Japan’s stock markets have shown significant gains recently, with the Nikkei 225 Index rising 5.6% and the broader TOPIX Index up 3.7%, driven by optimism from China’s stimulus announcements and dovish commentary from the Bank of Japan. This positive market environment provides a favorable backdrop for investors seeking reliable income streams through dividend stocks. When evaluating dividend stocks, it's essential to consider factors such as yield consistency, payout ratio, and the company's financial health—especially in a dynamic market like Japan's where economic policies and international relations can significantly impact performance.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.19% | ★★★★★★ |

| Globeride (TSE:7990) | 4.33% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.85% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.85% | ★★★★★★ |

| Kondotec (TSE:7438) | 3.81% | ★★★★★★ |

| Innotech (TSE:9880) | 4.98% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.52% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.30% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.58% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

Click here to see the full list of 463 stocks from our Top Japanese Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

TOCALOLtd (TSE:3433)

Simply Wall St Dividend Rating: ★★★★☆☆

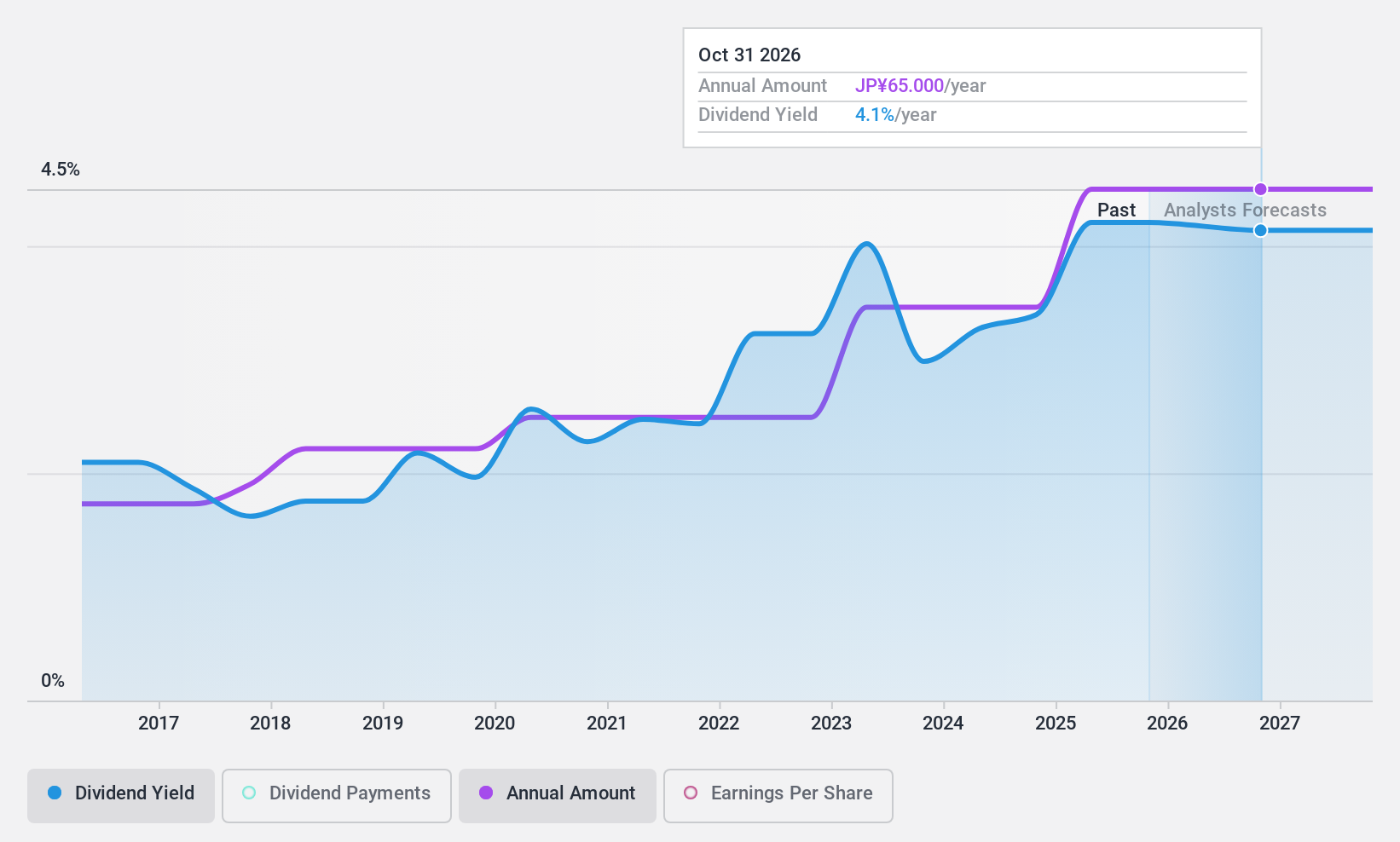

Overview: TOCALO Co., Ltd. develops surface modifying technologies in Japan and internationally, with a market cap of ¥113.88 billion.

Operations: TOCALO Co., Ltd.'s revenue segments include Thermal Spraying at ¥35.50 billion, Foreign Subsidiary at ¥7.56 billion, and Domestic Subsidiary at ¥3.04 billion.

Dividend Yield: 3%

TOCALO Ltd.'s dividend payments are well covered by earnings with a payout ratio of 47.4%, but not by free cash flows, indicated by a high cash payout ratio of 115.4%. Despite this, the company has a stable dividend history over the past decade and has consistently increased its dividends. Recent events include plans to acquire TERADA KOSAKUSHO Co., Ltd., which may impact future financials and dividend sustainability.

- Dive into the specifics of TOCALOLtd here with our thorough dividend report.

- Upon reviewing our latest valuation report, TOCALOLtd's share price might be too optimistic.

Nippon SeisenLtd (TSE:5659)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Seisen Co., Ltd. manufactures and sells stainless steel wires both in Japan and internationally, with a market cap of ¥37.70 billion.

Operations: Nippon Seisen Co., Ltd. generates revenue from various regions, including ¥40.88 billion from Japan, ¥5.08 billion from Thailand, and ¥1.45 billion from China and South Korea.

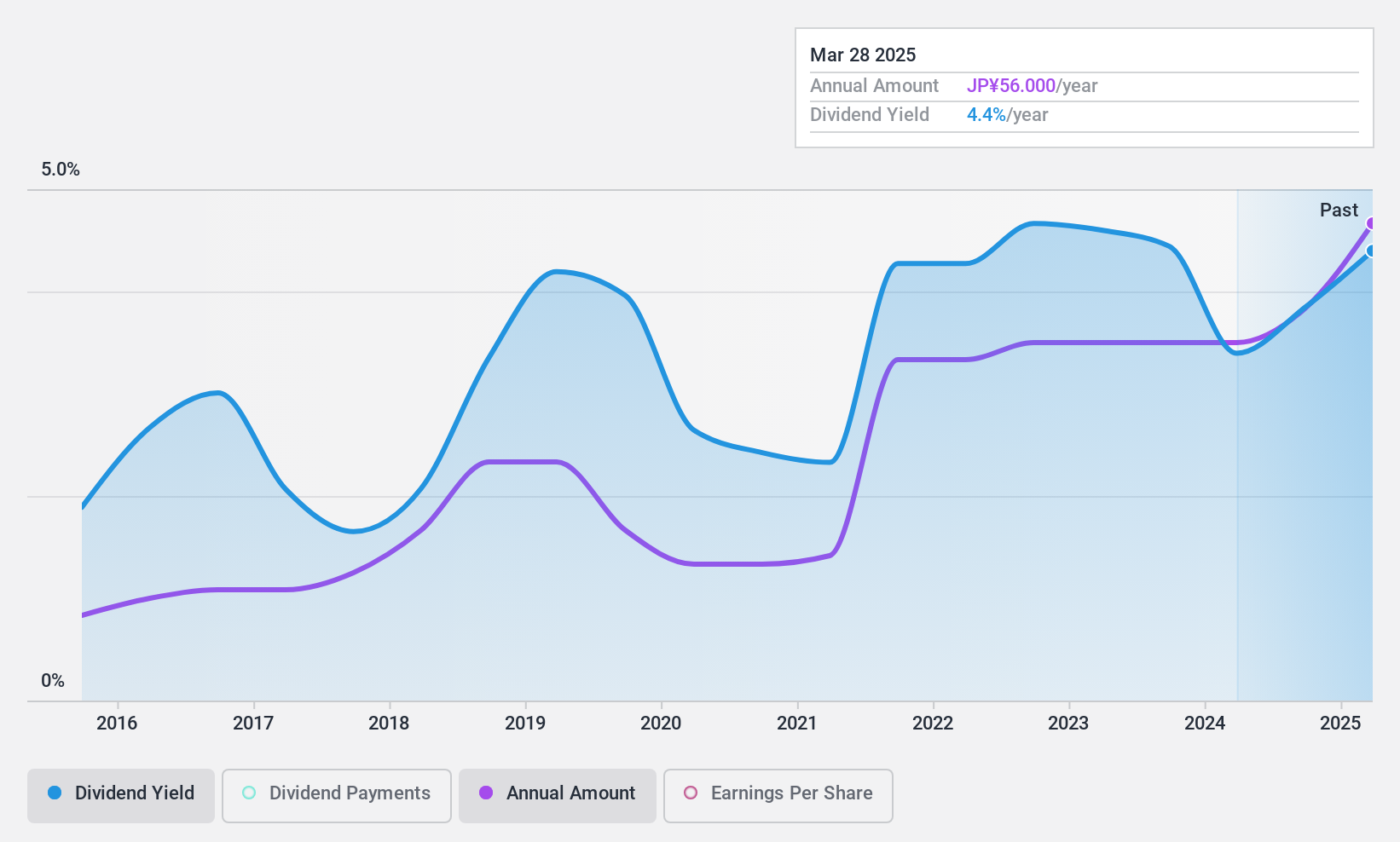

Dividend Yield: 3.7%

Nippon Seisen Ltd.'s dividend payments, yielding 3.74%, are in the top 25% of JP market payers but have been volatile over the past decade. Despite a reasonable cash payout ratio of 69%, the high earnings payout ratio of 236.2% raises concerns about sustainability. Earnings have grown at an annual rate of 12.8% over five years, and recent ex-dividend date was July 9, with a ¥28 cash dividend scheduled for September 27, 2024.

- Take a closer look at Nippon SeisenLtd's potential here in our dividend report.

- Our valuation report unveils the possibility Nippon SeisenLtd's shares may be trading at a premium.

Hagihara Industries (TSE:7856)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hagihara Industries Inc., with a market cap of ¥21.13 billion, manufactures and sells flat yarns in Japan through its subsidiaries.

Operations: Hagihara Industries Inc. generates revenue from two main segments: Machinery Products, which contribute ¥6.20 billion, and the Synthetic Resin Processed Product Business, accounting for ¥26.59 billion.

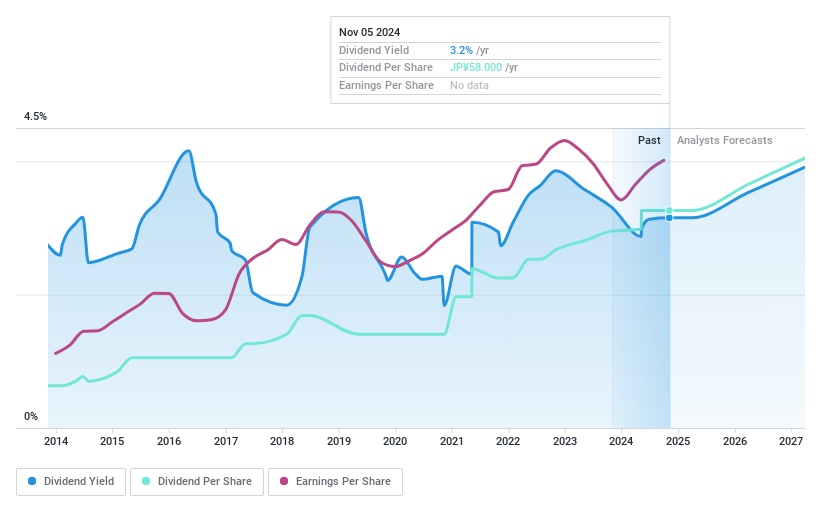

Dividend Yield: 3.2%

Hagihara Industries' dividend yield of 3.24% is slightly below the top 25% in Japan. Despite stable and growing dividends over the past decade, recent profit margins have declined from 10.4% to 4.6%. The company lacks free cash flows to cover its dividends, although a low payout ratio of 45.7% suggests earnings coverage is adequate. Earnings are projected to grow by 18.75% annually, but sustainability remains a concern due to insufficient cash flow coverage.

- Delve into the full analysis dividend report here for a deeper understanding of Hagihara Industries.

- The analysis detailed in our Hagihara Industries valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Unlock more gems! Our Top Japanese Dividend Stocks screener has unearthed 460 more companies for you to explore.Click here to unveil our expertly curated list of 463 Top Japanese Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hagihara Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7856

Hagihara Industries

Through its subsidiaries, manufactures and sells flat yarns in Japan.

6 star dividend payer with excellent balance sheet.

Market Insights

Community Narratives