater China, Thailand, Singapore, Australia, rest of Asia, Hong Kong, the United Kingdom, Indonesia, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives