- Japan

- /

- Commercial Services

- /

- TSE:4666

3 Japanese Stocks Possibly Trading At Discounts Up To 43.1%

Reviewed by Simply Wall St

Japan's stock markets have recently shown significant gains, with the Nikkei 225 Index rising by 5.6% and the broader TOPIX Index up by 3.7%. This positive momentum is partly driven by China's stimulus announcements, which have boosted sentiment among Japanese companies that are closely tied to Chinese demand. In this context, identifying undervalued stocks can be a strategic move for investors looking to capitalize on potential market inefficiencies. A good stock in today's market conditions often exhibits strong fundamentals and resilience amid economic shifts, making it a compelling choice for those seeking value investments.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3420.00 | ¥6695.60 | 48.9% |

| Densan System Holdings (TSE:4072) | ¥2659.00 | ¥5310.06 | 49.9% |

| IMAGICA GROUP (TSE:6879) | ¥512.00 | ¥1018.10 | 49.7% |

| Kotobuki Spirits (TSE:2222) | ¥1820.50 | ¥3434.73 | 47% |

| Stella Chemifa (TSE:4109) | ¥4125.00 | ¥8066.14 | 48.9% |

| Pilot (TSE:7846) | ¥4435.00 | ¥8866.17 | 50% |

| Hibino (TSE:2469) | ¥3525.00 | ¥6952.41 | 49.3% |

| Appier Group (TSE:4180) | ¥1782.00 | ¥3490.85 | 49% |

| Infomart (TSE:2492) | ¥327.00 | ¥617.25 | 47% |

| Nxera Pharma (TSE:4565) | ¥1232.00 | ¥2370.72 | 48% |

Underneath we present a selection of stocks filtered out by our screen.

Avant Group (TSE:3836)

Overview: Avant Group Corporation, with a market cap of ¥81.99 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: Avant Group's revenue segments include the Group Governance Business at ¥7.54 billion, Management Solutions Business at ¥8.52 billion, and Digital Transformation Promotion Business at ¥8.85 billion.

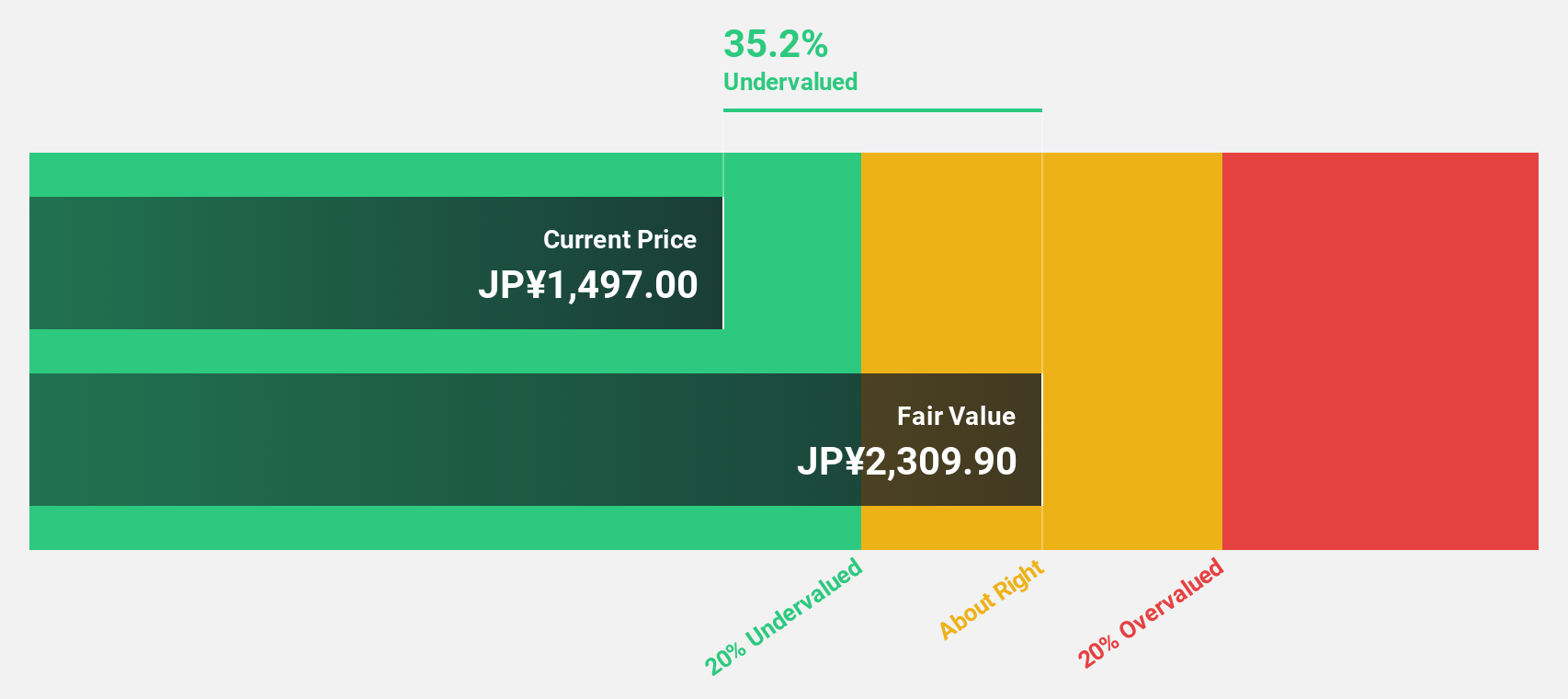

Estimated Discount To Fair Value: 43.1%

Avant Group is trading at ¥2,254, significantly below its estimated fair value of ¥3,961.01. Forecasts indicate earnings growth of 17.87% annually and revenue growth of 15.8% per year, both outpacing the broader Japanese market. Recent buybacks and dividend increases highlight strong cash flow management. The company expects net sales of ¥28.8 billion and an operating profit of ¥4.9 billion for the fiscal year ending June 30, 2025.

- Our earnings growth report unveils the potential for significant increases in Avant Group's future results.

- Unlock comprehensive insights into our analysis of Avant Group stock in this financial health report.

PARK24 (TSE:4666)

Overview: PARK24 Co., Ltd. operates and manages parking facilities in Japan and internationally, with a market cap of ¥305.79 billion.

Operations: The company's revenue segments include the Mobility Business at ¥107.36 million, Parking Lot Business Japan at ¥178.06 billion, and Parking Lot Business Overseas at ¥79.23 billion.

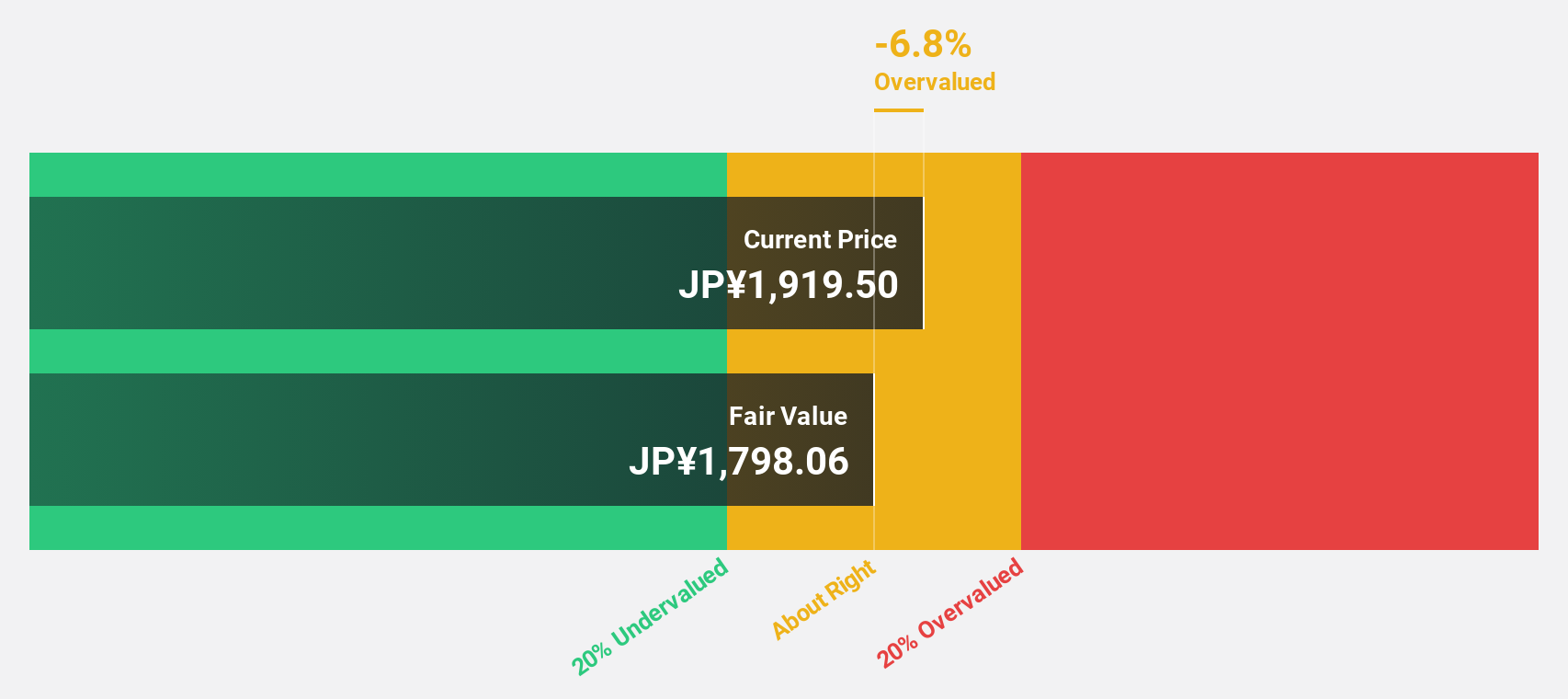

Estimated Discount To Fair Value: 28.3%

PARK24 is trading at ¥1,792.5, well below its estimated fair value of ¥2,500.83. Earnings are forecast to grow 16.1% annually, outpacing the broader Japanese market's 8.7%. Despite high debt levels, the company has shown a solid earnings growth of 9.4% over the past year and maintains strong cash flow management. Recent strategic alliances and pilot programs with Uber Japan could further enhance revenue streams and operational efficiency in the rideshare sector.

- According our earnings growth report, there's an indication that PARK24 might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of PARK24.

Kawasaki Heavy Industries (TSE:7012)

Overview: Kawasaki Heavy Industries, Ltd. operates in aerospace systems, energy solutions and marine engineering, precision machinery and robotics, rolling stock, and motorcycle and engine businesses both in Japan and internationally with a market cap of ¥972.35 billion.

Operations: The company's revenue segments include Aerospace Business (¥435.40 billion), Power Sports & Engine (¥594.38 billion), Energy Solutions & Marine (¥388.09 billion), Precision Machinery / Robot (¥249.35 billion), and Vehicle (¥196.26 billion).

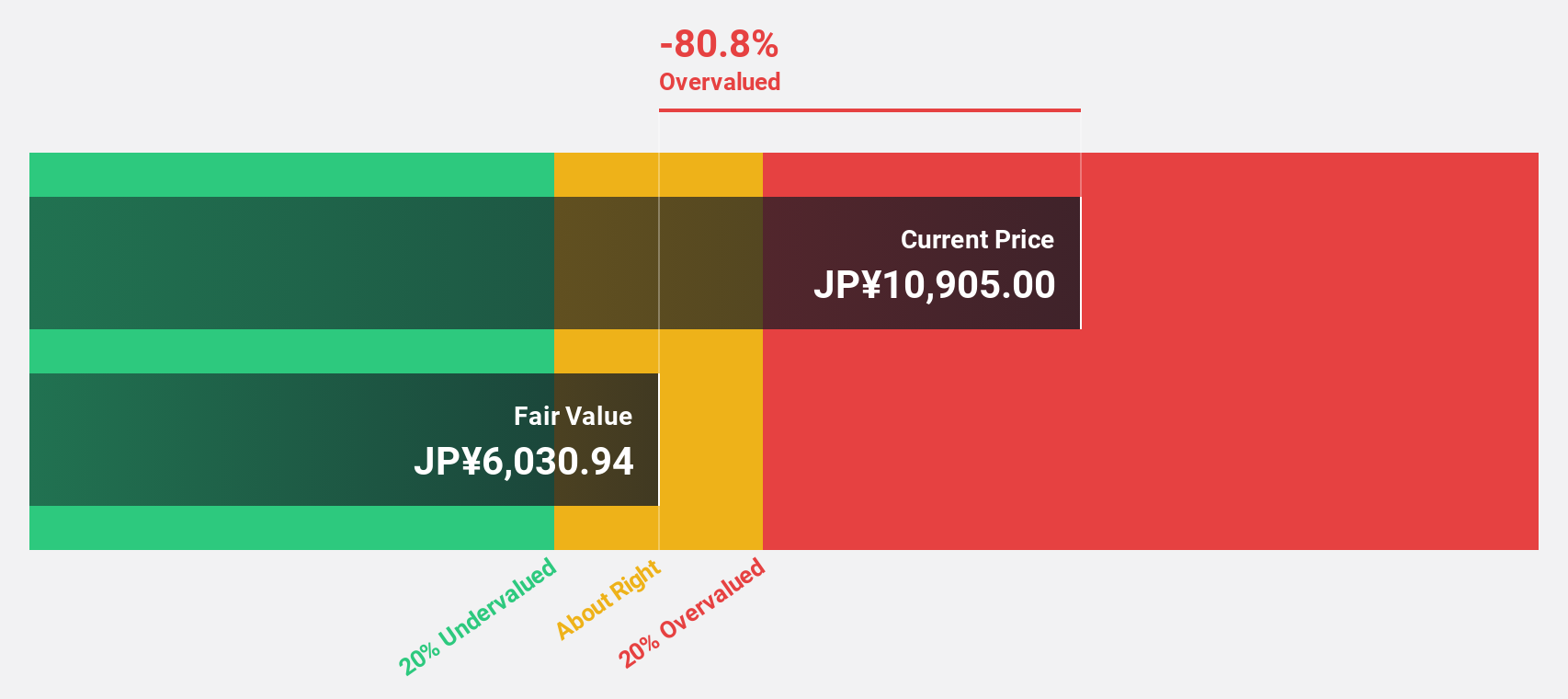

Estimated Discount To Fair Value: 21.9%

Kawasaki Heavy Industries is trading at ¥5,805, significantly below its fair value estimate of ¥7,432.78. Despite a volatile share price and lower profit margins compared to last year, the company is expected to see earnings grow by 22.1% annually, outpacing the Japanese market's growth rate of 8.7%. However, debt coverage by operating cash flow remains a concern and dividends are not well supported by free cash flows.

- Our comprehensive growth report raises the possibility that Kawasaki Heavy Industries is poised for substantial financial growth.

- Take a closer look at Kawasaki Heavy Industries' balance sheet health here in our report.

Taking Advantage

- Click here to access our complete index of 79 Undervalued Japanese Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4666

PARK24

Operates and manages parking facilities in Japan and Internationally.

Good value with reasonable growth potential.