Evaluating Morinaga (TSE:2201): Does the Sanrio Collaboration Signal Hidden Value?

Reviewed by Simply Wall St

The collaboration between Morinaga&Co (TSE:2201) and Sanrio has caught the market's interest, as both brands are well known in Japan's snack and character goods space. By joining forces, they stand to broaden product appeal and consumer reach.

See our latest analysis for Morinaga&Co.

Morinaga&Co’s collaboration with Sanrio arrives as momentum shows signs of recovery, with the stock notching a 10.7% gain in the past 90 days. While the latest share price stands at ¥2,658, short-term price moves have only partially offset this year’s modest decline. The total shareholder return over the past year is still slightly negative. However, long-term investors have seen robust results, with a three-year total shareholder return of 51.9%, which signals strong underlying performance despite some recent volatility.

If you’re curious what other opportunities are taking shape in the market right now, it could be time to broaden your perspective and discover fast growing stocks with high insider ownership

With the collaboration generating fresh buzz, the real question now is whether Morinaga&Co’s growth prospects are fully reflected in the current share price or if investors are being presented with a genuine buying opportunity.

Price-to-Earnings of 12.5x: Is it justified?

Morinaga&Co’s shares are trading at a price-to-earnings (P/E) ratio of 12.5x, noticeably below both peer and industry averages. This suggests a potential undervaluation at the latest close of ¥2,658.

The price-to-earnings ratio measures what investors are willing to pay today for a company’s earnings. For mature industries like food and beverage, this multiple is often used to compare companies’ relative value and profitability.

With Morinaga&Co’s P/E lower than the industry average and its own fair P/E estimate, the market appears to be underestimating the company’s earnings power. If the P/E multiple were to move closer to the industry level, there could be significant upside potential.

Result: Price-to-Earnings of 12.5x (UNDERVALUED)

Explore the SWS fair ratio for Morinaga&Co

However, slower revenue growth or a reversal in net income gains could limit upside potential and challenge confidence in Morinaga&Co’s current valuation.

Find out about the key risks to this Morinaga&Co narrative.

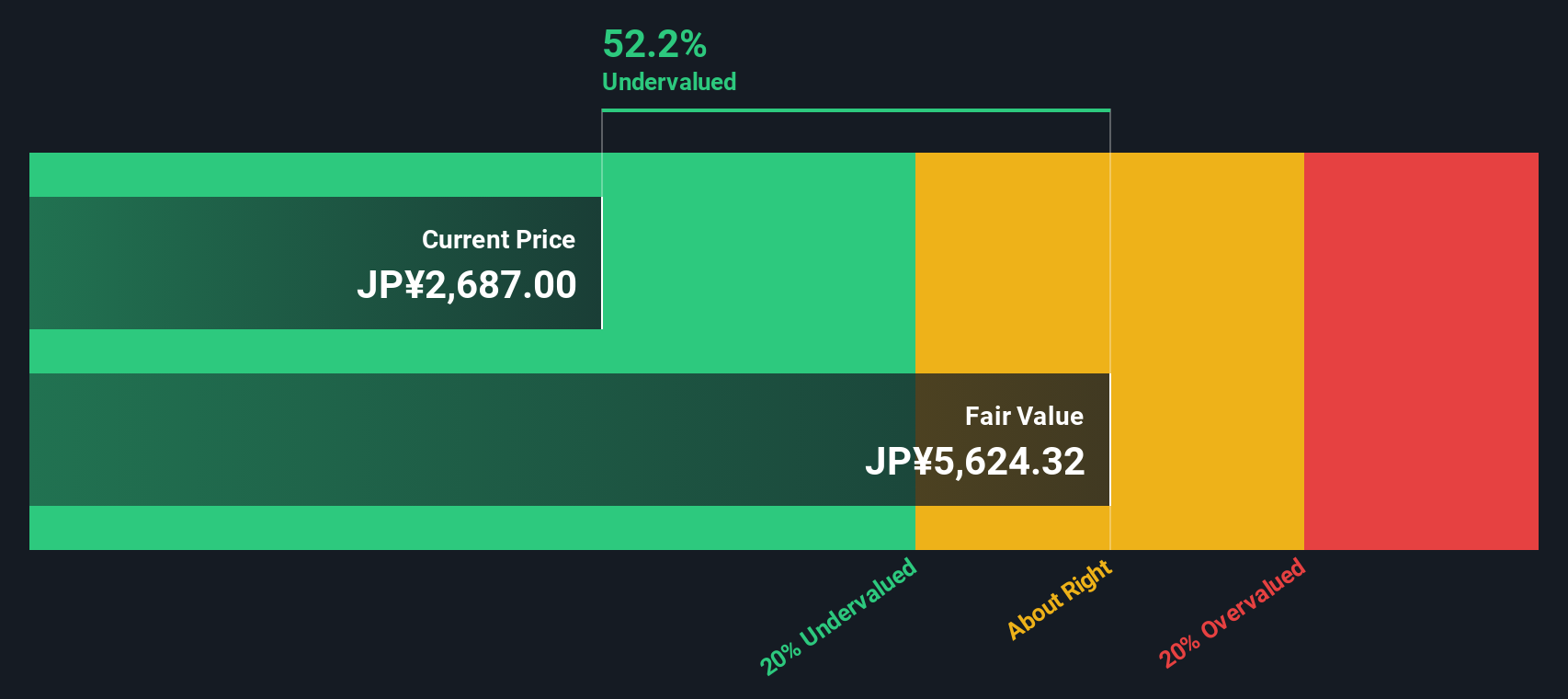

Another View: Discounted Cash Flow Insights

Switching to the SWS DCF model, Morinaga&Co appears even more undervalued. The DCF estimate suggests a fair value of ¥5,624.32, which is more than double the recent share price. This perspective challenges the market’s current stance and raises the question: could the stock’s true worth be significantly higher than investors realize?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Morinaga&Co for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Morinaga&Co Narrative

If you have a different perspective or enjoy digging into the details yourself, you can shape your own view on Morinaga&Co in just a few minutes, and Do it your way

A great starting point for your Morinaga&Co research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment ideas?

Seize the chance to expand your portfolio with powerful themes. Simply Wall St’s screeners make it simple to access curated opportunities you won’t want to miss.

- Spot income potential by reviewing these 17 dividend stocks with yields > 3% that consistently pay yields above 3% and reward shareholders over time.

- Pursue innovation and rapid growth by checking out these 26 AI penny stocks transforming industries through artificial intelligence advancements.

- Capitalize on undervalued prospects with these 871 undervalued stocks based on cash flows that are trading below their cash flow potential, offering compelling value for savvy investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2201

Morinaga&Co

Manufactures, purchases, and sells confectionaries, food, frozen desserts, and health products in Japan and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives