Japan’s stock markets have been buoyed recently by optimism stemming from China’s stimulus measures, which have provided a favorable backdrop for many Japanese companies. The Nikkei 225 Index rose 5.6% and the broader TOPIX Index climbed 3.7%, reflecting positive sentiment. In this environment, identifying stocks that can capitalize on these tailwinds is key to enhancing your portfolio. Here are three undiscovered gems in Japan that could offer promising opportunities amidst the current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NJS | NA | 4.97% | 5.30% | ★★★★★★ |

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Techno Quartz | 18.64% | 16.15% | 22.17% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| Techno Ryowa | 1.77% | 2.06% | 5.32% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

| Yukiguni Maitake | 170.63% | -6.51% | -39.66% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Techno Ryowa (TSE:1965)

Simply Wall St Value Rating: ★★★★★☆

Overview: Techno Ryowa Ltd. specializes in the design, construction, and maintenance of environmental control systems primarily in Japan and has a market cap of ¥43.49 billion.

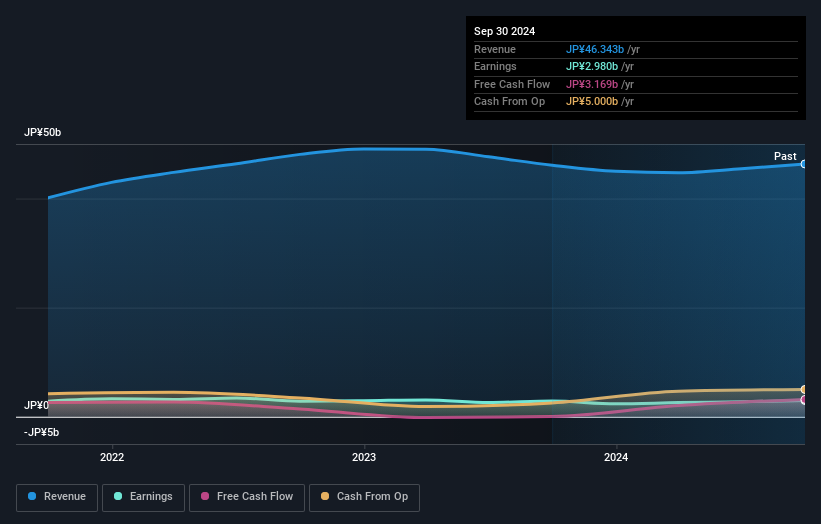

Operations: Techno Ryowa generates revenue primarily from the Air Conditioning Hygiene Equipment Construction Business (¥47.04 billion) and General Building Equipment Work (¥24.41 billion). The Electrical Equipment Construction Business and Cooling and Heating Equipment Sales Segment contribute smaller portions, with ¥2.64 billion and ¥1.16 billion respectively.

Techno Ryowa, with a P/E ratio of 9.5x, is trading below the JP market average of 13.7x. The company's earnings grew by 99% over the past year, significantly outpacing the construction industry's 26.6%. Over five years, its debt-to-equity ratio improved from 2.7% to 1.8%. Recently added to the S&P Global BMI Index on September 23, Techno Ryowa also declared a ¥50 cash dividend for September end.

- Get an in-depth perspective on Techno Ryowa's performance by reading our health report here.

Explore historical data to track Techno Ryowa's performance over time in our Past section.

Kotobuki Spirits (TSE:2222)

Simply Wall St Value Rating: ★★★★★★

Overview: Kotobuki Spirits Co., Ltd. produces and sells sweets in Japan with a market cap of ¥283.35 billion.

Operations: Kotobuki Spirits generates revenue primarily from its Shukrei and Casey Shii segments, contributing ¥27.03 billion and ¥18.88 billion respectively. The company also earns significant income from Kotobuki Confectionery/Tajima Kotobuki at ¥13.19 billion, Sales Subsidiaries at ¥7.06 billion, and Kujukushima at ¥6.56 billion.

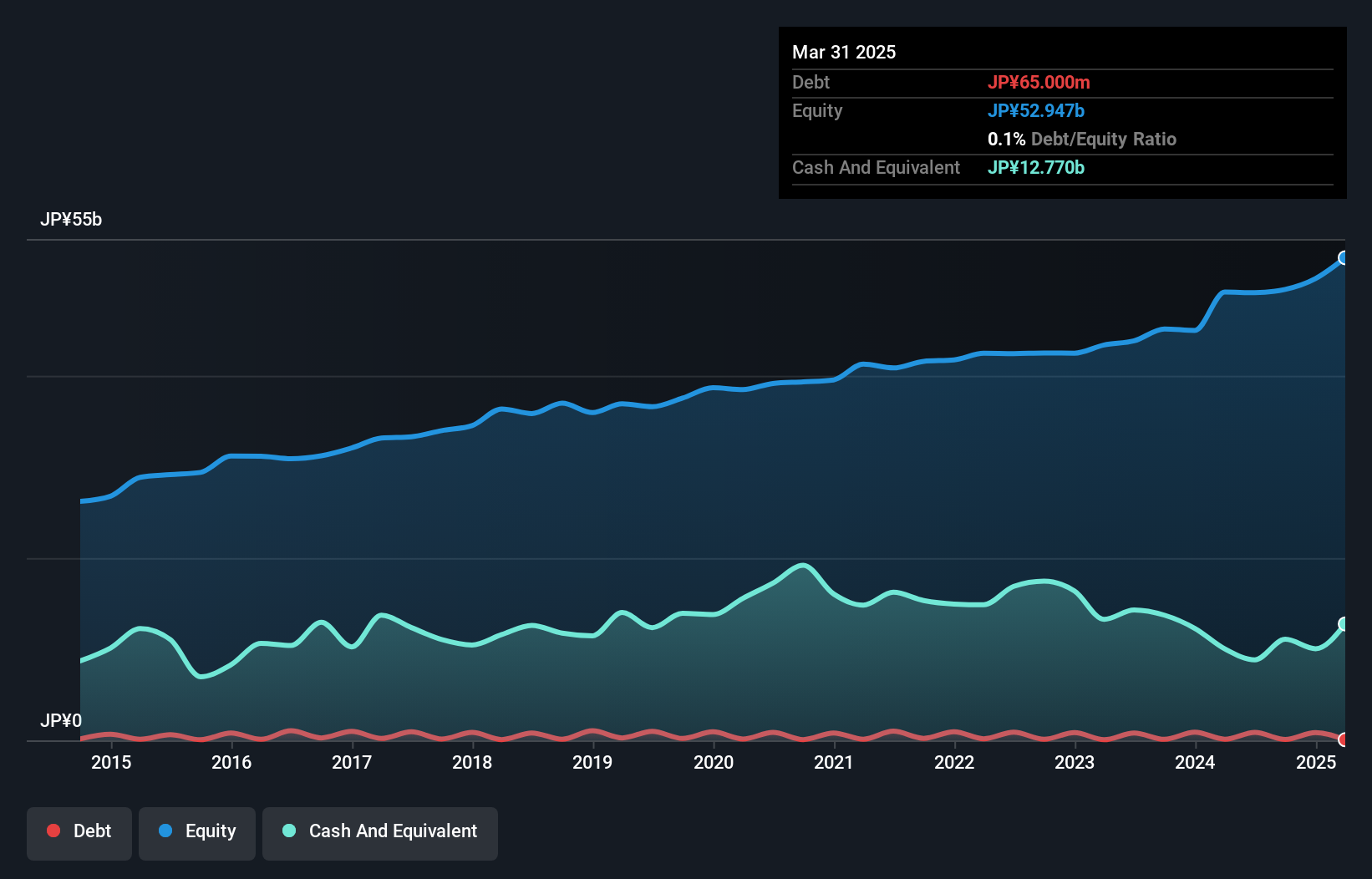

Kotobuki Spirits, a small cap in Japan's food sector, has shown impressive earnings growth of 33.7% over the past year, outpacing the industry’s 26.8%. The company trades at 47% below its estimated fair value and boasts high-quality past earnings. Over five years, Kotobuki reduced its debt-to-equity ratio from 2.1 to 0.9 while maintaining a positive free cash flow position. Earnings are forecasted to grow at an annual rate of 12.77%.

Nippon SeisenLtd (TSE:5659)

Simply Wall St Value Rating: ★★★★★★

Overview: Nippon Seisen Co., Ltd. manufactures and sells stainless steel wires in Japan and internationally, with a market cap of ¥37.70 billion.

Operations: The company's primary revenue streams are from Japan (¥40.88 billion), Thailand (¥5.08 billion), and China and South Korea (¥1.45 billion).

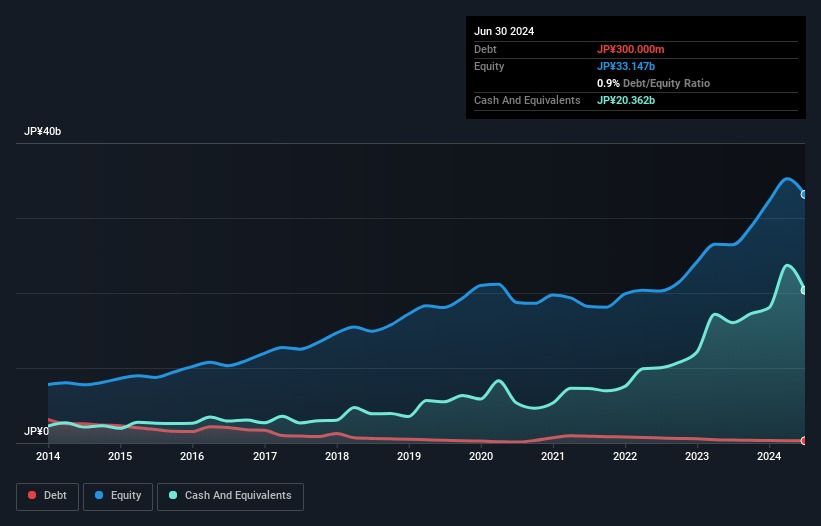

Nippon Seisen, a small yet promising player in Japan's industrial sector, has shown consistent financial health. Over the past five years, its debt-to-equity ratio has improved from 1.8 to 1.1, indicating prudent financial management. The company's earnings have grown at an annual rate of 12.8%, although last year's growth of 4.8% lagged behind the industry average of 17%. Recently trading at ¥28 per share and offering dividends on Sep-27-2024, Nippon Seisen seems undervalued by approximately 28.7%.

- Dive into the specifics of Nippon SeisenLtd here with our thorough health report.

Understand Nippon SeisenLtd's track record by examining our Past report.

Turning Ideas Into Actions

- Dive into all 744 of the Japanese Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kotobuki Spirits might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2222

Flawless balance sheet with solid track record.