Is Yamazaki Baking (TSE:2212) Still Undervalued? A Fresh Look at Valuation After Recent Market Shifts

Reviewed by Simply Wall St

Price-to-Earnings of 17.7x: Is it justified?

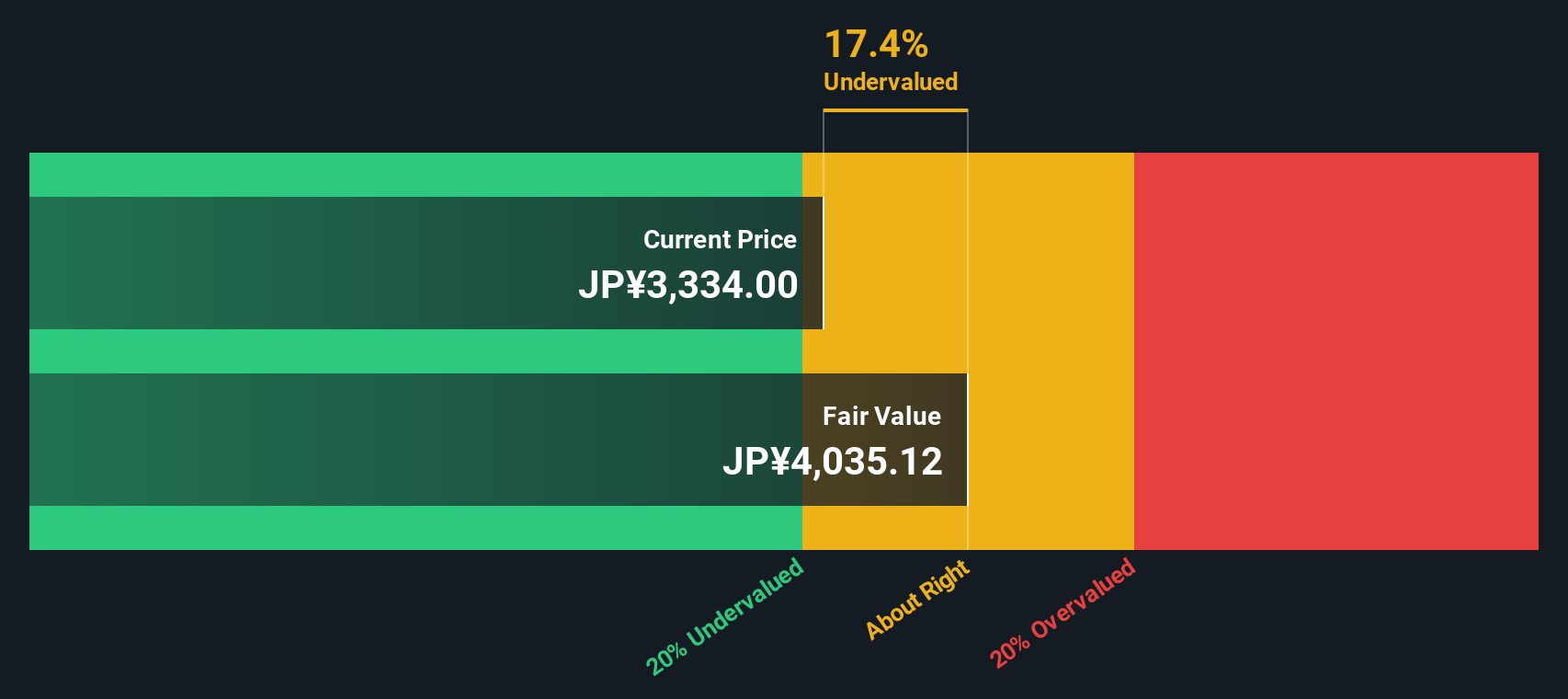

Based on the Price-to-Earnings ratio, Yamazaki Baking is trading at 17.7 times its earnings. This places it slightly above the average for the Japanese Food industry, which tends to indicate a premium placed on its current earnings potential. However, it remains below the estimated fair Price-to-Earnings ratio, suggesting some undervaluation compared to what analysts consider justifiable.

The Price-to-Earnings (P/E) ratio is a widely used metric that measures a company's current share price relative to its per-share earnings. For consumer staples companies such as Yamazaki Baking, the P/E ratio is especially relevant, as it reflects market expectations for stable, long-term earnings and often signals investor confidence in consistent financial performance, even during industry downturns.

An above-average P/E ratio suggests the market may be pricing in expectations for continued steady earnings growth. On the other hand, given recent slowing profit margins and only moderate earnings growth forecasts, the premium may not be fully warranted unless future results exceed current projections.

Result: Fair Value of ¥4,035.12 (UNDERVALUED)

See our latest analysis for Yamazaki Baking.However, still, slowing revenue growth and recent negative price momentum could quickly sway sentiment if fundamentals do not improve in upcoming quarters.

Find out about the key risks to this Yamazaki Baking narrative.Another View: SWS DCF Model Perspective

Looking at Yamazaki Baking through the lens of our SWS DCF model yields a similarly optimistic result. This supports the idea that the shares appear undervalued. But can both approaches be right, or is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Yamazaki Baking Narrative

If you find your perspective differs, or if you are inclined to dig deeper into the numbers and form your own view, you can craft a personalized analysis of Yamazaki Baking in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Yamazaki Baking.

Seeking More Investment Opportunities?

Smart investors keep their edge by searching for the next great opportunity. Widen your horizons now and discover ideas you may not have considered yet.

- Capture potential high returns by targeting penny stocks with strong balance sheets using penny stocks with strong financials.

- Capitalize on market mispricing and unlock hidden gems among companies trading below their true value by using undervalued stocks based on cash flows.

- Secure regular income and enhance your portfolio’s stability by exploring companies offering yields above 3% with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2212

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives