Exploring High Growth Tech Stocks In Japan For September 2024

Reviewed by Simply Wall St

Japan's stock markets have seen significant gains recently, with the Nikkei 225 Index rising 5.6% and the broader TOPIX Index up 3.7%, buoyed by dovish commentary from the Bank of Japan and optimism surrounding China's stimulus measures. This favorable market environment sets a promising stage for exploring high-growth tech stocks in Japan, where companies that exhibit strong innovation capabilities and robust market potential can thrive amidst these positive economic indicators.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

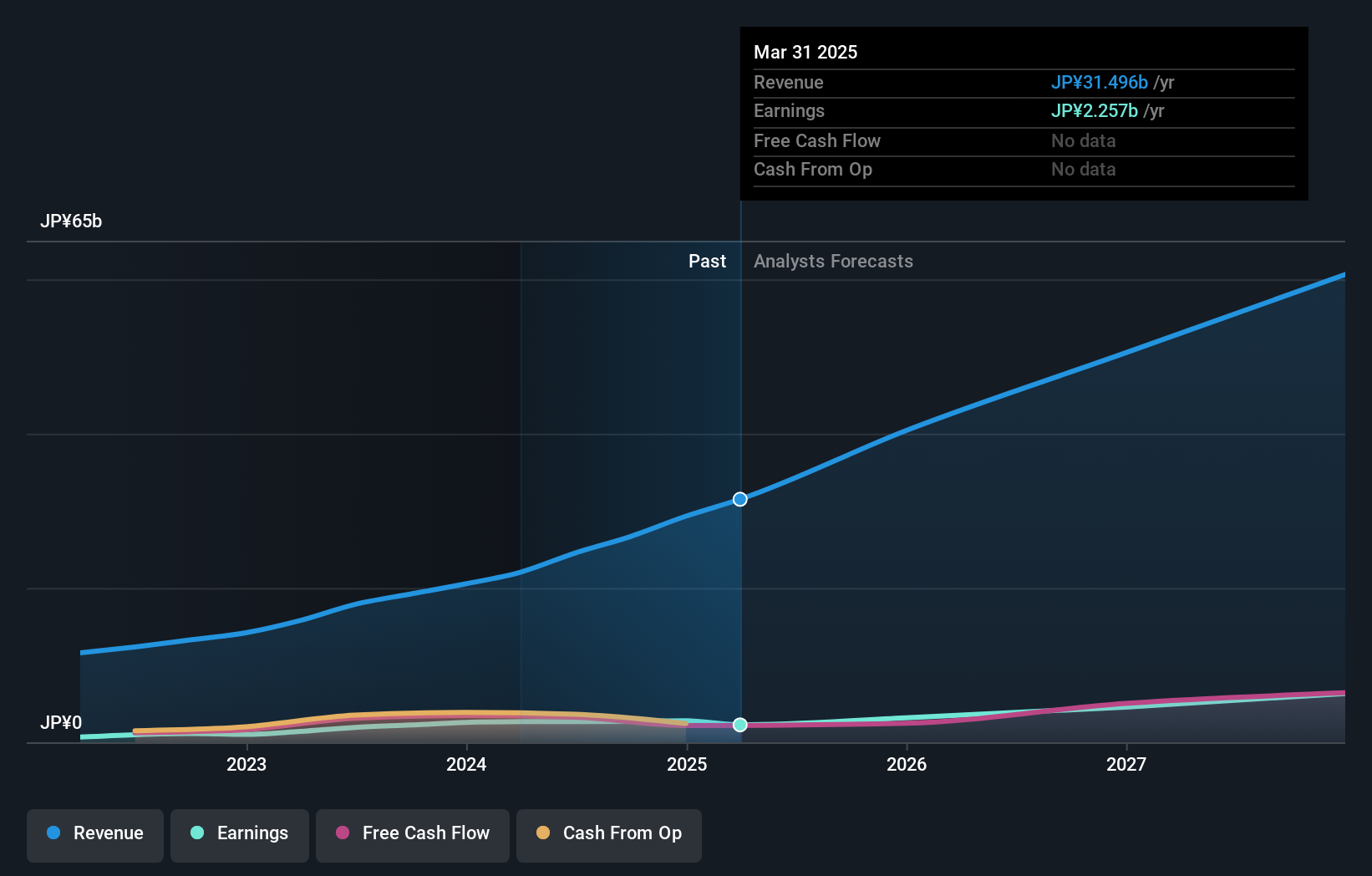

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States with a market cap of ¥124.25 billion.

Operations: Medley, Inc. generates revenue primarily through its Human Resource Platform Business and Medical Platform Business, with the former contributing ¥17.87 billion and the latter ¥6.09 billion. The company also has a New Services segment generating ¥573 million in revenue.

Medley's strategic move to potentially acquire Offshore Inc. signifies a robust expansion strategy, aligning with its recent 25% annual revenue growth forecast, outpacing the Japanese market's 4.3%. This acquisition could further enhance Medley’s service offerings and market reach. Moreover, the company’s R&D investment remains a critical pillar of its innovation strategy, with R&D expenses constituting a significant portion of its revenue. This commitment to development is reflected in the projected earnings growth of 30.4% per year, suggesting an aggressive pursuit of technological advancements and market leadership in healthcare services.

- Get an in-depth perspective on Medley's performance by reading our health report here.

Review our historical performance report to gain insights into Medley's's past performance.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare businesses with a market cap of ¥1.29 trillion.

Operations: OMRON Corporation generates revenue primarily from its Industrial Automation Business (¥373.70 billion), Social Systems, Solutions and Service Business (¥156.85 billion), Healthcare Business (¥150.40 billion), and Devices & Module Solutions Business (¥143.69 billion).

OMRON's strategic emphasis on R&D is evident, with expenses earmarked at a significant 5.6% of its revenue, supporting its pursuit of innovation in automation technologies. Despite a challenging market, the company's earnings are projected to surge by 46.2% annually, underlining its potential to outpace broader industry growth rates. Additionally, OMRON's recent Q1 earnings call highlighted these advancements and their alignment with long-term financial goals, coupled with a consistent shareholder return policy through regular dividends set at ¥52.0 per share as of September 2024. This blend of aggressive growth and shareholder value positions OMRON distinctively in Japan's tech landscape.

- Dive into the specifics of OMRON here with our thorough health report.

Understand OMRON's track record by examining our Past report.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kadokawa Corporation operates as an entertainment company in Japan with a market cap of ¥429.48 billion.

Operations: The company's primary revenue streams include Publication (¥143.28 billion), Game (¥28.63 billion), Animation/Film (¥46.36 billion), Web Service (¥20.44 billion), and Education/Edtech (¥13.83 billion). The Publication segment is the largest contributor to revenue, followed by Animation/Film and Game segments.

Kadokawa stands out in Japan's tech arena, not just for its size but for its strategic focus on innovation through sustained investment in research and development. Last year, R&D expenses accounted for a robust 6.7% of its revenue, fueling advancements that have seen earnings surge by 21.5% annually. This growth trajectory is supported by a strong performance against industry averages, where Kadokawa's earnings growth of 23.8% starkly outpaces the media sector's modest 3.8%. Looking ahead, while the broader market anticipates an annual revenue increase of around 4.3%, Kadokawa is expected to exceed this with a projected rise of 6.7%, suggesting promising prospects for continued leadership and influence in high-tech innovations within Japan.

- Click to explore a detailed breakdown of our findings in Kadokawa's health report.

Evaluate Kadokawa's historical performance by accessing our past performance report.

Next Steps

- Dive into all 124 of the Japanese High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadokawa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9468

Flawless balance sheet with solid track record.